A Simple Guide to Tokens in Cryptocurrency

Ever feel like you’re trying to learn a new language when people start throwing around terms like NFTs, utility tokens, or governance tokens? If so, you've landed in the right spot.

Think of a crypto token as a digital asset that lives on an existing blockchain. It can represent just about anything you can imagine—a piece of art, a membership card, or even a vote in a project's future. They are the versatile building blocks for entire new economies, online communities, and groundbreaking applications.

Your Guide to Understanding Crypto Tokens

If cryptocurrencies like Bitcoin are digital cash, then tokens are everything else you might find in your wallet. They can be like arcade tickets, concert passes, loyalty points, or even the deed to a house—all wrapped up in a digital package.

The key difference is that a token is built on top of an existing blockchain, whereas a native coin (like Bitcoin or Ether) operates on its own dedicated blockchain. This distinction makes tokens incredibly flexible and much easier to create, which is why we've seen such a massive wave of innovation in the crypto world.

This guide is your map through the often-confusing world of crypto tokens. We’ll cut through the jargon and show you how these digital assets are so much more than just internet money; they are the gears that make new applications and communities turn.

The Core Difference: Coins vs. Tokens

To really get what tokens are all about, it helps to first understand how they differ from their more famous cousins, crypto coins. The distinction is pretty straightforward but incredibly important.

Here’s a quick breakdown to help you see the difference at a glance:

Key Differences Between Crypto Coins and Tokens

| Feature | Cryptocurrency (Coin) | Cryptocurrency (Token) |

|---|---|---|

| Foundation | Operates on its own independent blockchain. | Built on top of a pre-existing blockchain (e.g., Ethereum, Solana). |

| Primary Use | Primarily a medium of exchange, store of value, and used to pay network fees ("gas"). | Represents a specific utility, asset, or right within a particular project or ecosystem. |

| Creation | Requires building a whole new blockchain from the ground up—a complex and resource-intensive process. | Can be created relatively easily using established standards on an existing blockchain. |

| Examples | Bitcoin (BTC), Ether (ETH), Litecoin (LTC) | Uniswap (UNI), ApeCoin (APE), Chainlink (LINK) |

Basically, coins are the native currency of their own digital nation, while tokens are created by developers to perform specific jobs within that nation's borders.

This ease of creation has led to an absolute explosion of digital assets. The crypto space has mushroomed to over 20,000 different cryptocurrencies and tokens, a number that just keeps climbing as new ideas take shape. You can dive deeper into this incredible growth in the digital asset market.

A Simple Analogy: Think of a blockchain like Ethereum as a smartphone's operating system (like iOS or Android). A coin (Ether) is the native currency you use to pay for things on that OS, like app store fees. Tokens are the thousands of different apps you can build and run on it. Each app has its own unique function, but they all rely on the same core system to work.

By piggybacking on established blockchain platforms, developers can issue tokens that represent anything from a concert ticket to fractional ownership in a skyscraper. Now, let’s get into what makes this technology so powerful.

