What Is Crypto Token? A Beginner's Guide to Crypto Coins

When you first dive into crypto, you'll hear the words "coin" and "token" thrown around a lot, often interchangeably. But they're not the same thing. A crypto token is a digital asset that’s built on top of an existing blockchain, like Ethereum. It represents a specific asset or utility within a particular project's ecosystem.

Think of it this way: a token is like a ticket to a concert. That ticket isn't cash, but it has a specific value—it gets you into the show. In the crypto world, a token gives you similar rights or value, but inside its own digital environment.

Demystifying the Digital Arcade Token

Let's use a simple analogy to really nail this down. Picture yourself in a massive arcade. You can't use dollars to play the games; you have to buy the arcade's special tokens first. Those tokens are worthless at the grocery store, but inside that arcade, they're everything. They unlock every game and let you win prizes.

That's pretty much how crypto tokens work. Projects create them on established blockchains (Ethereum is the most popular host by far) to serve a specific purpose. They can represent anything from voting power in a project to a unique piece of digital art.

This brings us to the most important distinction you need to remember:

- Crypto Coins, like Bitcoin or Ether, are the native currency of their own blockchain. They're the "dollars" that keep the entire network running.

- Crypto Tokens are the "arcade tokens." They're created by individual projects that live on that network and have a specific job to do within their own self-contained economy.

If you want to go deeper, you can learn more about the fundamental roles of tokens in cryptocurrency in our detailed guide.

Crypto Tokens vs Crypto Coins at a Glance

To make this distinction crystal clear, here’s a quick comparison highlighting the main differences between crypto tokens and coins. While both are digital assets, their purpose and technical backbone are fundamentally different. Getting this right is the first real step to understanding how the crypto world actually works.

| Feature | Crypto Coins (e.g., Bitcoin) | Crypto Tokens (e.g., LINK) |

|---|---|---|

| Blockchain | Operate on their own native blockchain. | Built on top of an existing blockchain. |

| Primary Use | Act as a store of value or medium of exchange. | Grant access to a service, represent an asset, etc. |

| Analogy | A country's official currency (USD, EUR). | An arcade token, concert ticket, or stock share. |

| Creation | Requires building a new blockchain. | Follows a standard template (like ERC-20). |

See the difference? One is the foundational money of a network, while the other is a specialized asset created for a specific purpose within that network. It's a simple but crucial concept to grasp as you explore the crypto space.

How Tokens and Coins Actually Differ

So, we know they're not the same thing, but why does that distinction even matter? Let's break it down.

A crypto coin is the native currency of its own blockchain. It’s the fuel that makes the whole network run. Think of Bitcoin on the Bitcoin blockchain or Ether on the Ethereum blockchain. These coins are absolutely essential for processing transactions, paying network fees, and keeping everything secure.

A crypto token, on the other hand, is more like a guest living on an existing blockchain.

Picture the Ethereum blockchain as a huge, thriving digital city. The city's official currency is Ether (ETH), which is a coin. But inside this city, tons of different businesses issue their own unique tickets, loyalty points, or gift cards—these are the tokens. They're used for specific services, products, or events within that business, but they all operate within the city's infrastructure.

This setup is what makes the crypto space so dynamic. It means developers can launch new projects and cool ideas without the monumental task of building a new blockchain from the ground up. They just set up shop on an established network like Ethereum, Solana, or Polygon and get to work on their unique application.

Native Currency vs. Guest Asset

The core difference really comes down to this: a coin owns the highway, while a token just drives a car on it.

Coins are the foundation. They're responsible for the infrastructure and security of the entire system. Without the native coin, the blockchain simply wouldn't work. For a closer look at how they work together, you can dig into the essential differences between a crypto coin and token and see how they interact.

