Crypto Gamification Your Guide to Web3 Engagement

Crypto gamification is all about using fun, game-like features—think quests, points, and rewards—in apps that aren't actually games. The secret sauce? It’s all powered by blockchain.

The real game-changer here is that the rewards aren't just imaginary points locked in an app. They're verifiable digital assets, like crypto tokens or NFTs, that users genuinely own. This simple twist turns everyday, passive actions into a fun, rewarding experience where people earn things with real value.

What Is Crypto Gamification Anyway

Let's break it down without the buzzwords. Think of it as a supercharged loyalty program, but for the crypto world. The rewards you earn aren't just flimsy points; they have actual, provable value. Crypto gamification is really just the art of making normal user tasks—like sharing a post, trying a new feature, or voting in a poll—feel like a compelling game.

So, instead of collecting points that are stuck on one company's platform, users get their hands on digital assets they can trade, sell, or show off. It’s a powerful shift that turns passive followers into deeply invested community members. Suddenly, engaging with a project isn't a chore; it's an exciting journey with tangible rewards at the end.

Why This Is More Than Just a Trend

We're not just talking about slapping a leaderboard onto a website and calling it a day. Crypto gamification is a fundamental shift in how projects build and keep a loyal community. It taps directly into our very human desires for achievement, competition, and ownership, creating a powerful feedback loop that keeps people coming back for more.

The benefits are real and you can actually see them:

- Deeper Engagement: When there are real incentives on the line, users are far more motivated to explore every nook and cranny of your platform.

- Stronger Community Bonds: Working towards shared goals and a little friendly competition does wonders for building a sense of camaraderie. Our guide on strategies for crypto community building dives into how these bonds are formed.

- Verifiable Ownership: When someone earns an NFT or some of your project's tokens, they own a small piece of the ecosystem. That feeling of ownership creates a level of loyalty that old-school points systems can't even touch.

At its heart, crypto gamification is a powerful form of interactive marketing. It sparks a genuine two-way conversation between a project and its users where the value exchange is clear and good for everyone.

This isn't about simple, one-off transactions. It's about creating an ecosystem where users feel like true stakeholders who are directly contributing to—and benefiting from—the project's success.

The Growing Market Demand

This isn't just some niche idea anymore; it's a market that's blowing up. The broader gamification market is on track to be worth somewhere between $12.8 billion and $29.1 billion by 2025.

A huge reason for this explosion is the blend of blockchain and tokenization, which makes verifiable rewards possible and opens the door for new kinds of loyalty programs that work across different platforms. These numbers scream one thing: people want on-chain rewards like tokens and NFTs baked into their online experiences. This momentum proves that turning engagement into an ownable asset isn't just a cool concept—it's the future of building dedicated Web3 communities.

The Building Blocks of Crypto Gamification

So, how does crypto gamification actually work under the hood? It’s not about one magic bullet. Instead, it’s a mix of a few key ingredients working together to create an experience that’s genuinely rewarding for users.

