What Are Tokens in Crypto? A Simple Guide You Can't Miss

When people talk about crypto, the words "coin" and "token" get thrown around a lot, often used to mean the same thing. But there's a crucial difference, and it's pretty simple once you break it down.

Crypto tokens are digital assets built on top of an existing blockchain, rather than having their own. They don't need their own network because they essentially "borrow" the infrastructure of a platform like Ethereum.

Think of it like this: Ethereum is the operating system (like iOS or Android), and tokens are the apps that run on it. The apps don't have to build a whole new phone; they just use the OS that's already there.

Understanding Tokens vs Coins

So, what’s the real difference? A crypto coin, like Bitcoin (BTC) or Ether (ETH), is the native currency of its own blockchain. It’s the "fuel" that keeps that specific network running, paying for transactions and rewarding participants.

A crypto token, on the other hand, is created by a project that doesn't want to build a whole blockchain from the ground up. Instead, they use smart contracts on an established network to create their asset, allowing them to focus on building their specific application or community.

Crypto Coins vs Crypto Tokens at a Glance

To really nail down the distinction, let's put them side-by-side.

| Feature | Crypto Coins (e.g., Bitcoin, Ether) | Crypto Tokens (e.g., UNI, LINK, APE) |

|---|---|---|

| Foundation | Has its own independent blockchain. | Built on an existing blockchain (like Ethereum). |

| Primary Use | Acts like digital money—a store of value or way to pay. | Represents an asset, a right to vote, or access to a service. |

| Creation | Generated by the blockchain's core rules (like mining). | Created and issued via smart contracts on a host network. |

| Analogy | The native currency of a country (e.g., U.S. Dollar). | A voucher, concert ticket, or arcade token for a specific venue. |

Understanding this difference is key, because tokens are a massive and incredibly diverse part of the crypto world. The global cryptocurrency market, which is full of these tokens, was valued at USD 5.70 billion in 2024 and is expected to nearly double. For a deeper dive, you can explore more data on the crypto market growth to get a sense of the scale we're talking about.

How Crypto Tokens Are Actually Created

Crypto tokens don't just magically appear. They're built on purpose, following a set of rules called token standards. The best way to think about a standard is like a universal blueprint or a digital recipe. It lays out the essential functions and rules every token of that type needs to follow.

This is a bigger deal than it sounds. Because of these shared blueprints, the whole crypto world just works together. When a new token uses a popular standard, wallets, exchanges, and apps instantly recognize it and know how to handle it—no custom coding required. That plug-and-play ability was a game-changer for developers.

The Power of a Shared Blueprint

The most famous of these blueprints is easily Ethereum’s ERC-20 standard. While crypto tokens are just digital assets living on existing blockchains, Ethereum really took over as the go-to host when it launched ERC-20 back in 2015. It gave developers a simple, fill-in-the-blanks template to mint their own tokens, which completely blew the doors open for innovation. Just look at the thousands of tokens created using this method to see the impact.

Before standards like this, launching a new digital asset was a huge headache that required some serious coding chops. With ERC-20, projects could finally stop reinventing the wheel and focus on what made their idea special. This made the whole launch process, often called a Token Generation Event (TGE), so much simpler. We have a whole guide on what a TGE means in crypto if you want to dive deeper into how new tokens are introduced to the world.

A token standard isn't just code; it's a social agreement. It ensures that a token created by one developer can be understood and used by everyone else in the ecosystem, creating a shared language for digital value.

