TGE Meaning Crypto Unpacked for Beginners

Alright, let's cut through the jargon. What exactly is a Token Generation Event (TGE)?

Think of it as the big bang for a new cryptocurrency. It’s the precise moment a project's digital token goes from being just an idea on a whitepaper to a living, breathing asset on the blockchain. This is what people are talking about when they ask for the "TGE meaning crypto."

The Official Launch of a Crypto Token

Before the TGE, a token is purely conceptual. After the event, it's a real digital asset you can hold, trade, or use. It’s the starting gun for the project's entire economy.

Let's make this super simple with an analogy. Imagine a new craft brewery getting off the ground.

- The Whitepaper: This is the brewer's secret recipe. It details every ingredient, the brewing process, and what makes their beer unique.

- Fundraising: This is like a pre-sale campaign where they sell vouchers for the first batch to beer lovers who believe in the recipe.

- The TGE: This is bottling day. The beer is officially brewed, bottled, and ready to be delivered to everyone who bought a voucher.

That's a TGE in a nutshell. It’s not just some technical backend process; it’s the shift from a promising idea to a live product. The project’s smart contract acts like the digital bottling plant, creating (or "minting") the tokens and sending them out to early investors, the team, and the project's own coffers.

To give you a quick cheat sheet, here’s a simple breakdown of what a TGE involves.

TGE at a Glance

| Component | Simple Explanation |

|---|---|

| Smart Contract | The digital "factory" that automatically creates the tokens based on pre-set rules. |

| Tokenomics | The "recipe" that defines the total supply, how tokens are distributed, and their purpose. |

| Minting | The act of creating the new tokens on the blockchain. It's the "bottling" part of our analogy. |

| Distribution | Sending the newly minted tokens to the wallets of early investors, team members, and the treasury. |

| Listing | The token becomes available for public trading on a crypto exchange for the first time. |

Essentially, getting your head around the TGE is the first real step to understanding how any new crypto project gets its start.

Why TGEs Are a Big Deal for Crypto Projects

Okay, so we know what a TGE is, but why is everyone in crypto so obsessed with them? Let's get real: a TGE isn't just some technical step on a checklist. It’s the make-or-break moment that can set the entire trajectory for a project's future.

This is the event that fires the starting pistol for the project's economy. It’s where a concept living in a whitepaper becomes a live, breathing ecosystem with its own currency. For the early believers who invested, this is the day they finally get their hands on the tokens they bought into.

A well-handled TGE is the ultimate proof point. It completely changes the conversation from "what if" to "what's next," telling the world that the project is officially open for business.

Kicking Off the Market and Building Momentum

You can think of the TGE as a project's grand debut on the public stage. It's the moment the token gets its initial price and liquidity, which allows it to get listed on exchanges and traded by pretty much anyone. A smooth launch can create a massive wave of excitement and positive chatter.

That initial momentum is everything. It pulls in new users, developers, and more investors, kickstarting a network effect that fuels the ecosystem's growth. It's a lot like a rocket launch—a powerful TGE provides that massive initial thrust needed to break free and get into orbit.

A strong TGE isn't just about making a token exist; it's about building confidence. It shows everyone that the team can actually deliver on its promises and pull off a complex technical and economic event without a hitch.

The Foundation of a New Economy

When crypto projects think about the TGE meaning crypto, they need to see it as the bedrock for their entire on-chain economy. The world of "crypto" has grown from simple digital money like Bitcoin into incredibly complex systems for decentralized finance and smart contracts. If you want to dive deeper into this growth, Grandview Research has some great insights on the expanding crypto market size.

A TGE is what puts a project's tokenomics—the rules that define a token's supply and purpose—into action. It’s where all the theory crashes into reality. This event nails down the specifics:

- Initial Supply: How many tokens are created right out of the gate.

- Distribution: Who actually gets the tokens (e.g., investors, the team, the community).

- Vesting Schedules: The rules dictating when insiders can start selling their tokens.

Getting these details right from the very beginning is absolutely vital for the project's long-term health and success.