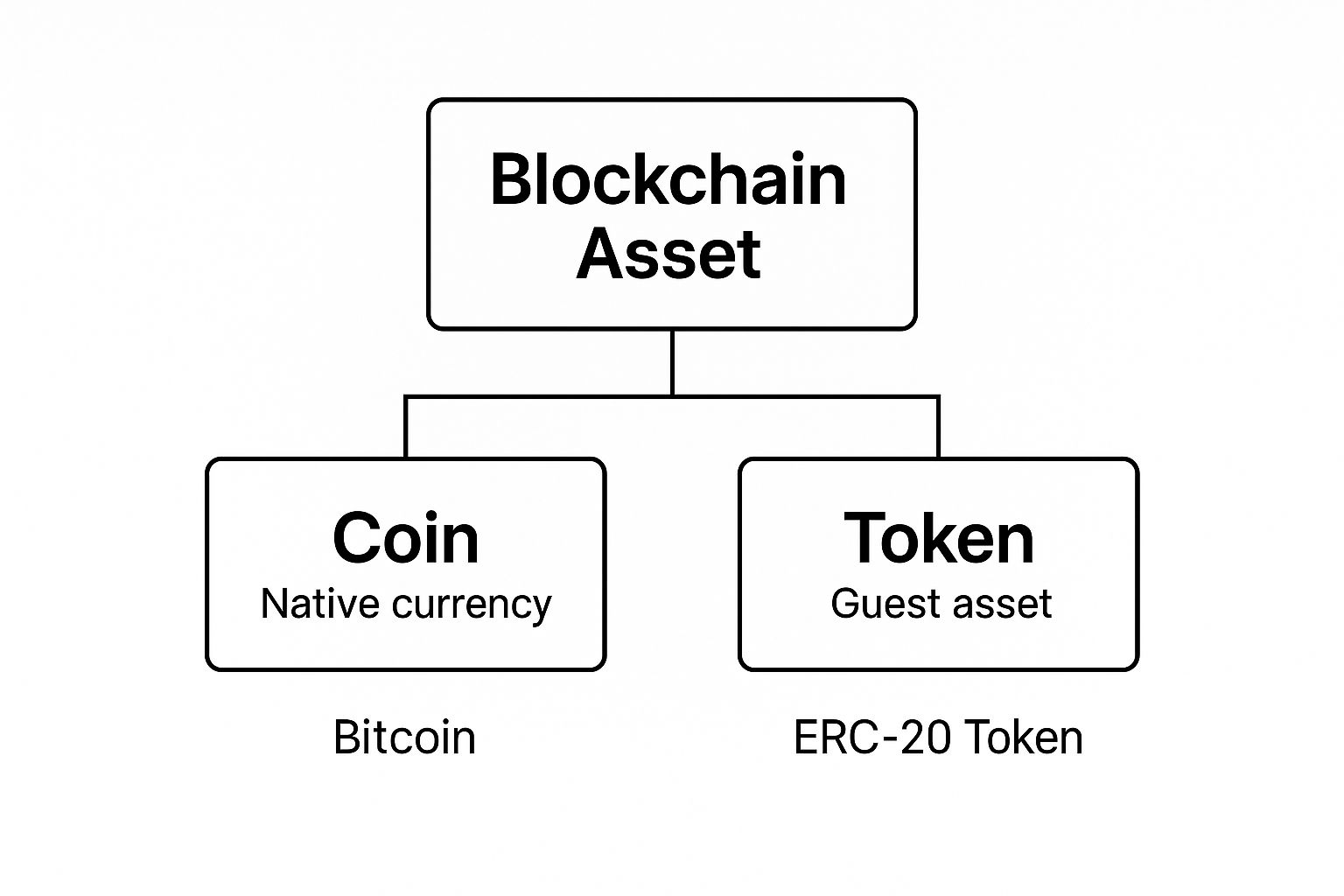

This visual helps clarify how coins and tokens are related but exist on different levels of the ecosystem.

As you can see, both are blockchain assets, but the coin is native to its chain, while the token is built on top of an existing one. It's this "guest" relationship that sparks so much innovation, allowing creators to build all sorts of digital assets quickly and securely.

Key Takeaway: A coin is the foundational money of its own blockchain. A token is a secondary asset built on that blockchain to do a specific job for a project or app.

This means a token's very existence depends on its host blockchain. For instance, if you want to send an Ethereum-based token to someone, you have to pay the transaction fee (called "gas") using Ethereum's native coin, Ether (ETH).

This creates a really cool symbiotic relationship:

- Coins provide the secure, decentralized backbone.

- Tokens bring the utility, applications, and innovation that run on that backbone.

