Crypto Coin and Token Explained: Key Differences You Need to Know

Even though you'll hear crypto coin and token used interchangeably, they're fundamentally different beasts. Think of a crypto coin, like Bitcoin or Ethereum, as the native currency of its own country—its own independent blockchain. It's the digital money that makes that specific network run.

A crypto token, on the other hand, is built on top of an existing blockchain. It’s more like a voucher or an asset that lives within a larger ecosystem.

Coins vs Tokens: Unpacking the Core Concepts

Getting this distinction right is the first step to really understanding the crypto space. Coins are the bedrock. They provide the economic juice and security for their own blockchains, used for things like paying transaction fees, participating in network security through staking, and acting as a store of value.

Tokens are where things get really creative. They're spun up using smart contracts on established platforms like Ethereum, Solana, or Polygon. This is a huge advantage because developers don't have to go through the massive effort of building and maintaining a brand new blockchain from scratch. It's this ease of creation that has led to an absolute explosion of token-based projects. If you want to go deeper on this, we've got a great guide on what tokens are in cryptocurrency.

This innovation is fueling some serious growth. The global crypto market was valued at around USD 5.7 billion in 2024 and is expected to climb to nearly USD 11.7 billion by 2030. That’s a compound annual growth rate of roughly 13.1%, which shows just how much momentum is in this space.