The Two Main Flavors of Crypto Tokens

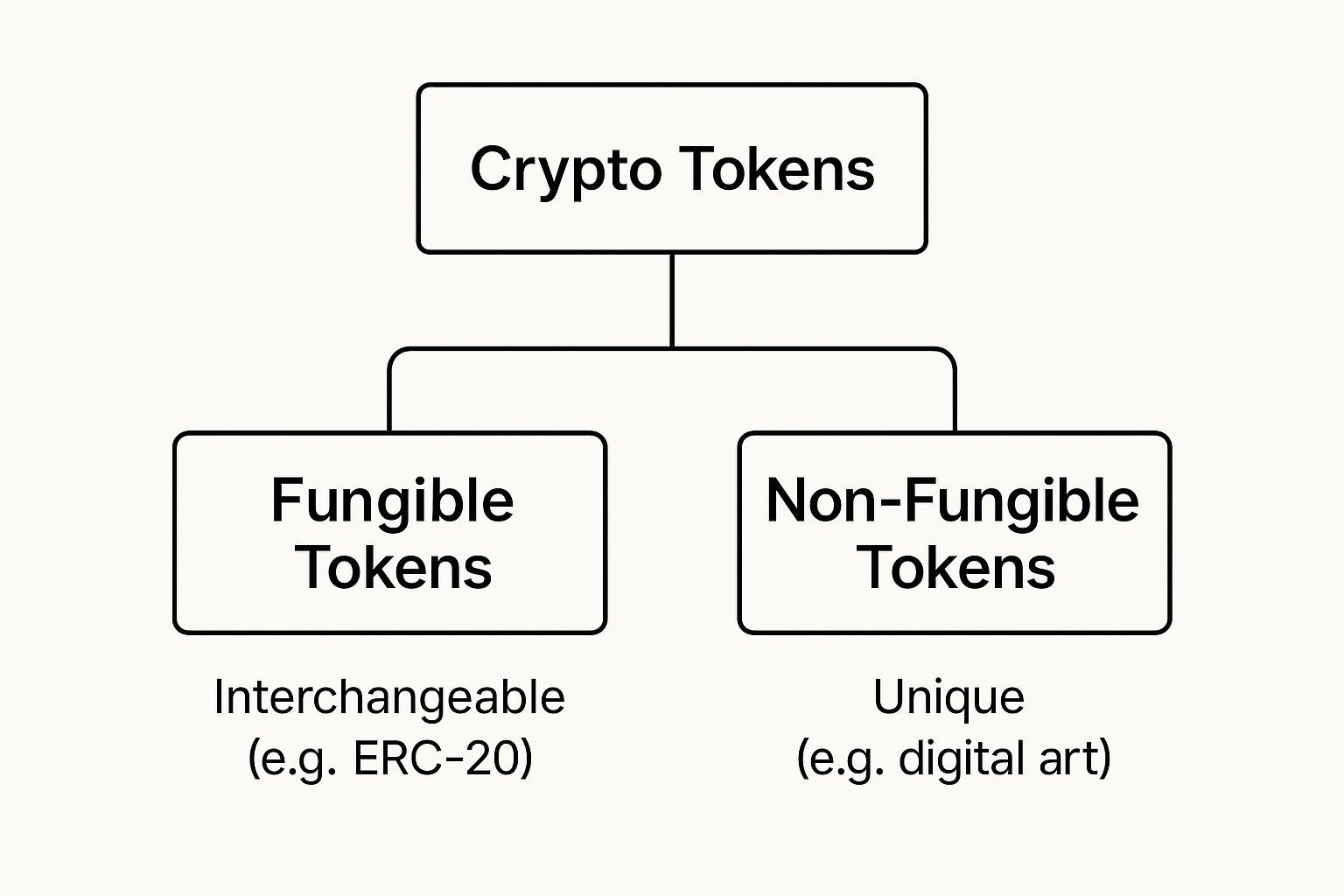

When you dive into the world of crypto, you'll quickly realize not all tokens are created equal. The biggest and most important difference comes down to one simple but powerful idea: fungibility. Once you get this concept, you'll understand why different tokens have such wildly different purposes and values.

At a high level, every token you encounter fits into one of two buckets. It’s the first and most fundamental split you need to know.

This image nails it: tokens are either interchangeable (fungible) or they're unique (non-fungible). That one distinction changes everything about what you can do with them. Let's break down what that really means.

Fungible Tokens: The Workhorses of Web3

First up are fungible tokens, the most common type you'll see. "Fungible" is just a fancy word for interchangeable. Think of a dollar bill. You don't care which specific dollar you have, right? A dollar is a dollar. They all have the same value, and you can swap one for another without a second thought.

Fungible tokens work the exact same way. One token is identical to any other token of its kind. For example, if you have one Chainlink (LINK) token and I have one LINK token, we can trade them. Nothing has changed—we both still have one LINK.

This interchangeability makes them perfect for anything that needs a consistent and divisible unit of value.

- Digital Currencies: Think of them as in-game money or platform-specific cash.

- Loyalty Points: Brands can give out tokens that you can redeem for cool perks or discounts.

- Governance Rights: Holding a certain number of tokens can give you a vote in a project's future.