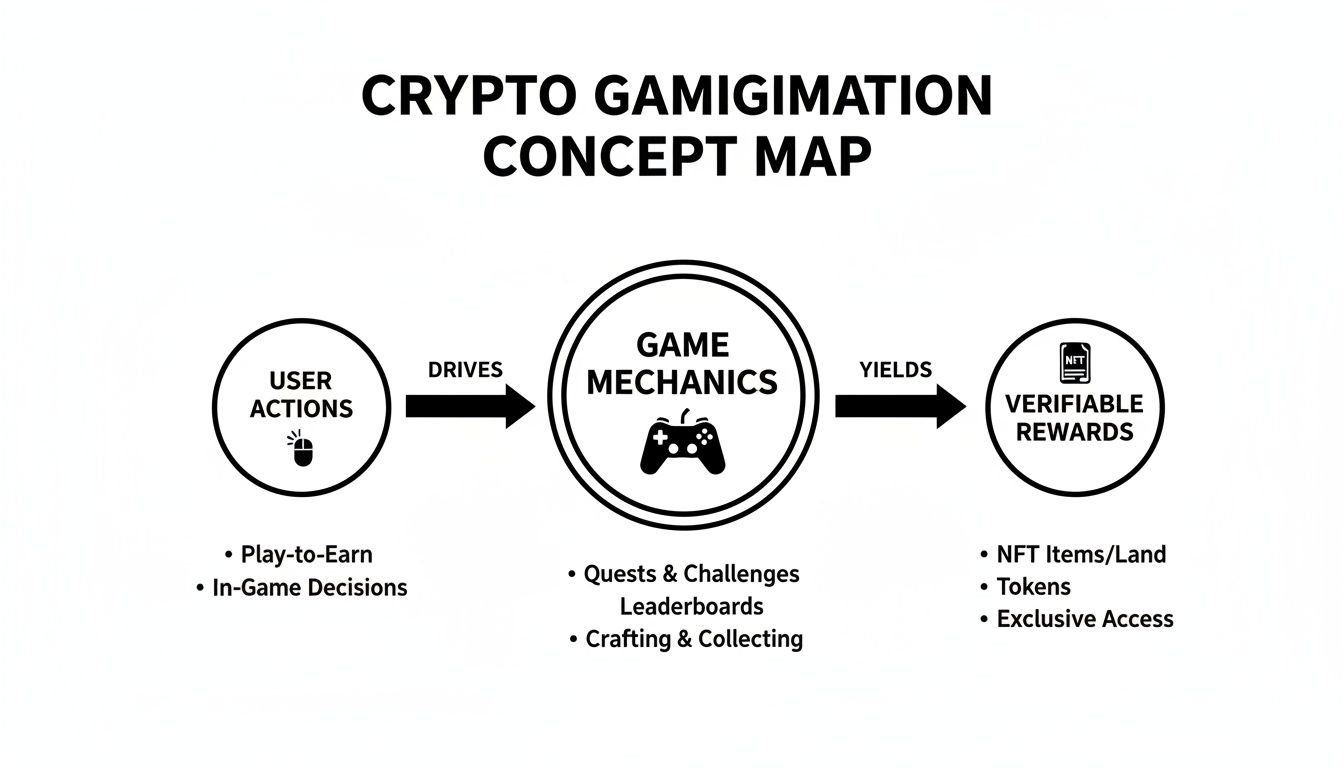

At its core, the flow is pretty straightforward: you give users things to do, use game mechanics to track their progress, and then reward them with real, verifiable digital assets.

This map lays out the basic journey pretty clearly.

You can see how a user's action kicks off a process that flows through game mechanics and ends with a reward. This simple loop is the engine of any gamified system.

Quests And Tasks: The Heart Of Engagement

Everything starts with quests—the specific, actionable tasks you want people to complete. Think of these as the bread and butter of your strategy. They’re what guide users through your world and reward them for taking part in meaningful ways.

These tasks generally fall into two buckets, each with its own job to do.

- On-Chain Tasks: These are actions that happen right on the blockchain. Because they’re on-chain, they’re super easy to verify automatically. Common examples include swapping a token, staking an asset, or minting an NFT.

- Off-Chain Tasks: These are the things that happen on familiar platforms outside your dApp, like social media or community forums. We're talking about joining a Discord, retweeting an announcement, or even writing a product review.

The real magic happens when you blend them. A smart campaign might ask someone to first join the project’s Telegram (off-chain) and then use the platform to perform a token swap (on-chain). Just like that, you've created a full, measurable journey for your user.

Tokenomics: The Fuel For Your Engine

Quests give users a map, but tokenomics gives them a reason to start the journey. This is where crypto gamification leaves old-school points systems in the dust. The rewards aren't just imaginary numbers on a screen; they’re digital assets with real-world scarcity and purpose.

A lot of crypto gamification strategies lean heavily on Non-Fungible Tokens (NFTs) as unique rewards and status symbols. You can get a sense of their market impact by looking at some key NFT statistics.

The two main types of rewards you'll see are:

- Fungible Tokens: These are your project's native tokens (or another crypto) that can be used for governance, staked for yield, or traded on an exchange. They’re like a cash-back reward, offering direct financial value.

- Non-Fungible Tokens (NFTs): These are one-of-a-kind digital collectibles. They can represent anything from an achievement badge or a special in-game item to an access pass for an exclusive community channel.

By connecting these assets to quest completion, you create a powerful economic flywheel. Users add value to the ecosystem with their actions, and in return, they get a real stake in its future. This model is a cornerstone of modern Web3 loyalty programs because it perfectly aligns the project's goals with the community's.