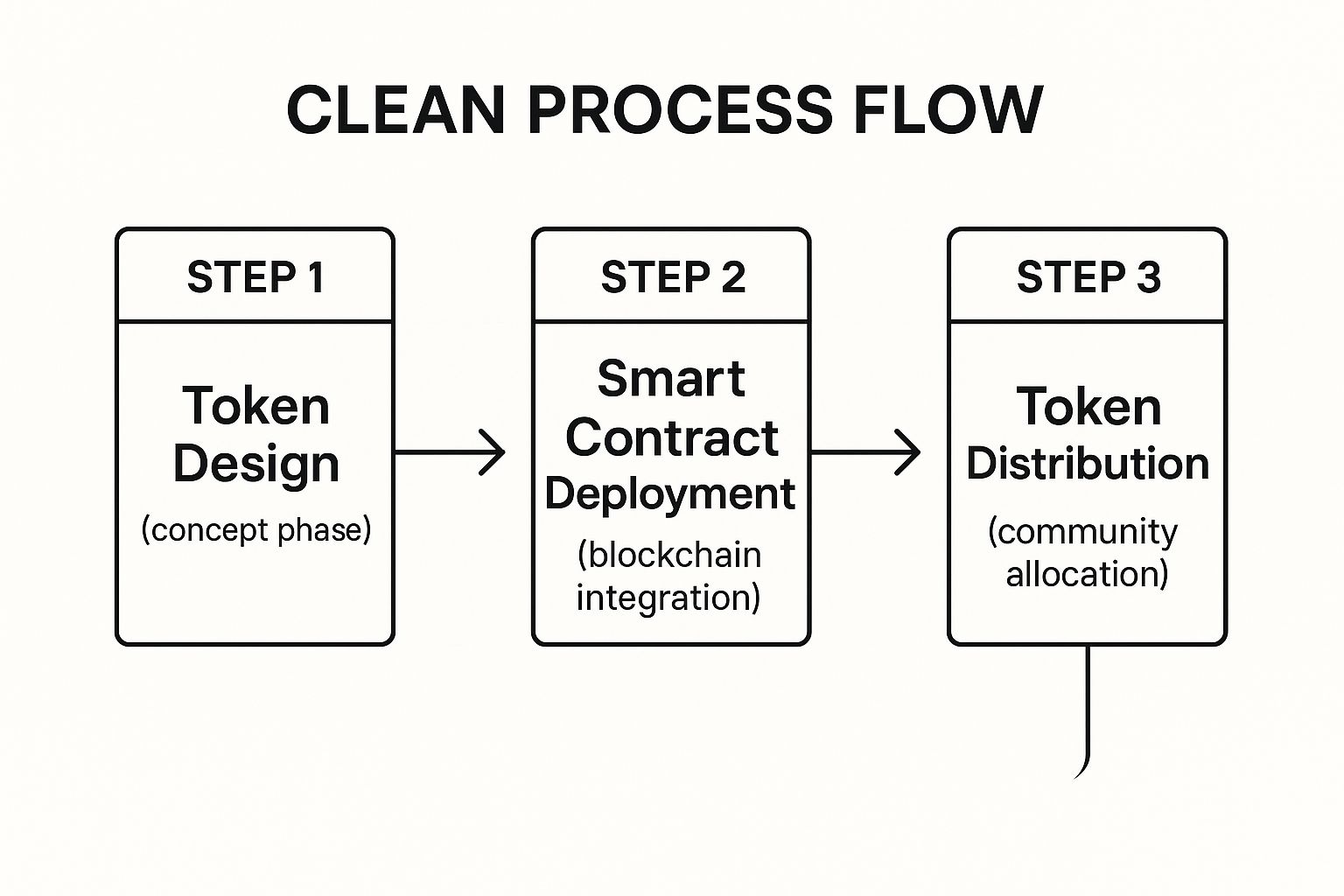

How a Token Generation Event Actually Works

A Token Generation Event isn’t just about flipping a switch and creating a new crypto token. It's more like a carefully planned product launch, unfolding in distinct phases that take an idea from a whitepaper to a real, tradable asset on the blockchain. Let's break down how it all comes together.