Getting this relationship is the key to truly understanding what a crypto token is and why it's become such a powerful tool for building new digital economies. In this shared environment, one really can't exist without the other.

The Different Flavors of Crypto Tokens

When you first dive into crypto, the sheer variety of tokens can feel overwhelming. It's not just one thing; it's an entire ecosystem of specialized digital assets, each built for a different job.

Think of it this way: not all tokens are trying to be money. Some act like keys, others are more like stock certificates, and some are like unique, one-of-a-kind collectibles. Once you get a handle on the main categories, the whole space starts to click. Let's break down the most common types you’ll run into.

Utility Tokens: The Keys to the Kingdom

The most widespread type of token you'll find is the utility token. The name says it all—it has a specific use or utility within a project's ecosystem. Think of it as an access pass or a software key.

A project might require you to hold or spend its utility token to unlock certain features, get a discount on services, or pay transaction fees on its platform. Essentially, it’s the internal currency that makes a specific application go round.

A perfect example is the LINK token from Chainlink. For the network to work, smart contracts need reliable, real-world data. Node operators provide that data, and they get paid in LINK for their service. The token is the fuel that powers the entire network.

Security Tokens: Digital Ownership

Now we get into security tokens. These are a whole different ballgame. They are the crypto world's answer to traditional stocks and bonds, representing legal ownership of a real-world asset.

This could be equity in a company, a fractional share of a rental property, or even a piece of fine art. Because they represent ownership and often come with the expectation of profit, security tokens fall under strict financial regulations. This means they have to comply with securities laws, which gives investors a layer of protection you don't typically see with other tokens.

Governance Tokens: A Voice in the Project

Ever wished you could have a say in how your favorite app or platform is run? That’s exactly what governance tokens are for. Holding these tokens gives you voting power on proposals that shape a project's future.

Proposals can cover anything from changing platform fees to deciding how to spend funds in the community treasury. Typically, one token equals one vote, so the more you hold, the bigger your say. This is the core idea behind Decentralized Autonomous Organizations (DAOs), where the community is in the driver's seat.

Key Insight: The sheer variety of token types shows just how flexible this technology is. Tokens are essentially digital building blocks that allow us to create new forms of value, ownership, and community interaction online.

Non-Fungible Tokens (NFTs): The One-of-a-Kinds

Last but not least, we have Non-Fungible Tokens (NFTs). This is where things get really interesting. All the other tokens we've discussed are "fungible," meaning one is identical to and interchangeable with another, just like dollar bills.

NFTs are the opposite. Each one is completely unique and can't be replaced. An NFT is basically a digital certificate of authenticity and ownership for a specific item. That item could be a piece of digital art, a collectible video game item, a song, or even a ticket to an event. It's this provable uniqueness that gives them their value.

To pull it all together, here’s a simple table breaking down these token types.

Types of Crypto Tokens and Their Functions

| Token Type | Main Purpose | Simple Analogy | Example |

|---|---|---|---|

| Utility Token | Grants access to a product or service | An arcade token or a software license key | Chainlink (LINK) |

| Security Token | Represents ownership of a real-world asset | A digital stock certificate or property deed | tZERO (TZROP) |

| Governance Token | Gives voting rights in a project's decisions | A seat on a board of directors | Uniswap (UNI) |

| NFT | Proves ownership of a unique digital/physical item | A signed piece of art or a collectible card | CryptoPunks |

These different categories really highlight the incredible versatility of crypto tokens. Their wide-ranging applications are a huge reason why the global cryptocurrency market, valued at around USD 5.7 billion, is projected to hit USD 11.7 billion by 2030. If you're curious about the numbers, you can explore detailed market growth projections on grandviewresearch.com to see what’s driving this growth.

How a Crypto Token Is Born

Ever wondered where a crypto token actually comes from? It’s not some mystical digital process. It’s more like following a well-established, open-source recipe. The secret sauce is something called a token standard.

Think of a token standard as a universal blueprint for building things on an existing blockchain.

It’s a bit like USB-C. Because all sorts of companies agreed to follow the USB-C blueprint, pretty much any cable you grab works with any compatible device, no matter who made it. Token standards do the same thing for the crypto world. They guarantee that a new token built using the blueprint will instantly work with all the existing wallets, exchanges, and apps in that ecosystem.