Quick Look: Coins vs. Tokens at a Glance

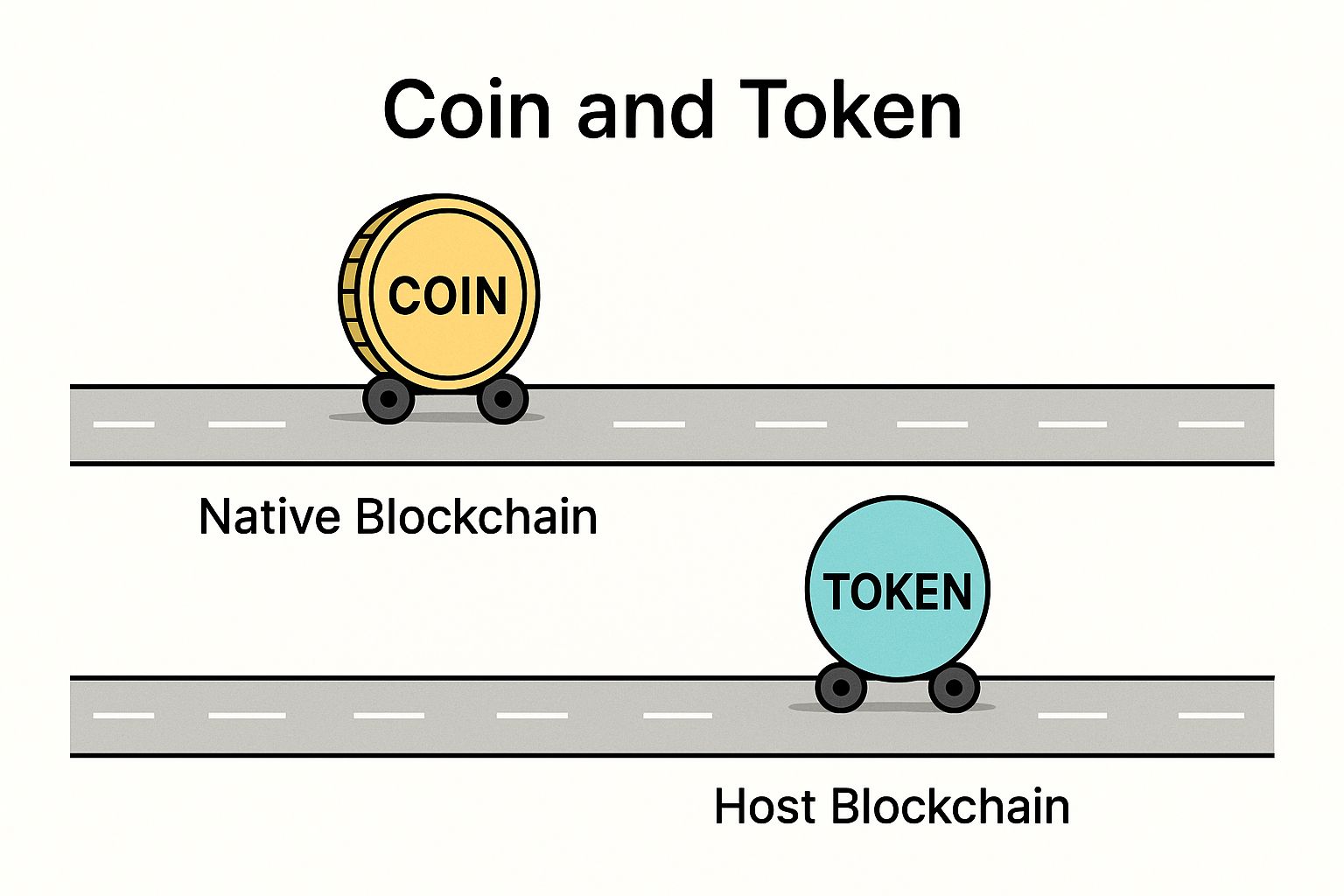

Here’s a simple analogy: A coin is a car that built its own private highway system to drive on (its native blockchain). A token is a car that just uses the public highway system someone else already built (a host blockchain like Ethereum).

This infographic really helps visualize that relationship.

As you can see, coins are tied at the hip to their own blockchain, while tokens are guests on another network. That’s the single most important technical and functional difference to remember.

To make it even clearer, let's break down the key differences in a quick table.

| Attribute | Crypto Coin | Crypto Token |

|---|---|---|

| Blockchain | Operates on its own native, independent blockchain. | Built on top of an existing host blockchain (e.g., Ethereum). |

| Creation | Involves creating and launching a new blockchain. | Created via a smart contract on an existing network. |

| Primary Use | Store of value, medium of exchange, payment for network fees. | Represents utility, governance rights, or ownership of assets. |

| Example | Bitcoin (BTC), Ether (ETH), Solana (SOL) | Uniswap (UNI), Chainlink (LINK), Shiba Inu (SHIB) |

This side-by-side view really boils it down: coins are the infrastructure, and tokens are the applications built on that infrastructure.

The Technical Divide Between Coins and Tokens

To really get what separates a crypto coin and token, we have to look under the hood. The difference isn't just semantics—it's about where they live and how they're built. A crypto coin is the native currency of its own blockchain. It's the lifeblood of that specific digital ledger.

Take Bitcoin (BTC). It’s not just an asset floating in cyberspace; it runs on the Bitcoin blockchain. Every single transaction and every mined block is logged on this dedicated network. The coin, BTC, is what makes the whole thing work, mostly by paying the miners who keep the network secure and validate transactions.

Because of this, creating a new coin is a huge undertaking. You have to build an entire blockchain from scratch, which means designing your own consensus rules (like Proof-of-Work), setting up security protocols, and gathering a community to run the network. It's a massive technical lift.

How Smart Contracts and Token Standards Change the Game

Tokens take a much simpler route. Instead of paving a new road, they just drive on an existing highway. They're created using smart contracts on established blockchains like Ethereum, Solana, or Polygon.

These smart contracts are just pieces of code that act as self-enforcing agreements. They lay out all the rules for the token: how many can be created, what they can be used for, and how they get moved around. This is why we've seen an absolute explosion of tokens—all the hard work of building and securing a blockchain is already taken care of.

This whole process is made easier by token standards, which are basically just templates for creating new tokens on a given network.

- ERC-20 on Ethereum: This is the big one. It's a set of rules that most tokens on Ethereum follow, which is why you can hold thousands of different ERC-20 tokens in one Ethereum wallet. If you want to get into the nitty-gritty, you can explore the ERC-20 standard in this detailed app.

- SPL on Solana: This is Solana's version of the standard, built for super-fast transactions and low fees.

- BEP-20 on BNB Chain: This standard is for tokens built on the BNB Smart Chain, another go-to choice for developers.

By piggybacking on these standards, developers can whip up a new crypto token in a matter of minutes, not years. It completely lowers the barrier to entry, fueling the incredible pace of innovation we see in DeFi, gaming, and NFTs.

A Tale of Two Security Models

This core architectural split has a direct effect on security. A coin’s security is only as strong as its own blockchain. The more miners or validators a network has spread across the globe, the harder it is to attack.

A token, on the other hand, just inherits the security of its host. An ERC-20 token built on Ethereum is protected by the thousands of nodes that secure the entire Ethereum network. The token's creators don't have to worry about building that security from the ground up; they're essentially outsourcing it.

This also explains why the crypto world has grown so fast. The user base, which jumped by around 40 million globally in just six months as of late 2024, is overwhelmingly interacting with tokens on these big, established chains. This easy access is a major reason why so many people are dipping their toes into the crypto coin and token ecosystem.

