Difference Between Coins and Tokens Cryptocurrency Explained

When you're trying to make sense of the crypto world, one of the first hurdles is figuring out the whole coin vs. token thing. They're often used interchangeably, but they're fundamentally different beasts.

The core distinction boils down to their architecture. A coin is the native currency of its own blockchain. A token, on the other hand, is built on top of an existing blockchain.

Think of it this way: a coin is like the US Dollar, the official currency of the United States. A token is more like an arcade token or a concert ticket—it has a specific use but only within a particular venue (the blockchain it was built on).

Decoding Your Digital Wallet Coins vs Tokens

Really getting this difference is key to understanding everything else in crypto. Coins like Bitcoin (BTC) and Ether (ETH) are the bedrock. They run on their own dedicated blockchains—the Bitcoin network and the Ethereum network, respectively. These coins are the fuel that powers their ecosystems, used for everything from paying transaction fees to securing the network.

Tokens are a whole different story. They're digital assets created by projects that piggyback on another blockchain's infrastructure. This is a much smarter and faster way for new projects to get off the ground since they don't have to go through the massive effort of building a blockchain from scratch. They can just use a proven template, like the super-popular ERC-20 standard on Ethereum.

A Rapidly Expanding Universe

This "build-on-top" approach is why the crypto space exploded. The token ecosystem was pretty small until 2017, when the number of tokens skyrocketed from fewer than 50 to over 400 in a single year. This growth was driven by new decentralized finance (DeFi) concepts and much easier ways to raise funds. You can find some fascinating reads on this historic crypto boom and how it shaped the market.

The simplest way to remember it? Every coin has its own blockchain, but tokens are just guests living in a coin's house.

To really nail this down, let's put them side-by-side.

Quick Look: Coins vs Tokens at a Glance

Here’s a simple table to break down the key differences at a glance. It's a handy reference for quickly telling them apart.

| Attribute | Cryptocurrency Coins | Cryptocurrency Tokens |

|---|---|---|

| Underlying Tech | Operate on their own native, independent blockchain. | Built on top of an existing blockchain (e.g., Ethereum). |

| Primary Purpose | Act as a store of value or medium of exchange. | Represent a utility, asset, or right within a specific project. |

| Example | Bitcoin (BTC) on the Bitcoin blockchain. | Chainlink (LINK) on the Ethereum blockchain. |

Essentially, coins are the foundation, and tokens are the diverse applications built on that foundation. One can't really exist without the other in today's crypto ecosystem.

Diving Deep into Cryptocurrency Coins

To really get the difference between a crypto coin and a token, we have to start with coins. A cryptocurrency coin is the native currency of its own blockchain. It's the fuel that runs the entire network. Think of Bitcoin (BTC) or Litecoin (LTC)—they aren't just assets existing on a network; they are the network's lifeblood.

Their main job is to act like money, but without a bank or government in the middle. This means they're built to be a:

- Store of Value: Something that can hold its purchasing power over time, kind of like a digital version of gold.

- Medium of Exchange: You can actually use it to buy stuff.

- Unit of Account: A common yardstick for pricing goods and services.

Bottom line: a coin and its blockchain are a package deal. You can't separate them. Every single transaction, every fee, and every security function on that specific blockchain is powered by its native coin. This direct, functional link is where a coin gets its core value.

How Coins Are Made

Coins aren't just printed; they're brought into existence through intricate processes called consensus mechanisms. You've probably run into the two big ones:

- Proof-of-Work (PoW): This is the OG model that Bitcoin uses. Miners fire up powerful computers to crank through complex math problems. The first one to find the solution gets to add the next "block" of transactions to the blockchain and is rewarded with brand-new coins.

- Proof-of-Stake (PoS): This is the more energy-friendly approach. Instead of mining, people known as "validators" lock up their own coins—a process called "staking." This gives them a shot at validating new transactions and earning rewards. Here, the network's security comes from everyone having skin in the game.

The big idea here is that a coin's value is completely intertwined with the security, popularity, and overall health of its blockchain. A thriving, secure network almost always means a more valuable native coin.

This is a world away from tokens, which we'll get into next. For a perfect example of a coin's purpose, just look at how Bitcoin pitches itself as a financial system for the internet.

Here’s a snapshot from the official Bitcoin homepage, which really drives home its mission as a peer-to-peer electronic cash system.

Right off the bat, the site doesn't talk about Bitcoin as just some speculative thing to trade. It presents it as a foundational piece of tech for a new kind of internet money. This focus on building a completely independent financial ecosystem is what defines a cryptocurrency coin. It’s not just a currency; it’s the heart of its own digital economy.