The whole process starts long before the first token even exists. This is the pre-TGE phase, and it’s all about laying the groundwork. The team is busy building a community, generating hype, and securing initial funding. This usually involves private sales to big-time investors and venture capital firms, followed by public sales like an Initial Coin Offering (ICO) that lets everyday crypto enthusiasts get in on the action.

From Blueprint to Blockchain

With funding in the bank, the real tech work begins. The developers get to work writing and deploying the smart contract. Think of this as the digital DNA of the token—it's a self-executing piece of code that lives permanently on the blockchain and lays down the law.

This smart contract defines all the critical details, such as:

- Total Supply: The hard cap on how many tokens can ever be created.

- Token Symbol: The ticker you'll see on exchanges (like BTC for Bitcoin).

- Token Behavior: The rules for how the token can be transferred and used.

This contract is the core of the TGE. It automates everything, ensuring the token is created and sent out exactly as promised, without any need for a central authority to manage the process.

This infographic breaks down the core sequence of events, from the initial planning stages right through to the final distribution.

As you can see, it's a logical flow. You have to build a solid technical foundation before you can start handing out tokens.

The Main Event: Token Minting and Distribution

This is the big moment—the TGE itself. At a specific, pre-announced time, the smart contract is triggered to mint (or create) the entire supply of new tokens.

From there, the smart contract automatically distributes these freshly minted tokens to different wallets according to the project’s master plan, or "tokenomics." This is where a project's digital economy officially comes to life.

The distribution dictates who gets what. This includes early investors, the development team (often with locked tokens), the project’s treasury to fund future operations, and, of course, the community.

Distribution can take a few different forms. Sometimes it's a direct transfer to investor wallets. Other times, projects kick things off with a community-focused airdrop to reward early supporters and create a buzz. If you're curious about that specific method, you can dive deeper into how a crypto airdrop works.

Once this final step is complete, the TGE is over, and the token is officially out in the wild.

TGE vs. ICO vs. IDO: Clearing Up the Confusion

The crypto world is notorious for its alphabet soup of acronyms. It's easy to see terms like TGE, ICO, and IDO thrown around and assume they're all the same thing. They all happen around a project's big debut, but they play very different roles.

Let's start with a simple rule of thumb that cuts through the noise.

ICOs, IDOs, and IEOs are all about fundraising. They are different flavors of events where a project sells its tokens to raise money.

A TGE is the technical event where those tokens are officially born on the blockchain and sent out.

Think of it like a new book launch. The ICO is the pre-order campaign where the author sells advance copies to fund the printing costs. The TGE is the actual publication day—the moment the books are printed, bound, and shipped to everyone who pre-ordered.

One is about raising capital, the other is about creating and delivering the actual asset.

The Different Ways to Raise Funds

While a TGE is a specific, technical moment in time, fundraising can happen in a few different ways. Each method has its own vibe and structure.

- Initial Coin Offering (ICO): This is the classic, OG crypto crowdfunding model. The project team runs the sale themselves, usually right on their own website. They're in complete control, from marketing to collecting funds.

- Initial DEX Offering (IDO): In an IDO, the token sale is hosted on a decentralized exchange (DEX). The cool part about this is that the token can often start trading on that DEX almost immediately after the sale ends, creating instant liquidity.

- Initial Exchange Offering (IEO): With an IEO, a big, centralized crypto exchange like Binance or Coinbase hosts the token sale. This is a big deal because the exchange vets the project, giving it a stamp of credibility and exposing it to millions of potential buyers.

All of these—the ICO, IDO, and IEO—are designed to bring in cash. The TGE is what comes next to make good on the promises made to those early backers.

Fundraising vs. Creation Events

To really nail this down, let's put them side-by-side. Seeing the terms compared directly makes their unique roles crystal clear.

| Term | Primary Purpose | When It Happens | Analogy |

|---|---|---|---|

| ICO / IDO / IEO | Fundraising | Before the token is publicly available or tradable | Selling pre-order tickets for a huge concert. |

| TGE | Token Creation & Distribution | The moment the token becomes a live asset on the blockchain | The day of the concert when you actually get your ticket scanned at the gate. |

This distinction is more than just semantics; it’s fundamental. You participate in an ICO to invest in a project's future. You wait for the TGE to actually get your hands on the tokens you bought. Simple as that.