The technical blueprint that started it all is Ethereum's ERC-20 standard. It made launching new fungible tokens so straightforward that it sparked an explosion of innovation. A huge chunk of the tokens in circulation today are built on it. If you want to dig deeper, our guide on the differences between a crypto coin and token can shed more light on how they fit into the bigger picture.

Non-Fungible Tokens: The Power of Uniqueness

On the complete other end of the spectrum, you have Non-Fungible Tokens (NFTs). As the name gives away, these are the total opposite of fungible tokens. Each NFT is a one-of-a-kind digital asset. It has its own unique identity and value, and you absolutely cannot swap it for another one like-for-like.

Here’s an easy way to think about it: a dollar bill is fungible, but the Mona Lisa is non-fungible. You can't just trade the Mona Lisa for another painting and call it even. It's a unique masterpiece. NFTs operate on that exact same principle.

You can think of an NFT as a digital deed or a certificate of authenticity that lives on the blockchain. It’s undeniable proof that you own a specific, unique item—whether that item is a piece of digital art or a token representing something in the real world.

This power of verifiable uniqueness is what makes NFTs so useful for representing ownership of distinct assets. The most popular standard for this on Ethereum is ERC-721, which guarantees that every single token is provably unique.

NFTs have popped up in all sorts of interesting places:

- Digital Art and Collectibles: This is the big one. Artists can now create and sell limited-edition digital works directly to their fans.

- Gaming Items: That epic, one-of-a-kind sword or rare character skin you earned? It can be an NFT that you truly own.

- Event Tickets: Your ticket for seat J-12 at a concert is non-fungible. It's unique to you, for a specific seat, at a specific time.

- Virtual Real Estate: In metaverse projects, plots of digital land are often sold as individual NFTs.

So, the core difference is crystal clear. Fungible tokens are all about uniform value, while NFTs are all about unique identity. This simple split is what allows tokens in cryptocurrency to do everything from running entire financial ecosystems to powering a global digital art movement.

Exploring the Different Jobs Crypto Tokens Do

Okay, so we've covered the difference between fungible and non-fungible tokens. That's the first big hurdle. Now we get to the fun part: what these tokens in cryptocurrency actually do.

Think of tokens like specialized employees. Each one is hired to do a specific job within a project's ecosystem. While a single token can sometimes wear a few different hats, most have one primary role. It's these roles that give them real value and turn them from digital novelties into genuinely useful tools.

Utility Tokens: The Access Pass of Web3

The most common token you'll bump into is the utility token. Just like the name implies, these tokens give you "utility"—they're your ticket to access a product or service. They don't represent ownership. Instead, they act like digital keys, arcade tokens, or an exclusive membership card.

Let’s say there's a decentralized cloud storage service. You'd likely need to pay for that storage space using the platform's own utility token. In that scenario, the token isn't an investment in the company itself; it’s simply the currency you need to use what they've built.

Here are a few jobs utility tokens often have:

- Platform Access: Getting you past the velvet rope to use special features.

- Network Fees: Paying the "gas" or transaction fees within a specific ecosystem.

- Rewards: Earning them for doing stuff, like in play-to-earn games or on community platforms like Domino.

- Discount Vouchers: Holding a certain number of tokens might get you reduced fees or other perks.

The interesting thing about a utility token is that its value is directly linked to how much people want to use the project. If the platform takes off and everyone wants in, they'll all need the token, which can naturally drive up its price.

Governance Tokens: Giving the Community a Voice

Next up, we have governance tokens. These are a huge deal because they represent a fundamental shift in how projects are run. If you hold these tokens, you get a vote on important decisions about the project's future. It's like having voting shares in a decentralized company.

This is the whole idea behind Decentralized Autonomous Organizations (DAOs), where the community itself is in the driver's seat. Token holders can propose and vote on everything from changing the fee structure to deciding how to spend money from the community treasury.

Governance tokens turn users into stakeholders. Instead of a classic top-down corporate structure, power gets spread out among the community members who actually use and believe in the project. It’s a far more democratic way to build.

Take Uniswap's UNI token, for instance. Holders can vote on proposals that directly impact how the decentralized exchange operates. This system makes sure the platform evolves in a way that actually benefits its users. The more tokens you have, the more weight your vote carries, giving the most invested members a bigger say.