A Look Into the Versatile World of Crypto Tokens

Now, let's switch gears from the foundational nature of coins and dive into the incredibly diverse and adaptable world of crypto tokens. Here’s a simple analogy: if a coin is like a computer’s operating system, a token is the application you run on it.

Tokens are digital assets built on top of blockchains that already exist. This approach totally changes the game, making it much easier for new projects to get off the ground without the monumental task of building a whole new blockchain from scratch.

Developers can use established frameworks, like the famous ERC-20 standard on Ethereum, to get a token up and running fast. It’s a bit like a "plug-and-play" model that lets them instantly tap into the host blockchain's security, infrastructure, and all its users right from the get-go.

This ease of creation has caused a token explosion. In fact, there are now roughly eight tokens for every one coin out there in the wild, which shows just how popular they’ve become for all sorts of different projects. You can check out the data yourself to see the growth of crypto coins and tokens over the years. This fundamental difference in how coins and tokens are created is what really fuels a ton of the innovation in the space.

The Main Flavors of Tokens

Tokens aren't a one-size-fits-all deal. Their real value comes from the specific job they do within a project’s ecosystem. At their core, they're just digital placeholders for value or a right to do something.

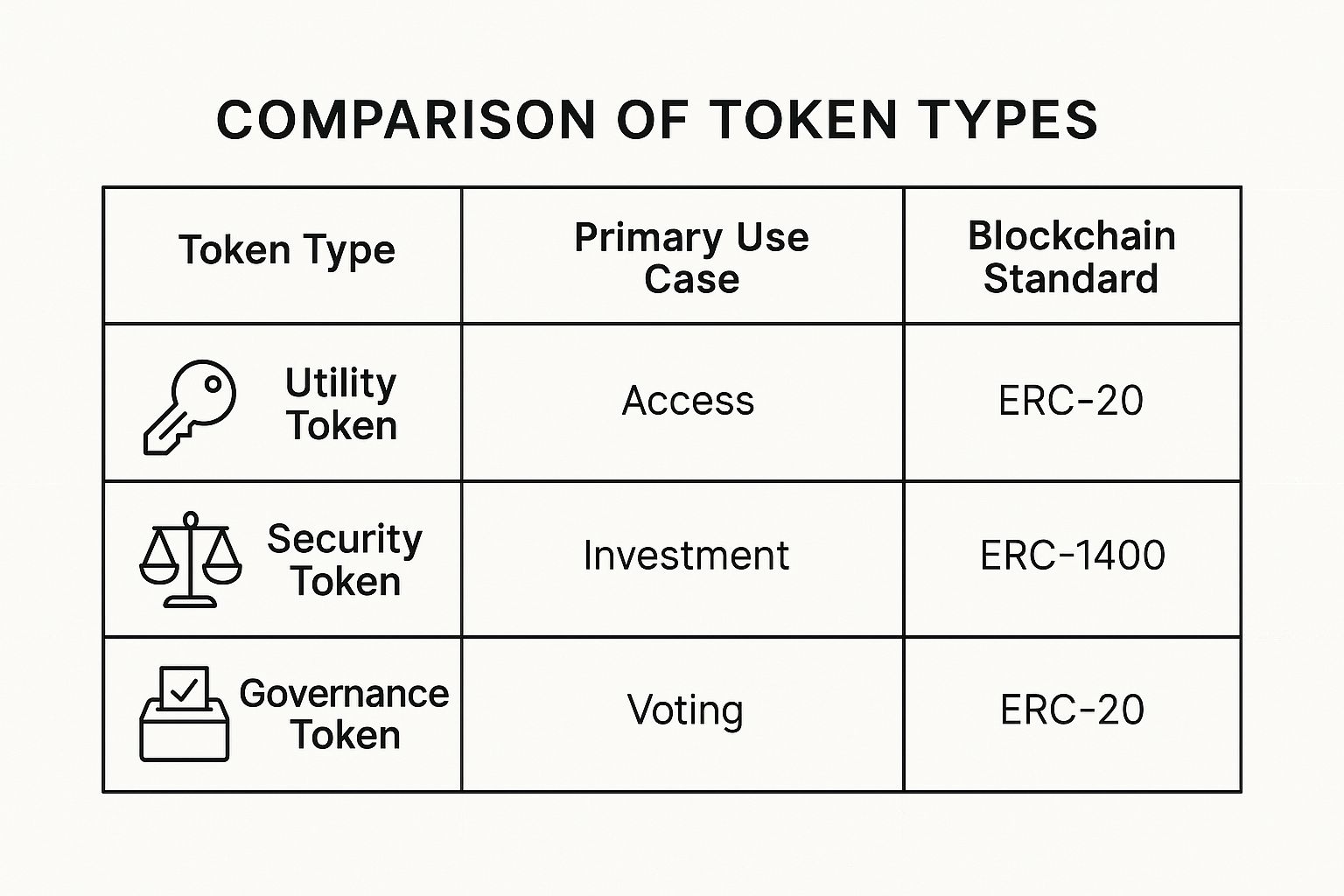

Here’s a quick rundown of the most common types you’ll come across:

- Utility Tokens: These are the workhorses of the token world. They give you access to a product or service. A great parallel is an arcade token—you need one to play the game. A real-world example is the Basic Attention Token (BAT), which is used to tip creators and publishers inside the Brave browser ecosystem.

- Security Tokens: Think of these as a digital version of a traditional financial asset. A security token could represent a share in a company, a stake in a real estate project, or other investments. Because of this, they fall under strict financial regulations and are a direct claim on ownership.

- Governance Tokens: These tokens give their holders real power. Owning them grants you voting rights to help steer a project's future. For instance, people who hold Uniswap’s UNI token can vote on proposals that impact how the protocol is developed or how its treasury funds are used.

- Non-Fungible Tokens (NFTs): While most tokens are interchangeable (fungible), every single NFT is one-of-a-kind. It represents proven ownership of a unique digital or physical item, whether that’s a piece of digital art, a rare collectible, or a special in-game asset.

The key takeaway is simple: a coin's main job is to act like money on its own blockchain. A token's job, on the other hand, is all about function and is tied to the specific project that created it.

The Ethereum organization has some fantastic resources that show how different tokens live and work within its ecosystem, really putting their flexibility on display.

This image perfectly illustrates how tokens for things like digital art (NFTs) or decentralized finance (DeFi) can all operate securely on the same Ethereum blockchain. Getting a handle on the different types of tokens in cryptocurrency is the first step to really understanding their potential to build entirely new applications and economies.

A Side-by-Side Technical Showdown

Let's get down to brass tacks and compare coins and tokens directly. While both are digital assets, how they're built and what they're meant to do are completely different. Getting this right is one of the most important first steps for anyone serious about understanding crypto.

The biggest difference is foundational. Coins live on their own, custom-built blockchains. They're the native currency of that specific digital nation, like the US Dollar is to the United States. Tokens, on the other hand, are more like tenants—they're built on top of an existing blockchain, borrowing its security and infrastructure.

How They're Made

The way these assets are born is another massive point of difference. Coins usually come into existence through a process that's deeply tied to securing their entire network. It's tough work by design.

- Mining (Proof-of-Work): This is the OG method. Computers around the world race to solve incredibly difficult math problems. The winner gets to add the next "block" of transactions to the chain and is rewarded with brand-new coins. Think of Bitcoin as the prime example. It's a hugely energy-intensive process.

- Staking (Proof-of-Stake): A more modern and energy-friendly approach. Instead of burning electricity, network participants lock up their own coins as collateral (a "stake"). This gives them a chance to be chosen to validate transactions and, in return, they earn newly created coins. Ethereum switched to this model, and it's become a popular alternative.

Tokens have a much simpler origin story. They are created and issued via smart contracts on a host blockchain. A development team writes the rules—total supply, how they're distributed, what they can do—into a piece of code. They can then deploy it and generate the tokens, often through an event like an Initial Coin Offering (ICO). This is a world away from the complexity and cost of launching a whole new blockchain.

What They're For

The "why" behind each asset is also fundamentally different. A coin's job is almost always about money. It's designed to be the economic lifeblood of its blockchain—used for paying transaction fees, rewarding miners or stakers, and acting as a store of value within its ecosystem.

The easiest way to spot the difference? Look at transaction fees. When you send a coin like Bitcoin, you pay the network fee in Bitcoin. But if you want to send a token like Chainlink (LINK), you have to pay the transaction fee using the host blockchain's coin—in this case, Ether (ETH).

Tokens are built for a specific purpose. Their function is defined by the project that created them, and they can do a whole lot more than just transfer value. They're the specialized tools that make decentralized applications (dApps) work.

This infographic does a great job of breaking down the common types of tokens you'll run into.

As you can see, tokens are designed for specific roles, whether it's providing utility in an app, representing an investment, or giving holders a vote in a project's future.

To really put these differences into perspective, let's look at them in a table.