The Most Famous Blueprint: ERC-20

The most famous and widely used blueprint by a long shot is Ethereum’s ERC-20. This standard is basically a set of rules that every token on Ethereum agrees to follow.

It defines the core functions of a token, like:

- How to check a wallet's balance

- How to transfer tokens from one person to another

- What the total supply of the token is

By using this ready-made template, developers don't have to build a new blockchain from the ground up every time they have an idea for a new token. This has been a massive catalyst for innovation, letting thousands of projects pop up on the Ethereum network. For a deeper dive into the foundational tech, understanding blockchain technology is a great place to start.

Launching a New Token into the Wild

Okay, so you've used a standard like ERC-20 to mint your token. Now what? You have to actually get it out there and into people's hands. This launch phase is a huge deal, and it's often done through what’s called a Token Generation Event (TGE).

A Token Generation Event is the moment a new cryptocurrency is created and introduced to the public. It marks the official birth of the token and the start of its circulation in the market.

One of the most common ways to run a TGE is through an Initial Coin Offering (ICO). You can think of an ICO as the crypto world's version of crowdfunding. During an ICO, a project will sell a chunk of its brand-new tokens to early believers and investors to raise the money needed to build out their vision.

To get the full story, it's worth exploring the complete TGE meaning in crypto to see how these launches really work.

Tokens in the Wild: Real-World Use Cases

It’s one thing to know what the different types of tokens are, but it’s seeing them in action that really makes the concept click. Tokens are way more than just assets for speculation; they're the functional tools being used to build the next wave of digital services. From finance to gaming, their applications are already making a serious impact.

One of the clearest examples is in Decentralized Finance (DeFi). Think about a financial system that’s always open and doesn't need a traditional bank to work. That's the promise of DeFi. Utility and governance tokens are the engines powering platforms that let you lend, borrow, and trade directly with others, often with much lower fees and more transparency than you'd get from a bank.

The growth in this space has been pretty staggering. The DeFi market cap hit around USD 98.4 billion, which speaks volumes about its resilience and the utility of tokens in creating new financial instruments. Digging into real-world adoption, roughly half of small and medium-sized businesses globally have begun accepting crypto payments. You can get more stats on this trend over at coinlaw.io.

Fueling New Digital Economies

Beyond the world of finance, tokens are laying the groundwork for entirely new economies, especially in gaming and the metaverse. In these virtual spaces, tokens represent actual, tangible value.

- In-Game Assets: That rare sword or unique character skin you earned? It can be an NFT, giving you true ownership. You can then sell or trade it on an open market, not just within the game's walled garden.

- Virtual Real Estate: In projects like Decentraland, tokens (called LAND) represent plots of digital terrain. Owners can build whatever they want, rent it out, or host events, effectively creating a user-owned virtual world.

- Play-to-Earn (P2E) Gaming: Some games actually reward players with utility tokens for their skill and time investment. This completely changes the dynamic, turning a hobby into a potential income stream.

Once you’ve got a handle on the basics, a very common way people interact with tokens is through crypto trading. This allows anyone to speculate on the future value of different projects and their tokens, giving them a direct stake in these emerging economies.

The Big Picture: Tokens are turning passive users into active owners. Whether you're getting a vote in a project's future or owning a slice of a virtual world, tokens are shifting power away from centralized companies and into the hands of the community.

From Supply Chains to Digital Identity

And the use cases just keep expanding. Companies are using tokens to track goods all the way from the factory to the store shelf, which helps guarantee authenticity and fight counterfeiting. Other projects are focused on self-sovereign identity, where you control your own personal data with a secure token instead of trusting big tech companies to hold it for you.

All these examples show what a crypto token is in practice: a flexible, powerful building block for a more open and user-focused internet. They are the keys to unlocking a world where value, ownership, and control belong to the people who actually build and participate in the network.

What Actually Gives a Crypto Token Its Value?

So, why is one token trading for pennies while another is worth a small fortune? It’s not just hype or a lucky guess. The real answer lies in something called tokenomics—basically, the economic rulebook written for a specific token. Getting a grip on these fundamentals is how you learn to see past the noise and spot what gives a token real, long-term potential.