Coins vs. Tokens: What Do They Actually Do?

Okay, so we've covered the technical side of things, but what really matters is what you can do with a crypto coin versus a token. This is where their paths really diverge. Coins are the foundation, the native currency of their own blockchains, and their jobs are few but incredibly important.

Think about Bitcoin (BTC) or Solana (SOL). Their main gigs are pretty straightforward: they work as a medium of exchange (letting you send money without a middleman), a store of value (like digital gold), and most importantly, they're used to pay network transaction fees, or "gas." These fees are what keep miners and validators motivated to secure the network.

Bottom line: the coin is the fuel that keeps its own blockchain engine running. Without it, the whole system stalls out.

The Swiss Army Knife of Digital Assets

Tokens are a completely different animal. Since they're built on top of existing blockchains, they don't have to worry about running the network itself. This frees them up to be, well, almost anything. This incredible versatility is what's fueling so much of the innovation in Web3.

Let's look at the most common flavors of tokens you'll run into:

- Utility Tokens: These are your keys to the kingdom. They grant you access to a specific product or service. A classic example is Filecoin (FIL), which you use to pay for decentralized data storage.

- Governance Tokens: Want a say in a project's future? That’s what these are for. Holders of MakerDAO’s MKR token, for instance, can vote on critical protocol changes, putting the community in the driver's seat.

- Security Tokens: These are essentially traditional financial assets, like stocks or bonds, dressed up for the digital age. They represent actual ownership in a company and have to play by securities regulations.

- Non-Fungible Tokens (NFTs): Unlike the others, every single NFT is one-of-a-kind. It's a digital certificate of ownership for a unique item, whether that's a piece of art, a concert ticket, or even a real-world property deed.

The easiest way to think about it is this: If a coin is the engine that powers a blockchain, a token is everything else you can build with it—the steering wheel, the seats, the stereo system.

Interestingly, the 2025 Chainalysis Global Adoption Index shows that this isn't just a niche hobby. Countries like Ukraine, Moldova, and Georgia are leading the charge in crypto adoption when adjusted for population, signaling major retail and institutional interest in what both coins and tokens have to offer. You can dig deeper into these global crypto adoption trends on chainalysis.com.

Practical Use Cases: Coins vs. Diverse Token Types

To really drive the point home, let's put these assets side-by-side. You'll see that a coin's job is pretty fixed, while a token's role is defined entirely by the project that created it.

| Category | Example Project | Primary Function |

|---|---|---|

| Native Coin | Ethereum (ETH) | Pays for gas fees, secures the network, and acts as a store of value. |

| Utility Token | Chainlink (LINK) | Used to pay for decentralized oracle services that bring real-world data to smart contracts. |

| Governance Token | Uniswap (UNI) | Grants holders the right to vote on changes to the Uniswap decentralized exchange protocol. |

| NFT | Bored Ape Yacht Club | Represents unique ownership of a digital art collectible and membership in an exclusive club. |

This table lays out the fundamental split. So, next time you're looking at a new project, ask yourself this one simple question: Is this asset the fuel for its own blockchain (a coin), or is it an application running on someone else's (a token)? The answer will tell you everything you need to know about its purpose and potential.

How to Evaluate a Crypto Project

Alright, so you know the difference between a coin and a token. That's the first hurdle. Now for the hard part: figuring out how to spot a promising project and steer clear of a potential dud.

This isn’t financial advice. Think of it more as a mental toolkit for doing your own homework. The questions you need to ask change a bit depending on whether you’re looking at a project with its own native coin or a token that piggybacks on another network.

When you're sizing up a coin-based project—think Bitcoin or Solana—you’re really kicking the tires on the blockchain itself. The entire focus is on that core infrastructure. Is it strong? Is it secure? Is it built to last? A shaky foundation puts everything on top of it at risk.

But for a token-based project, your perspective shifts. The token runs on a host blockchain like Ethereum, so you don't have to sweat the network security as much—it just borrows it. Instead, you get to focus on what the project actually does. The analysis is about the app, not the highway it's driving on.

Analyzing a Coin-Based Project

For any native crypto coin, the health of its blockchain is the whole game. You’re looking for a network that’s secure, decentralized, and actually being used. Anything less is a deal-breaker.

Here’s what to dig into:

- Network Security: How is the network defended? For a Proof-of-Work coin like Bitcoin, you'd look at the hash rate. A higher hash rate means more computing power is protecting the network, making it incredibly expensive to attack. For a Proof-of-Stake coin, the amount of capital staked is the metric to watch.