Security Tokens: The Digital Evolution of Ownership

Finally, there are security tokens. These are in a totally different league and are heavily regulated. At its core, a security token is a digital representation of ownership in a real-world asset, and it’s all recorded on a blockchain.

Think of them as traditional financial securities—like stocks, bonds, or a deed to a property—that have been "tokenized." This means they're subject to the same strict financial regulations as their old-school counterparts.

So why bother? The benefits are pretty compelling:

- Fractional Ownership: It’s way easier to sell a tiny piece of a tokenized apartment building than it is to sell a few bricks from the real thing.

- Increased Liquidity: Assets that are notoriously hard to sell, like fine art or private equity, can be traded much more easily when they're tokens.

- 24/7 Markets: The crypto market never sleeps. Unlike the New York Stock Exchange, you can trade these assets anytime, day or night.

Platforms like Robinhood are already dipping their toes in, exploring stock tokens in the EU that give customers a way to invest in US companies via blockchain. It's a fascinating blend of Wall Street and Web3.

To make these distinctions even clearer, here’s a quick breakdown of the different token types and how to think about them in simple terms.

Crypto Token Types and Their Functions

| Token Type | Primary Function | Real-World Analogy |

|---|---|---|

| Utility Token | Grants access to a product, service, or feature. | An arcade token or a ski pass |

| Governance Token | Gives holders voting rights on project decisions. | A voting share in a co-op |

| Security Token | Represents ownership of a real-world asset. | A digital stock certificate |

| NFT | Proves ownership of a unique digital or physical item. | A deed to a piece of art |

By getting a handle on these distinct roles—utility, governance, and security—you can start to see that the world of tokens in cryptocurrency is about so much more than just digital money. It’s the foundation for a whole new kind of functional, community-driven digital economy.

How Stablecoins Bring a Little Calm to the Crypto Chaos

Let's face it, the crypto world can feel like a rollercoaster. Prices shoot up one day and plummet the next. In the middle of all this excitement, one type of token is designed to be intentionally… well, boring. Meet the stablecoin.

While most crypto is all about wild price swings, stablecoins are built for the exact opposite. Their entire job is to hold a steady value, acting as a calm harbor in the often-stormy seas of the crypto market.

Think of it this way: a stablecoin is like a digital version of a US dollar. You can zip it around the world on the blockchain, trade it for other crypto, or use it in decentralized finance (DeFi), all without worrying that its value will have changed by the time your transaction goes through. This predictability is a game-changer.

The Magic Trick: How Do They Stay Stable?

So, how do they pull off this feat of stability? The most common method is pretty straightforward: they’re pegged 1:1 to a real-world asset, usually the U.S. dollar. For every one stablecoin out there, there's supposed to be one real dollar (or an asset of equal value) sitting in a reserve somewhere, like a bank.

This backing is what gives the token its predictable value. It's not just a digital IOU; it's a claim on a real-world asset.

There are a few different approaches to maintaining this peg:

- Fiat-Collateralized: This is the most popular type. Big names like Tether (USDT) and USD Coin (USDC) fall into this category. They hold a mix of actual cash and super-safe investments (like short-term government bonds) in their reserves. They're usually managed by a central company that gets audited to prove they have the goods to back up every token.

- Crypto-Collateralized: These get a little more "meta." They are backed by a basket of other cryptocurrencies. Since the crypto backing them is also volatile, they are typically "over-collateralized"—meaning they hold, say, $1.50 worth of crypto for every $1.00 stablecoin they issue. This extra cushion helps absorb any price shocks.

- Algorithmic Stablecoins: These are the mad scientists of the group. They don't use reserves at all. Instead, they rely on complex algorithms and smart contracts to automatically manage the token supply. If the price drifts above $1, the algorithm creates more tokens; if it drops below, it takes tokens out of circulation. It's a high-wire act and has had some very public failures.

Why Do We Even Need Stablecoins?

Stablecoins are far more than just a niche crypto asset; they are the bedrock of the entire crypto economy. They’re the essential bridge connecting the old-school world of traditional finance with the new frontier of DeFi.