On-Chain Vs Off-Chain Gamified Tasks

To make this clearer, let's break down the kinds of tasks you might ask users to perform, both on and off the blockchain. Each serves a distinct purpose in your overall campaign.

| Task Type | Example Action | Verification Method | Primary Goal |

|---|---|---|---|

| On-Chain | Mint a specific NFT from a collection | Wallet activity monitoring | Driving protocol usage |

| On-Chain | Swap Token A for Token B on a DEX | Smart contract interaction logs | Increasing liquidity/volume |

| On-Chain | Stake a minimum of 100 project tokens | On-chain data query | Enhancing network security |

| Off-Chain | Follow the project's X (Twitter) account | Social media API integration | Growing social media reach |

| Off-Chain | Join the official Discord server | Discord bot verification | Building community engagement |

| Off-Chain | Write a review on a third-party site | Manual review or user submission | Generating social proof |

As you can see, a healthy mix of both on-chain and off-chain tasks allows you to engage users across your entire ecosystem, from social platforms to the core functions of your protocol.

Game Mechanics: Tying It All Together

Finally, we sprinkle in classic game mechanics to make the whole experience feel less like a chore and more like... well, a game. These elements tap into basic human drivers like competition, achievement, and the desire for progress.

Simple mechanics like leaderboards and achievement badges can boost user retention significantly by creating clear goals and social recognition for participation.

Here are a few of the most popular mechanics you can deploy:

- Leaderboards: Nothing sparks friendly competition like a public ranking of users based on points or quests completed. It’s a powerful motivator for consistent engagement.

- Achievement Badges: Awarding unique, non-transferable NFTs for hitting certain milestones gives users a way to show off their status and accomplishments within the community.

- Leveling Systems: Let users "level up" by finishing tasks. This creates a satisfying sense of progression and can unlock new rewards or special privileges along the way.

And this isn't just theory anymore. Crypto-native gamification is already working at a massive scale. No-code Web3 community tools are powering tens of millions of completed tasks. Some of the top platforms report having tracked over 25 million completed quests across more than 13,000 campaigns. That’s proof that these reward loops are battle-tested and ready for prime time.

Proven Strategies for Gamified Campaigns

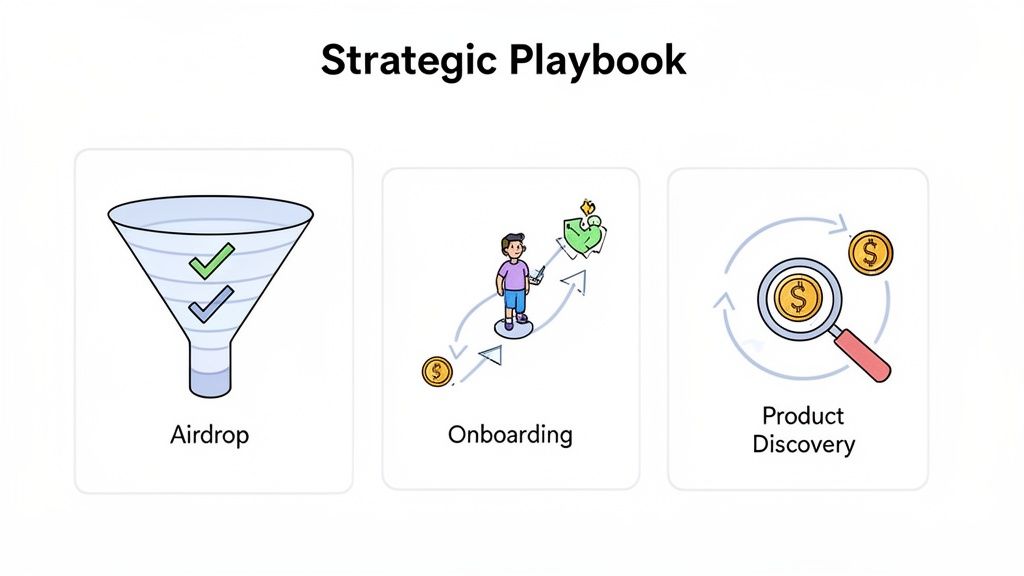

Alright, so you get the basic building blocks of crypto gamification. But how do you actually put them together to create a campaign that works? That's the real trick. Think of this next part as your playbook, filled with proven strategies that Web3 projects are using right now to hit some major goals.