Detailed Feature Breakdown: Coins vs. Tokens

This table breaks down the core technical and functional distinctions, giving you a quick reference for telling them apart.

| Feature | Coins (e.g., Bitcoin, Litecoin) | Tokens (e.g., UNI, LINK on Ethereum) |

|---|---|---|

| Technical Architecture | Operates on its own independent, native blockchain. | Built on top of an existing host blockchain (e.g., Ethereum, Solana). |

| Creation Process | Created through mining (Proof-of-Work) or staking (Proof-of-Stake). | Issued via smart contracts deployed on the host chain. |

| Primary Function | Acts as digital money; a store of value and medium of exchange for the network. | Varies widely; provides utility, governance rights, or represents an asset. |

| Transaction Fees | Paid in the native coin itself (e.g., BTC pays for BTC transactions). | Paid in the host blockchain's native coin (e.g., ETH pays for LINK transactions). |

| Development Cost | Extremely high; requires building and securing an entire new network. | Relatively low; leverages existing infrastructure and standards. |

This side-by-side view makes it clear: while they're both crypto assets, they play by a completely different set of rules.

The Cost and Complexity of Development

Finally, let's talk about the resources involved. Firing up a new blockchain and its native coin from scratch is a monumental task. It demands a team of expert developers, serious funding, and years of work to attract a community of users and miners/validators to make the network secure and useful.

Creating a token is a whole other ballgame. Thanks to established standards like Ethereum's ERC-20, a small team—or even one skilled developer—can launch a new token quickly and cheaply. This low barrier to entry is precisely why we've seen an explosion of tokens, driving a massive amount of innovation and experimentation across the crypto world.

How Coins and Tokens Are Used in the Real World

Knowing the technical difference between a crypto coin and a token is great, but the real "aha!" moment comes when you see how they actually work out in the wild. They might live in the same digital world, but they have very different jobs to do.

Think of coins as the digital equivalent of traditional money. They’re the economic bedrock of the crypto market, providing the liquidity and stability that the entire ecosystem needs to run.

Tokens, on the other hand, are the specialized tools built on top of that foundation. They unlock specific features in an app, give you voting rights, or represent ownership of something unique. This is where most of the creative innovation happens.

Practical Applications of Cryptocurrency Coins

Coins are the native currency of their own blockchains, and their main job is almost always related to money. Their use cases are pretty straightforward and are fundamental to the whole crypto economy.

- Cross-Border Payments: If you need to send money internationally, coins like Bitcoin and Litecoin can get it done in minutes instead of days, bypassing the slow and costly traditional banking system.

- Inflation Hedge: Bitcoin is often called "digital gold" for a reason—its supply is capped at 21 million. Many investors see it as a way to store value and protect their wealth when traditional currencies lose purchasing power.

- Exchange Base Currency: Go to almost any crypto exchange, and you'll see that major coins like BTC and ETH are the main trading pairs. You usually have to buy a coin first before you can swap it for a specific token.

These roles cement coins as the core infrastructure of the crypto world. They provide the stable ground on which everything else is built.

The Innovative Roles of Crypto Tokens

While coins keep the lights on, tokens are what drive the growth and experimentation. Their incredible flexibility is what allows for the explosion of decentralized applications and platforms we see today.

Coins are the market's foundation, providing stability and liquidity. Tokens are the catalysts for innovation, fueling the growth of new applications and economies on top of that foundation.

The global cryptocurrency sector was valued at USD 5.7 billion in revenue in 2024 and is on track to nearly double by 2030, with a projected compound annual growth rate of 13.1%. A huge chunk of that growth is coming from the incredible utility of tokens in decentralized finance (DeFi) and beyond. You can dig into the numbers yourself by checking out these crypto market growth trends.

Here are just a few ways tokens are shaking things up:

- Decentralized Finance (DeFi): Tokens are the lifeblood of DeFi. Utility tokens might give you access to lending services, while governance tokens like UNI from Uniswap give you a direct vote on the platform's future.

- Web3 Gaming: This is where Non-Fungible Tokens (NFTs) shine. They represent unique in-game items—characters, swords, plots of land—that players actually own and can sell on open markets.

- Community Governance: Decentralized Autonomous Organizations (DAOs) hand out governance tokens to their members, giving them voting power to make decisions about how to spend treasury funds or what the project should do next.

To jump into these ecosystems, you'll need to manage a portfolio of different tokens. That usually means setting up a wallet and getting comfortable with things like learning how to add different networks to MetaMask. This is where you really see the synergy in action: you need a coin (like ETH) to pay for gas fees, and a token to actually interact with the app.