- Decentralization: Who's really in control? Check out the number of active nodes or validators. A project with thousands of independent participants spread globally is way more resilient than one run by a small, cozy group.

- Developer Community: Is anyone actually working on this thing? A quick look at the project's GitHub repository tells you a lot. If you see consistent, recent activity from a vibrant developer community, that's a great sign. A ghost town is a huge red flag.

A coin’s value is directly tied to the trust and utility of its native blockchain. If the chain can’t pull in users, developers, and miners or validators, the coin has no real purpose beyond pure speculation.

Evaluating a Token-Based Project

With tokens, you can stop worrying about the blockchain’s plumbing and start investigating the project itself. You're basically analyzing a business or application that just happens to use a blockchain to operate.

The things that really matter here are utility, the team, and the token's economic design.

- Utility and Use Case: What does the token actually do? Does it get you access to a service, give you voting rights in a DAO, or act as a digital IOU? A token without a clear, compelling purpose is often just a speculative vehicle waiting for a crash.

- Team Credibility: Who are the people behind the curtain? Look for a public-facing team with a solid track record. Anonymous founders can be a major warning sign—it’s a lot easier to disappear when things go south if no one knows who you are.

- Tokenomics: This is the nitty-gritty of the token’s economic blueprint. You need to understand its total supply, how it was distributed, and when new tokens are released. If the team and early investors got a massive slice of the pie, you can probably expect some heavy selling pressure down the road.

The rules that govern a token's supply and distribution, often finalized during a Token Generation Event (TGE), are absolutely critical. You can learn more about what a TGE means for a crypto project in our detailed guide. A smart economic model creates incentives that fuel long-term growth, but a poorly designed one can torpedo a great idea before it ever gets off the ground.

Choosing the Right Asset for Your Goals

So, you get the technical difference between a crypto coin and a token. That’s the easy part. The real trick is figuring out which one actually makes sense for what you’re trying to do. It all comes down to your personal goals—they’re the compass that will point you toward either a native coin or a versatile token.

This isn't about picking a "winner." It's about matching the tool to the job. Are you looking for a long-term digital safe haven, or are you eager to jump into the fast-paced world of decentralized apps? Each path leads to a very different kind of digital asset.

Aligning with Long-Term Value and Security

If you're hunting for a digital version of gold—something you can hold onto for the long haul as a store of value—then you’re probably going to lean toward established native coins. Think about assets like Bitcoin. Its blockchain has survived for over a decade, fending off countless attacks and proving its resilience. That’s what gives it immense network security.

The main job of a coin is to keep its own network secure and serve as a trustworthy way to transact within that ecosystem. This clear, singular purpose makes for a straightforward value proposition, especially if your top priorities are stability and security over fancy features. When you hold a coin like that, you’re making a bet on the long-term health and decentralization of its entire blockchain.

Engaging with Applications and Ecosystems

On the flip side, if you're more interested in the vibrant world of DeFi, Web3 gaming, or decentralized social media, you’ll be dealing almost exclusively with tokens. Tokens are what make these applications tick—they’re the keys, the voting ballots, and the in-game cash that bring these platforms to life.

Think about it in these real-world terms:

- Jumping into DeFi: Want to use a decentralized exchange like Uniswap or a lending platform like Aave? You'll need their tokens (UNI and AAVE). These often give you a say in how the protocol is run.

- Playing Web3 Games: In a play-to-earn game, you might get utility tokens for finishing a quest. You can then use those tokens to buy cool gear inside the game or even trade them on an exchange.

- Joining a DAO: To be a part of a Decentralized Autonomous Organization, you usually need to hold its governance token. That token is your ticket to vote on everything from major decisions to how the treasury's funds are spent.

In every one of these cases, the token has a specific job inside an application. Your bet isn't so much on the survival of the host blockchain (like Ethereum), but on the success and popularity of that one specific dApp.

Choosing between a crypto coin and token is really a strategic decision rooted in what you want to accomplish. A coin is a stake in the foundational infrastructure itself. A token is a stake in a specific application running on top of that infrastructure.