These aren't just theories—they're field-tested blueprints for getting people off the sidelines and into the game. Each playbook uses a different mix of quests, rewards, and game mechanics to nudge users toward actions that help both the project and the community. Let's break down a few of the most effective models.

The Airdrop Qualification Funnel

Let's be honest: the main goal of an airdrop is to get your token into the hands of real, long-term supporters—not just bots and professional "airdrop farmers." The Airdrop Qualification Funnel uses gamification to do just that, filtering out the noise and pinpointing the true believers who deserve a piece of the pie.

Instead of just taking a random snapshot, this strategy makes users complete a series of tasks over a set period. It creates a journey that naturally weeds out anyone who isn't genuinely committed.

- The Goal: Distribute tokens to high-quality, engaged users while blocking bots and mercenaries.

- How It Works: The campaign usually kicks off with easy off-chain stuff, like following you on social media. From there, it gets more serious with on-chain actions like swapping a token, providing liquidity, or test-driving a key protocol feature. This multi-step process is a surprisingly powerful way to fight off sybil attacks.

- The Payoff: Users rack up points or "XP" for every quest they finish. Only wallets that hit a minimum score by the deadline get a spot in the airdrop, making sure the rewards go to the people who actually put in the work.

The Community Onboarding Journey

A buzzing community doesn't just magically appear. The Community Onboarding Journey is a gamified playbook for turning brand-new faces into knowledgeable, active members. It’s basically an interactive tutorial that guides newbies through their crucial first steps.

This is so much more effective than just dumping a link to a dense "getting started" guide in their lap. You're making the learning process fun and rewarding from the get-go.

By gamifying the onboarding process, projects can seriously boost their new member retention. It turns what could be a confusing first impression into a fun, structured path toward becoming a power user.

The secret sauce is creating a clear, step-by-step path.

- Welcome & Socials: Start with super easy, low-effort tasks. Think "join the Discord," "say hi in the #intros channel," or "follow us on X." For more ideas here, our guide on running effective Discord quests is packed with community-building tactics.

- Learn the Lore: Next up, design quests that actually teach people about your project. This could be a quick quiz on your whitepaper, a scavenger hunt for a "secret code" in a blog post, or watching a short explainer video.

- First On-Chain Action: The journey should end with their first real interaction with your protocol. This could be minting a free commemorative NFT or making a tiny transaction. It’s the final step that officially turns them from a lurker into a participant.

The Product Discovery Loop

So you've built an awesome product with all these cool features... but how do you get people to actually use them? The Product Discovery Loop is designed to incentivize users to explore everything your platform has to offer, turning those neglected features into regular habits.

This strategy is killer for driving adoption for a new feature launch or just getting people to engage more deeply with your main product. It creates a non-stop cycle of explore, act, and reward that keeps people coming back for more.

- The Goal: Boost user engagement with specific product features and improve long-term retention.

- How It Works: You give users a checklist of features to try out. For a decentralized exchange (DEX), the list might include quests like "Perform a swap," "Add liquidity to a pool," and "Stake your LP tokens."

- The Payoff: Finishing one task might earn a user some points, but completing the entire "loop" unlocks a much bigger reward—like a unique NFT badge or a bonus token drop. This pushes users to experience the full value of your platform, not just a single, isolated part of it.

Choosing the Right Tools for the Job

Alright, you've got the concepts down and a few playbooks in your back pocket. Now it’s time to actually build something. This is usually the part where you'd think you need to hire a whole squad of expensive blockchain developers, but things have changed. A lot.

You can actually pull off a seriously powerful crypto gamification strategy today without writing a single line of code.

The secret? A new wave of no-code and low-code platforms designed specifically for Web3. Think of them as a mission control for your community campaigns. They let you mix and match different tasks, automate reward payouts, and track everything in one spot. It’s a huge shift, putting these growth tactics directly into the hands of marketers and community managers, not just engineers.

The Power of No-Code Gamification Platforms

I like to think of these platforms as the Shopify for Web3 engagement. You wouldn't build an entire e-commerce store from scratch, right? You'd use a toolkit with pre-built features. It’s the same idea here. For crypto gamification, you can just drag and drop quest types, hook up your social accounts, and set up on-chain reward triggers in a matter of minutes.