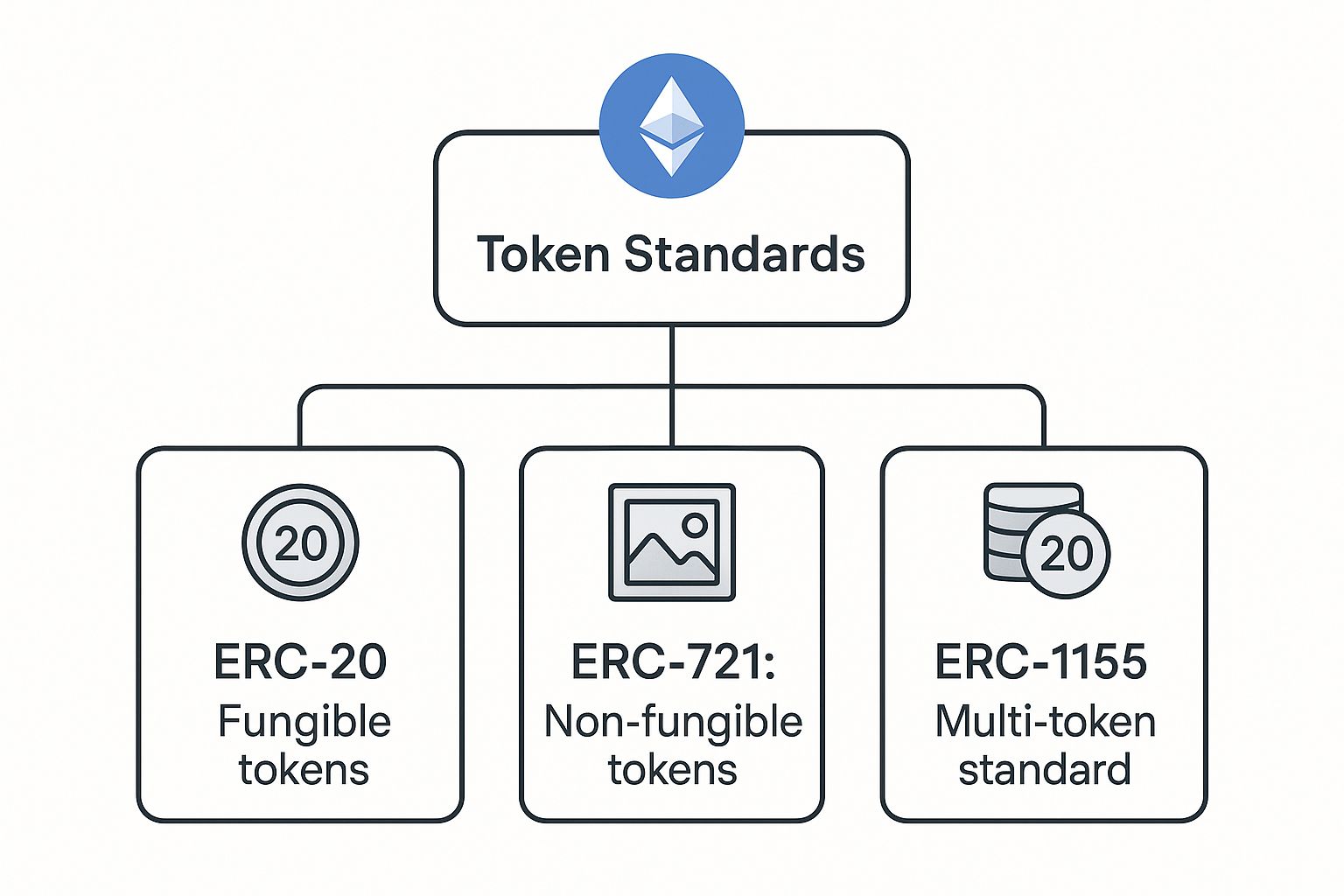

This infographic breaks down how different Ethereum standards are used to create all sorts of tokens, from the interchangeable ones to unique, one-of-a-kind digital items.

As you can see, ERC-20 is just the beginning. There are several other key standards, each one perfectly designed for a different type of digital asset.

Breaking Down the Different Types of Crypto Tokens

Okay, so we've covered how tokens get made. But what are they, really? It’s important to know they aren't all the same; they come in a few different flavors, each built for a specific job.