What Separates a Good TGE from a Bad One

Not all token launches are created equal. In crypto, the line between a killer Token Generation Event (TGE) and a total flop can literally make or break a project's entire future. A great TGE builds instant credibility and paves the way for sustainable growth. A bad one? It can be a complete disaster.

So, what’s the secret sauce for a healthy launch? It really boils down to transparent, careful planning. A project that’s upfront about its vision, tech, and the economic model behind its token is already playing in the big leagues.

Solid Tokenomics and Vesting Schedules

First and foremost, you have to look at the tokenomics—the economic DNA of the token. This covers everything from the total supply and how tokens are divvied up (team, investors, community) to what the token actually does in the ecosystem. A smart model incentivizes everyone to stick around for the long haul.

To see how these mechanics can be put into practice, check out our guide on building an ERC-20 token reward system.

Just as critical are the vesting schedules. Think of these as a lock-up period for team members and early investors. It stops them from cashing out all their tokens on day one and crashing the price. This forces them to have skin in the game, proving they’re committed to the project's long-term success, not just a quick profit.

A TGE without clear vesting schedules is a massive red flag. It often signals that insiders are more interested in a fast payday than in building something with real value.

Security and Transparency Are Non-Negotiable

Finally, security is everything. The smart contract behind the TGE needs to be rock-solid. Any serious project will pay for an independent security audit to hunt for bugs or vulnerabilities that hackers could exploit.

When a project publicly shares that audit report, it’s a huge sign of good faith and transparency.

The crypto market is booming and is forecast to hit USD 11.7 billion by 2030, but that growth attracts both innovators and scammers. That's precisely why knowing the signs of a good TGE is so crucial for anyone trying to navigate the space. You can dig into these projections on the crypto market to get a better sense of the scale.

A Few Common TGE Questions Answered

Even with a solid grasp of what a TGE is, some questions always seem to come up. Let's tackle them head-on to clear up any lingering confusion and give you the full picture of how these events play out in the wild.

Can a project have more than one TGE?

This is a big one. The short answer is no—at least, not for the same token. A project's main, native token has only one TGE. Think of it as its birthday; it only happens once.

That said, a project might decide to launch a completely different token down the road for a new feature or ecosystem. That new token would, of course, have its own separate TGE.

What happens to the token price after the TGE?

Get ready for a roller coaster. The moments after a token hits the open market are almost always volatile. Prices can swing wildly as the first wave of trading begins.

A hyped-up launch might see the price skyrocket, but it’s just as common for it to dip as early investors decide to take some profits off the table. This initial turbulence is a classic part of the crypto investing game. If you're just getting started, it helps to get comfortable with the basics, like learning how to add a new network to MetaMask to manage your assets across different chains.

Where can I find info on upcoming TGEs?

Good question. You'll want to go straight to the source and then verify.

- Official Project Channels: Always start with the project’s own website, whitepaper, and official social media accounts. This is ground zero for reliable info.

- Crypto Launchpads: Platforms that host token sales are great resources and usually keep a running calendar of upcoming events.

- News Outlets: Reputable crypto news sites are always on the lookout and will report on major upcoming launches.

The buzz around TGEs isn't just hype; it's a reflection of crypto's incredible growth. In 2024, an estimated 6.8% of the world's population—over 560 million people—now own cryptocurrency. That's a compound annual growth rate of 99% since 2018, a clear sign that crypto is going mainstream.

This explosive growth, especially in places like the Asia-Pacific region where transaction volumes just hit $2.36 trillion, shows why understanding core concepts like the TGE is more important than ever. You can dig into more of the fascinating data behind this explosive crypto ownership growth on Triple-A.

Ready to drive real community engagement for your Web3 project? With Domino, you can design, launch, and automate reward-based quests in minutes, no coding required. Join top Web3 teams who have powered over 25 million quests and see the difference. Launch your first campaign today.