This approach gives you some massive advantages:

- Speed: You can launch a campaign in hours, not weeks. That means you can jump on market trends or respond to community feedback almost instantly.

- Cost Savings: The resources needed to build and maintain a custom gamification engine from the ground up are enormous. No-code tools slash that cost.

- Flexibility: It's so much easier to experiment. You can try out an airdrop funnel one week and an onboarding journey the next, all without being locked into a rigid, custom-built system.

A Practical Look at Domino

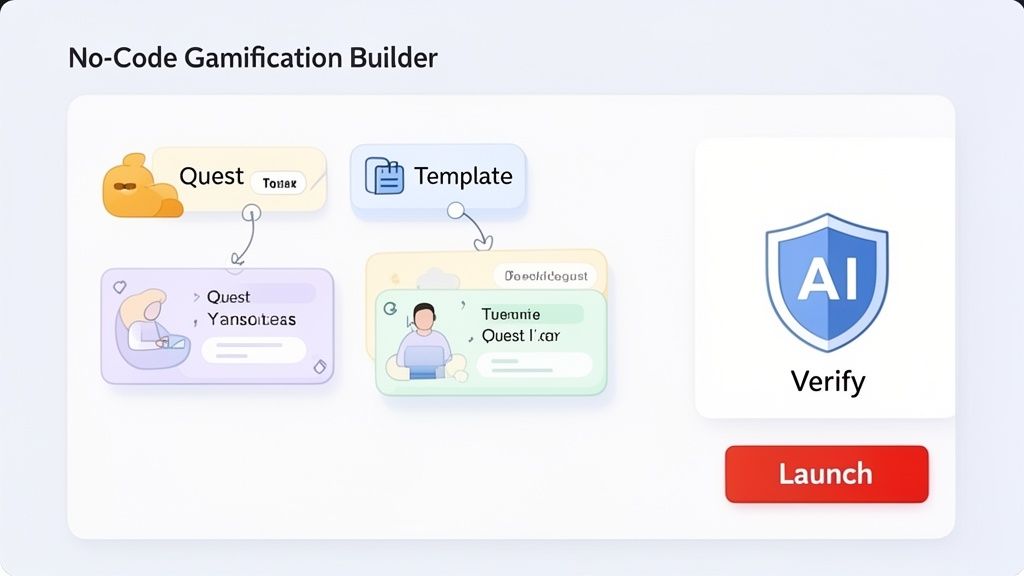

To make this less abstract, let’s look at a platform like Domino. It's built to handle every single piece of a gamified campaign, from creating the quests to using AI to verify them and automatically sending out the rewards. You get a visual interface where you can map out a user's entire journey, step-by-step.

Here's a peek at what a no-code quest builder actually looks like.

This dashboard shows how it all comes together—quests, templates, AI verification, and the launch button—all managed from one clean interface.

The real magic is in the integration. These platforms plug directly into blockchains, social media APIs, and other tools, acting like the central nervous system for your campaign. They can listen for an on-chain event (like someone making a token swap) or an off-chain action (like a retweet) and instantly credit the user.

The core value of a no-code tool is that it abstracts away the complexity. You don't need to know how to query a blockchain or build a Discord bot; you just need to decide what you want your users to do and what they’ll get for doing it.

Key Features to Look For

When you start shopping around for tools, a few key features separate the good from the great. You need a platform that truly lets you build out a full-blown strategy without hitting a wall.

- On-Chain and Off-Chain Task Support: This is non-negotiable. Your tool has to track actions wherever your community hangs out—from X and Discord right down to your protocol itself.

- Ready-Made Templates: Why reinvent the wheel? Platforms like Domino come with over 130 templates for common campaigns, which can save you an unbelievable amount of setup time.

- AI-Powered Verification: Manually checking thousands of submissions (like tweets or memes) is an absolute nightmare. AI verification is a must-have for stopping spam, catching cheaters, and keeping your campaign legit.

- Automated Reward Distribution: The platform should handle sending out tokens or NFTs to everyone who qualifies, right when they complete a quest. This gets rid of manual work and the human errors that come with it.

Picking a tool with these capabilities frees up your team to focus on what really matters: the story, the user journey, and the community experience. You get to be creative instead of getting stuck in the technical weeds. That's how you scale engagement the right way.