Think of them like specialized tools in a workshop. You wouldn't use a hammer to saw a board, right? The same logic applies here. Getting a handle on these categories is the key to understanding what tokens can actually do in the wild.

Fungible vs. Non-Fungible Tokens

The first major fork in the road is whether a token is fungible or non-fungible. Sounds a bit technical, I know, but the concept is actually pretty straightforward.

Something is fungible if you can swap it for another identical item without any loss of value. A dollar bill is a perfect example. You don't care about the serial number on your dollar; you just care that it's a dollar. It's interchangeable. Most cryptocurrencies are fungible.

Non-Fungible Tokens (NFTs) are the exact opposite. They are total one-of-a-kinds. Think of the Mona Lisa or the deed to your house. You can't just swap one for another because each is unique. This uniqueness is permanently recorded on the blockchain, proving you own a specific digital thing—whether that’s a piece of art, a collectible, or even a ticket to an event.

What's a Token's Job? Exploring Key Functions

Once you get past the fungible/non-fungible split, tokens are really defined by their purpose. What a token does within a project is what gives it value and determines how people use it.

Here are the main types you'll bump into:

Utility Tokens: Think of these as arcade tokens or access passes. They give you the right to use a product or service. A project might create a utility token that you have to spend to use their decentralized file storage or to unlock special features in a game. They aren't really meant to be investments; they're tools with a function.

Security Tokens: A security token is basically a digital contract representing ownership of a real-world asset. It could be a sliver of equity in a startup, a right to a company's profits, or even a piece of a commercial building. Because they act like traditional investments (stocks, bonds), they fall under heavy government regulations.

Governance Tokens: These tokens give you a say. Holding a project's governance token is like having a seat at the table—it gives you voting rights on key decisions. You could vote on things like software updates or changes to the rules. It’s all about putting the community in the driver's seat and decentralizing control.

While the difference between a crypto coin and a token can seem subtle, their functions are often worlds apart. A coin is the lifeblood of its own blockchain, whereas a token leverages an existing blockchain to perform a specific job, like granting access or representing ownership.

To make these distinctions even clearer, here’s a quick breakdown.

Comparing Key Token Categories

| Token Type | Primary Function | Real-World Analogy |

|---|---|---|

| Utility Token | Grants access to a product or service | An arcade token or a software license key |

| Security Token | Represents ownership of a tradable asset | A stock certificate or a property deed |

| Governance Token | Provides voting rights in a project | A shareholder's vote or a club membership |

Each of these serves a very different role, and understanding that is crucial. They are the building blocks developers use to create all sorts of new applications and digital economies.

If you want to dig a little deeper, our full guide on the differences between a crypto coin and token breaks it all down even further.

How Tokens Are Used in the Real World

It’s one thing to know the theory behind token types, but it's seeing them out in the wild that really makes it all click. Tokens aren’t just something to trade on an exchange; they're the nuts and bolts powering a whole new world of decentralized applications, or dApps.

Think of a utility token as your digital key or a special kind of arcade token. On a decentralized cloud storage service, you might spend its native token to rent server space for your files. In a blockchain game, that same idea applies—you could use tokens to snag a rare sword or unlock a new level.

Suddenly, these tokens create their own little economies. Users aren't just customers; they become active participants with a real stake in the platform's success.

Powering Finance and Community Decisions

One of the most explosive use cases for tokens is Decentralized Finance (DeFi). The entire goal of DeFi is to build a parallel financial system—think lending, borrowing, and trading—but without the banks and middlemen. In DeFi, tokens do all the heavy lifting.

- Lending and Borrowing: You can lock up your crypto tokens as collateral to borrow different assets, or you can lend yours out to earn interest. It’s all handled automatically by code.

- Automated Trading: On decentralized exchanges (DEXs), users pool their tokens together to create liquidity, letting anyone trade instantly while the providers earn a cut of the fees.

In DeFi, your tokens stop being passive holdings and become active, productive tools. You can put your crypto to work, earning yield and tapping into financial services that were once locked behind institutional gates.