The Bottom Line: Stablecoins are a "safe haven" inside the crypto market. When things get volatile, traders can quickly swap their Bitcoin or Ethereum for a stablecoin. This lets them lock in their gains and sit on the sidelines without having to completely cash out to a traditional bank account, keeping them ready to jump on the next opportunity.

Their stability also makes them incredibly useful for everyday stuff, like cross-border payments. Sending a stablecoin to someone on the other side of the planet is often way faster and cheaper than a wire transfer, and you both know the exact value being sent and received. No surprises.

They are a massive part of the tokens in cryptocurrency landscape. Just look at the volume moved by the two giants, Tether (USDT) and USD Coin (USDC). Tether has seen months with over $1 trillion in transaction volume, and USDC has hit monthly volumes ranging from $1.24 trillion to $3.29 trillion. Those aren't just small-time trades; that's serious money moving around, and it's only possible because of the trust in their stability. Discover more insights about global crypto adoption.

How Tokens Build Communities and Power Web3

Sure, tokens in cryptocurrency have all sorts of technical uses, but their secret superpower? They're amazing tools for building vibrant, energized communities. In the world of Web3, you're not just launching a product; you're building a whole ecosystem of users, developers, and fans. Tokens are the glue that holds these digital nations together.

This isn't your parents' one-way marketing. Tokens create a two-way street. They give people a real, tangible stake in a project, turning them from passive consumers into active participants. It's a fundamental shift in how online communities take root and grow.

Think about it: when someone holds your project's token, their success is tied to your success. If the project does well, the token's value might go up. This creates a powerful flywheel—a more engaged community builds a stronger project, which boosts the token's value, which gets the community even more excited.

Kickstarting a Community with Airdrops

One of the go-to plays for getting a community off the ground is the airdrop. It’s basically a surprise gift. Projects drop free tokens directly into the crypto wallets of early adopters, beta testers, or even people active in similar communities.

This move kills a few birds with one stone. Instantly, you have a broad base of token holders who now have a reason to care about what you're doing. It also drums up a ton of buzz and serves as a fantastic marketing tool, rewarding the very people who were interested from day one. To get a feel for the nitty-gritty, you can learn more about how a crypto airdrop works and see why it’s such a popular growth hack.

An airdrop is more than a giveaway. It's a strategic play to spread ownership far and wide, planting the seeds for a true grassroots movement.

From Users to Owners with Governance

This is where tokens really shine—giving the community a real voice. Like we mentioned earlier, governance tokens do just that by handing voting rights over to the people who hold them. This is the whole idea behind Decentralized Autonomous Organizations, or DAOs.

In a DAO, there's no CEO or board of directors calling all the shots from a corner office. Instead, the community of token holders guides the project's future together. They can propose ideas and vote on huge decisions, like:

- Treasury Management: How should we spend the money in the community bank?

- Protocol Upgrades: Should we approve this technical update or add a new feature?

- Partnership Decisions: Does it make sense to team up with this other project?

- Fee Adjustments: Should we change the fees on the platform?

This model completely flips the script on the user-platform dynamic. You go from just using a service to being a co-owner with a say in its future. It’s the difference between renting an apartment and owning a home in a neighborhood you help run.

Reinventing Loyalty and Engagement

Tokens are also breathing new life into stale old loyalty programs. Forget about earning points that are trapped with one brand and usually expire anyway. Token-based rewards give people something with actual, transferable value.

Projects can use platforms like Domino to set up quests and reward users with tokens for doing things that help the project—like sharing content, trying out new features, or showing up to community calls. This whole approach makes engagement feel much more meaningful because people are directly rewarded for contributions that fuel growth.

For instance, someone could earn tokens for making a great tutorial video. That video helps the whole community, and the creator gets a real reward for their effort. It builds a culture where everyone is excited to chip in for the collective good, knowing their work is genuinely valued.

So, Why Does Any of This Matter?

If you’ve stuck with me this far, you’ve probably realized something important. These crypto tokens aren't just funny money for internet speculators. They’re the actual nuts and bolts of the next version of the web. Think of them as the lifeblood pumping through these new digital ecosystems, making everything work.

Tokens are changing how we think about ownership, how we build communities, and how we interact with brands and each other. Whether it's a simple digital key to a private group or a powerful vote that shapes a project's future, tokens are at the center of it all. Understanding them isn't just for crypto geeks anymore—it's becoming a crucial skill for anyone in marketing, finance, or community building.