Think of it like this: you're trying to get tickets for the hottest concert in town. If there's a limited number of seats and everyone wants to go, what happens to the ticket prices? They shoot up. The same classic supply and demand principles are at play with crypto tokens, just with a few digital twists.

When you boil it all down, a token's value really rests on three core pillars.

The Power of Scarcity and Supply

First up, you have to look at the total supply. Is there a hard cap on how many tokens will ever exist, or can new ones be minted endlessly? A token with a fixed supply, like Bitcoin's famous 21 million cap, has scarcity baked right into its code. When demand for a finite asset goes up, the price naturally tends to follow.

On the flip side, a token with an inflationary model—where new tokens are constantly being created—can see its value get diluted over time. For its price to grow, demand has to consistently outpace the creation of new supply. Scarcity isn’t the whole story, but it’s a crucial piece of the value puzzle.

A token's design is its economic DNA. The rules governing its supply, distribution, and utility determine whether it has a foundation for sustainable value or is just built on temporary excitement.

Real-World Utility and Demand

Next, and this is arguably the most important part, is utility. What can you actually do with the token? A token's usefulness is what creates genuine demand.

- Access: Does holding the token unlock a special service or get you into an exclusive platform?

- Governance: Does it give you a vote on where the project goes next?

- Rewards: Can you stake it to earn more tokens or get a piece of the network's revenue?

The more vital a token is to its own ecosystem, the more people will need to buy and hold it. That creates real, sustained demand that isn't just based on speculation. A token with no utility is just a ship without a sail, waiting for a gust of wind.

How it's Distributed

Finally, you have to consider its distribution. How did the tokens get out into the world in the first place? A fair launch that gets the tokens into the hands of a wide community can build a powerful, decentralized base. But if a few insiders or early investors are sitting on most of the supply, they can easily manipulate the price, creating a ton of risk and instability for everyone else.

Alright, let's tackle some of the common questions that pop up once you start digging into the world of crypto tokens. Getting these sorted will help everything else click into place.

Can Any Token Actually Become the Next Bitcoin?

Honestly, it's a long shot. And I mean a really long shot.

The reason is they're built for completely different things. Bitcoin is the native currency of its own massive, secure blockchain. People treat it like digital gold—a store of value. Most tokens, on the other hand, are designed to do something specific inside a single app or ecosystem. Their value is tied directly to the success and utility of that one project.

Think of it this way: Bitcoin is like the US dollar, a foundational currency for a huge economy. A token is more like a gift card for your favorite coffee shop. Both have value, but they exist on totally different scales for entirely different reasons.

So, Are Crypto Tokens a Safe Bet for Investing?

Definitely not. They are high-risk investments, plain and simple.

The crypto market is known for its wild price swings, and a huge number of token projects just don't make it. Worse, some are created as outright scams. A token's value is completely dependent on things like its actual usefulness, the credibility of the team behind it, and the general mood of the market, which can change in an instant.

If there's one piece of advice to take away, it's this: DYOR—"Do Your Own Research." Before you even think about putting money in, you absolutely have to understand the project's tokenomics, its goals, and whether it has a realistic shot at succeeding.

Okay, Where Do I Even Get These Tokens and How Do I Keep Them Safe?

You'll typically buy tokens on a cryptocurrency exchange. Once you have them, you need a digital wallet that supports the token's blockchain. For example, if you buy a token built on Ethereum (an ERC-20 token), you'll need an Ethereum-compatible wallet.

These wallets come in two main flavors: software "hot wallets" that live on your phone or computer, and ultra-secure hardware "cold wallets" that look like little USB drives.

Do I Need to Own Crypto Coins to Use My Tokens?

Yep, you almost always will. Since tokens piggyback on an existing blockchain, you need that blockchain's native coin to pay for transaction fees. These are usually called "gas fees."

For instance, if you want to send an ERC-20 token to a friend, you'll need a little bit of Ether (ETH) in your wallet to cover the gas for that transaction on the Ethereum network. Without the coin, your tokens are basically stuck.

Ready to engage your Web3 community with reward-based quests? Domino lets you design and launch powerful campaigns in minutes, no code required. Drive user acquisition and boost on-chain activity effortlessly. Discover what you can build with Domino today!

Level Up Your dApps

Start using Domino in minutes. Use automations created by the others or build your own.