Matching Asset Types to Specific Goals

To make this crystal clear, let’s map out how different goals line up with coins versus tokens. You can use this as a quick reference to guide your thinking.

| Your Goal | Likely Asset Type | Why It Fits | Real-World Example |

|---|---|---|---|

| Store of Value | Native Coin | Its purpose is built around network security, decentralization, and a proven history as digital money. | Holding Bitcoin (BTC) as a long-term hedge, trusting its incredibly robust and battle-tested network. |

| Active Participation | Governance Token | Gives you voting power to help shape the future of a dApp or protocol you believe in. | Using Uniswap (UNI) tokens to vote on proposals for the world's biggest decentralized exchange. |

| Accessing a Service | Utility Token | It’s the required "key" or "currency" needed to use a specific decentralized service. | Paying with Filecoin (FIL) to rent decentralized storage space for your data. |

| Speculating on dApp Growth | Utility/Governance Token | The token’s price is directly tied to the hype and success of its specific application. | Buying the token for a new Web3 game because you think it’s going to be the next big hit. |

At the end of the day, your strategy is what matters most. Figure out what you want to achieve first—whether that’s protecting your capital, having a voice in a project, or just trying out a new service. Once you have that clarity, you can easily decide whether a crypto coin or a token is the right tool for the job. It turns a potentially overwhelming choice into a simple, goal-driven decision.

Common Questions About Coins and Tokens

Even with a solid grasp of the technical side, a few questions always seem to pop up when people are trying to untangle the whole coin vs. token thing. Let’s tackle some of the most common points of confusion head-on.

This isn’t about just repeating definitions. It’s about answering the practical questions you run into once you start exploring the space. Think of it as a quick FAQ to make sure everything clicks into place.

Can a Blockchain Have Both a Coin and Tokens?

Yep, absolutely. In fact, that’s the most common setup you’ll find. A blockchain has to have its own native coin to work, but it can also be home to thousands of different tokens.

The Ethereum network is the classic example here. Its native coin is Ether (ETH). You need ETH to pay for transaction fees (known as gas) for anything you do on the network—whether you’re sending money to a friend or interacting with a decentralized app. But at the same time, the Ethereum blockchain hosts hundreds of thousands of different ERC-20 tokens, like UNI, LINK, and SHIB.

Think of it like an arcade. The native coin (ETH) is the quarter you need to play any game in the building. The tokens (UNI, LINK) are the prize tickets you get from a specific machine. Those tickets have value and a purpose, but only within that arcade.

Is One a Better Investment Than the Other?

Ah, the million-dollar question. The honest answer is: it completely depends on your goals and how much risk you're comfortable with. There's no single "better" choice because a coin and a token are fundamentally different kinds of bets.

Investing in a major native coin like Bitcoin or Ether is often seen as a wager on the long-term success of the entire blockchain. You’re betting on the infrastructure itself, hoping it gains wider adoption over time.

Investing in a token, on the other hand, is a much more specific bet on a single project or application. Its success is tied directly to that project's ability to pull in users and deliver real value. A token for a hit DeFi app could go to the moon even if the host blockchain's coin is just trading sideways. But it could also crash to zero if the app fails, even if the underlying blockchain is doing great.

Can a Project Start as a Token and Later Launch Its Own Coin?

Yes, and this has become a pretty standard playbook for ambitious projects. A team might launch an ERC-20 token on Ethereum first to tap into its security, massive user base, and development tools. It’s a way to build a community and prove their concept without the massive headache and expense of building a brand-new blockchain from scratch.

If the project gets enough traction, they might eventually migrate to their own native blockchain. This is often called a "mainnet swap." When that happens, the original tokens are swapped for the new native coins on the project’s very own chain.

A great example is Crypto.com. It started with the CRO token on Ethereum and later moved to its own Crypto.org Chain, where CRO became the native coin.

Are All Tokens Created on Ethereum?

Not at all. While Ethereum kicked things off and is still the heavyweight champion for token creation, it's far from the only game in town. A bunch of other smart contract platforms now have their own thriving token ecosystems, each with different strengths.

- Solana (SPL Tokens): Built for insane speed and super-low transaction costs.

- BNB Smart Chain (BEP-20 Tokens): Known for its low fees and deep integration with the Binance ecosystem.

- Polygon: A "layer 2" network that gives projects a faster, cheaper way to operate while still being connected to Ethereum.

The choice of blockchain really boils down to what a project needs—whether that’s speed, rock-solid security, or reaching a specific audience. This multi-chain world is a huge part of what makes the crypto space so dynamic.

Ready to build and grow your Web3 community? Domino makes it easy to create engaging, reward-based quest campaigns without any code. From social media tasks to on-chain actions, our platform automates verification and helps you scale user acquisition effortlessly. Launch your first campaign in minutes at Domino.run.