It All Comes Down to What the Token Does

The first thing to get your head around is the different flavors of tokens. Is it fungible or non-fungible? That one distinction tells you almost everything you need to know. One is like a dollar bill—you don't care which one you have, they're all the same. The other is like a signed concert ticket—a one-of-a-kind original.

This simple difference opens up a whole world of uses:

- Fungible Tokens are the workhorses. They're great for building digital economies, running reward systems, and giving communities a voice through voting.

- Non-Fungible Tokens (NFTs) are all about proving you own something unique, whether it's a piece of digital art or a VIP pass to an event.

Once you can spot the difference, you can instantly see what a project is trying to achieve. You're not just looking at a token; you're looking at a tool designed for a specific job. That's when you can start navigating this space with real confidence.

The Real-World Impact Is Already Here

This isn't some far-off future we're talking about. The token economy is moving huge amounts of value right now. A quick look at the transaction data for crypto tokens shows just how big this has gotten. Bitcoin is still the king, making up 42% of all crypto transactions, but the stablecoin Tether (USDT) is right on its heels at 33%, with Ethereum at 11.5%.

With the total market transaction volume expected to hit a staggering $10.8 trillion, it’s obvious these aren't niche assets anymore. They're becoming a core part of a massive, fast-growing financial system. You can dig deeper into the latest crypto payment statistics to see for yourself.

At the end of the day, tokens are the tools that let us build decentralized apps, launch community-run projects, and invent entirely new ways to create value. They're the keys to a more democratic, user-owned internet. Now that you have a solid handle on how they work, you're not just watching the change happen—you're ready to be part of it.

Common Questions About Crypto Tokens

As you dive deeper into the world of tokens in cryptocurrency, it's totally normal for questions to start bubbling up. These concepts can feel a bit out there at first, but a few straightforward answers can make everything click. Let's walk through some of the most common questions to clear things up.

Are All Tokens a Type of Cryptocurrency?

Yes, but it's not that simple. There's a key difference you need to know. While all tokens are crypto assets, they aren't the same as native cryptocurrencies like Bitcoin or Ethereum, which we usually call "coins."

Coins are the native currency of their own independent blockchain. Tokens, on the other hand, are built on top of an existing blockchain, like the thousands of tokens that run on Ethereum using its popular ERC-20 standard.

Think of it this way: a blockchain is like an operating system (like iOS), a coin is its native currency (what you use in the App Store), and tokens are all the different apps you can build and run on it.

How Are New Tokens Created?

New tokens are usually created through a process called "minting," which often happens during a Token Generation Event (TGE). This is all handled by a smart contract deployed on a blockchain like Ethereum, Solana, or BNB Chain. If you want to get into the nitty-gritty of how these launches unfold, our guide on the details behind a TGE is a great place to start.

These platforms have standardized frameworks—like ERC-20 for fungible tokens or ERC-721 for NFTs—that act as a blueprint for developers. This means projects can issue their own tokens without the massive headache of building a brand-new blockchain from scratch.

Key Takeaway: Creating a token is a programmable event. A developer sets the rules—like total supply and what the token can do—inside a smart contract, then deploys it to a public blockchain for the world to use.

Can a Token Have More Than One Function?

Absolutely, and this is where token design starts to get really creative. Many projects today are building tokens that wear multiple hats, which helps maximize their value and get the community more involved.

For instance, a single token could be:

- A utility token for unlocking special features in an app.

- A governance token that gives holders a say in the project's future by letting them vote on proposals.

- A staking token that can be locked up to earn rewards, helping secure the network at the same time.

This multi-purpose strategy is a fantastic way to build a deeper connection with your community. It gives people more reasons to get and hold the token, turning them from passive users into genuine stakeholders who care about the project's success. This kind of layered utility is a signature of many successful tokens in cryptocurrency today.

Ready to use tokens to build your own thriving community? Domino is a no-code toolkit that lets you design and launch reward-based quests in minutes. Drive real engagement and accelerate user acquisition without writing a single line of code. Start building with Domino today.