How to Choose Between Coins and Tokens

So, coin or token? The truth is, there's no single "best" choice. It's not about picking a winner, but about finding the right tool for the job. The first step is getting your head around the core differences, but the real skill lies in knowing which one fits your specific goals.

Your decision hinges on what you're trying to do in the crypto world. Are you looking to invest, build a new project, or just use an application? Each angle completely changes the game.

For Investors

If you're an investor, your choice boils down to your risk tolerance and what you're betting on. Coins like Bitcoin are the heavyweights, the bedrock of the market. Many see them as a digital store of value or a long-term wager on the success of an entire blockchain ecosystem. They've been around longer and usually have deeper market liquidity.

Tokens are a different beast entirely. They represent a piece of a specific project or app. This can lead to explosive growth if that project takes off, but it also means your risk is much more concentrated. When you invest in a token, you're not just betting on a technology; you're betting on a specific team, their product, and their vision to carve out a niche. To get started with either, check out our guide on how to buy decentralized crypto.

For Developers and Entrepreneurs

For anyone building something new, this is a massive strategic decision. Creating your own coin means you're building a brand-new blockchain from scratch. Let's be clear: this is a monumental undertaking. It's incredibly complex, expensive, and requires you to convince a whole community of miners or validators to secure your network.

The strategic trade-off is clear: launching a coin offers total sovereignty at immense cost, while launching a token provides speed and network effects at the cost of some control.

On the other hand, launching a token on an established blockchain like Ethereum is a much more direct path. You get to piggyback on its existing security, infrastructure, and massive user base. This frees you up to focus on what really matters: building your application and its unique features.

For Everyday Users

If you're just looking to use a decentralized app (dApp), the choice is usually made for you. You'll almost always need both, just for different things.

You need the blockchain's native coin to pay for transaction fees (often called "gas"). For instance, you can't do anything on the Ethereum network without having some Ether (ETH) in your wallet to cover the costs.

Then, you need the project's specific token to actually use the dApp. Want to lend assets on a DeFi protocol, play a Web3 game, or cast a vote in a DAO? You'll need to get your hands on that project's utility or governance token to participate.

Got Questions? We've Got Answers

Alright, we've walked through the big picture of coins versus tokens. But let's be real—the crypto world is full of nuance and "what-if" scenarios. Here are some of the most common questions that pop up, answered in plain English.

Are All Altcoins Tokens?

This is a classic point of confusion, but the answer is a firm no.

Think of "altcoin" as a catch-all term for any cryptocurrency that isn't Bitcoin. That’s it. This massive category includes both coins and tokens.

For instance, Litecoin (LTC) is a famous altcoin, but it's a coin because it runs on its very own blockchain. On the flip side, Chainlink (LINK) is also a popular altcoin, but it's an ERC-20 token that lives on the Ethereum blockchain. So, the key takeaway is that most tokens are altcoins, but not every altcoin is a token.

Can a Token Ever Become a Coin?

Absolutely, and it happens more often than you might think. This is a pretty standard growth path for ambitious crypto projects.

A new project will often launch as a token on a battle-tested blockchain like Ethereum. Why? It's faster, cheaper, and lets them tap into an existing community and security infrastructure without having to build everything from scratch.

As the project gains traction and proves its value, it might decide it's time to build its own house. This process is called a mainnet swap, where the project migrates from the host blockchain (like Ethereum) to its own brand-new, independent blockchain. The moment that happens, their token officially graduates and becomes a coin.

This transition is a huge deal. It’s like a project moving out of a rented apartment and building its own custom home—a signal that it's mature and ready to control its own destiny.

Why Do I Need ETH to Send Other Tokens?

If you've ever tried sending a token on Ethereum, you've run into this. You're trying to send, say, some SHIB tokens, but the wallet demands you have some Ether (ETH) to complete the transaction. What gives?

Think of the Ethereum blockchain as a massive, decentralized supercomputer. When you send a token, you're asking that computer to do work—to process and secure your transaction. The people running the computers (validators) don't work for free.

They need to be compensated for their effort, and that payment is called a gas fee. On the Ethereum network, gas fees must be paid in the native currency of the land, which is ETH. Your token can't pay its own way; it needs ETH to cover the postage. For deeper dives and community chatter on topics just like this, checking out relevant crypto subreddits can be incredibly insightful.

Ready to grow your Web3 community without the headache? With Domino, you can launch engaging, reward-based quest campaigns in minutes—no code required. Automate user acquisition, boost on-chain activity, and manage it all from one simple dashboard.

Discover how Domino can accelerate your project's growth today.