Beyond the money aspect, governance tokens are shaking up how projects are run. If you hold a project’s governance token, you get a direct say in its future. You could be voting on anything from a major software update to a change in the fee structure. It's a way of handing the keys back to the community.

If you're curious about getting involved, a good guide on how to buy decentralized crypto is the perfect place to start.

What's Next for Crypto Tokens?

If you think tokens are just about digital money, you're only seeing a fraction of the picture. The real excitement is in what's coming next, and a couple of huge trends are completely changing the game.

First up, we have the tokenization of Real-World Assets (RWAs). This is a fancy way of saying we can turn pretty much anything of value in the real world into a digital token on a blockchain. Think about it: owning a tiny piece of a New York City skyscraper, a slice of a vintage Ferrari, or a share in a famous painting.

Historically, assets like real estate have been incredibly difficult to buy and sell quickly. RWA tokenization breaks them into tiny, tradable pieces, making these exclusive markets accessible to almost anyone.

The AI and Crypto Crossover

The other massive trend is the collision of Artificial Intelligence and crypto. We're seeing a wave of new projects built around "AI tokens." These aren't just for speculation; they're designed to be the fuel for decentralized AI networks.

These tokens might be used to:

- Pay for the massive computing power needed to train AI models.

- Gain access to specialized AI algorithms.

- Create brand new marketplaces where people can buy and sell data securely.

This isn't some far-off sci-fi concept. The AI token sector is already booming, with a combined market cap that has shot past $39 billion. That's a serious signal that people are betting big on a future where AI and blockchain work together.

These innovations are dissolving the boundaries between our physical and digital lives. If you want to keep a pulse on where the market is headed, this is the space to watch. For a deeper look, it's worth checking out the latest cryptocurrency market trends and updates. As all of this unfolds, our basic definition of what are tokens in crypto is going to keep getting a whole lot bigger.

Got Questions About Crypto Tokens?

As you start wrapping your head around crypto tokens, you’ll naturally run into some common questions. Let's walk through a few of the big ones to help connect the dots.

What's the Real Difference Between a Coin and a Token?

This is a classic. The easiest way to remember it is that a coin, like Bitcoin or Ether, has its own dedicated blockchain. It's the native currency of that network, the lifeblood that keeps the whole thing running.

A token, on the other hand, is a freeloader—in a good way! It's built on top of an existing blockchain, like Ethereum, and borrows its security and infrastructure. Think of the blockchain as the iPhone's operating system (iOS), and tokens are the apps you download.

So, Can Anyone Just Make a Crypto Token?

In theory? Yep. Platforms like Ethereum have standardized token templates (like the famous ERC-20) that make the technical side surprisingly simple. You could follow an online guide and have your own token in a matter of hours.

But here’s the catch: creating a valuable token is a completely different ballgame. The real work isn't just minting the asset; it's designing a solid economic model (tokenomics), ensuring it has a genuine use case, and navigating the legal minefield. That’s the hard part.

It's ironic that securities law has centered around regulating assets backed by specific promises. The often vague or incoherent nature of many modern tokens may be what makes them both legally ambiguous and more dangerous for uninformed buyers.

Are All Tokens a Good Investment?

Definitely not. And this might be the most crucial takeaway. The crypto world is famously volatile, and that risk is dialed up to eleven when you're looking at newer, unproven tokens.

For every token tied to a game-changing project, there are a hundred others with no real substance, fueled by pure speculation. That's why you'll constantly hear the phrase "do your own research (DYOR)." You absolutely have to dig into the project's mission, the team behind it, and the tech before you even think about putting money down.

And the golden rule always applies: never, ever invest more than you’re willing to lose.

Ready to put your community engagement on autopilot? With Domino, you can launch reward-based quests in minutes, integrating social shares, on-chain actions, and more—no code required. Learn how to accelerate user acquisition and engagement.

Level Up Your dApps

Start using Domino in minutes. Use automations created by the others or build your own.