Common Mistakes to Avoid in Your Strategy

Building a great crypto gamification system is an exciting process, but it's way too easy to stumble into common traps that can completely derail your efforts. Launching a campaign without thinking through the potential pitfalls is like setting sail without checking the weather—you might get lucky, or you could end up in a storm.

This section is your essential checklist of what not to do. By learning from the hard-won lessons of others, you can design a gamified experience that’s not just engaging on day one, but actually lasts. Let's dive into the critical mistakes that can sink a campaign before it ever gets a chance to swim.

Unsustainable Tokenomics

This is the big one. The most common and dangerous mistake is creating an economic model that simply can't last. It’s tempting to offer massive rewards to attract a flood of new users, but this often leads to a "sugar rush" effect. Once the initial hype dies down and the generous rewards dry up, users leave just as quickly as they arrived, leaving your token value in the dust.

Think of your token supply like a water reservoir. If you open the floodgates all at once, you'll create a huge splash, but you'll run dry in no time. The key is to create a controlled, steady flow that replenishes itself over time.

To get this right, you have to:

- Align Rewards with Real Value: Make sure the rewards you give out are tied to actions that genuinely benefit the ecosystem, like providing liquidity, stress-testing a new feature, or creating user-generated content.

- Implement Vesting Periods: Don't let users dump all their rewards on the market immediately. Use vesting schedules or lockup periods to encourage a long-term mindset and stabilize your token's price.

- Create Token Sinks: Build in mechanisms that take tokens out of circulation. This could be anything from using them for in-app purchases and exclusive features to governance votes. This helps balance the new supply you're creating.

A Clunky or Confusing User Experience

Even the most brilliant gamification concept will fall flat if it’s a pain to use. A confusing interface, quests with unclear instructions, or a reward system that’s hard to understand will just frustrate people and push them away. Your goal is to make participation feel effortless and fun, not like a homework assignment.

Every extra click or moment of confusion is a point where you might lose someone. The user's journey, from discovering a quest to claiming their reward, has to be as smooth and intuitive as possible.

A seamless user experience is the invisible foundation of successful crypto gamification. If users have to fight the interface to participate, they won't stick around long enough to see the rewards.

To improve the experience, focus on clarity and simplicity. Use clean design, write quest instructions in plain language, and give users a clear dashboard where they can easily track their progress and see what they need to do next.

Ignoring Bot and Sybil Attacks

In the world of crypto, where there's value, there are bots. Failing to protect your campaign from bad actors is a recipe for disaster. A Sybil attack is when a single person creates hundreds or thousands of fake accounts to unfairly farm rewards meant for your real community.

If bots dominate your campaign, you're not building a community; you're just paying for fake engagement. This not only drains your treasury but also demoralizes your real users, who see the system being rigged and lose trust.

Protecting your campaign is non-negotiable.

- Use Multi-Factor Verification: Don't rely on just one thing. Combine on-chain wallet activity with social media verification (like a connected X or Discord account) to create a much stronger barrier to entry for bots.

- Leverage AI-Powered Tools: Platforms like Domino use AI to analyze submissions and automatically flag suspicious activity. This can save you from the nightmare of manually reviewing thousands of entries.

- Design Smarter Quests: Create tasks that are easy for humans but difficult for bots. Think about things like participating in a live AMA, creating unique content, or solving a visual puzzle.

Answering Your Top Questions About Crypto Gamification

When you first start exploring crypto gamification, a bunch of questions usually pop up. It sounds great in theory, but how does it actually deliver results? Let’s walk through some of the most common questions we hear from projects on the verge of launching their first gamified campaign.

Think of this as your go-to FAQ, built to give you the confidence to dive in. We'll clear up the fog around measuring success, how it fits into more "serious" projects, and what really makes it different from old-school loyalty programs.

How Do You Actually Measure ROI on a Gamified Campaign?

This is the big one, right? It's one thing to see vanity metrics like Discord joins or Twitter followers go up, but how do you prove that gamification is actually driving real value? The trick is to tie your campaign goals directly to your core business KPIs.

Forget just celebrating a spike in social engagement. You need to look at what happens next. The real return on investment (ROI) isn't about getting clicks for the sake of clicks; it’s about sparking actions that lead to measurable growth.

Here’s how you can track what truly matters:

- Conversion Rates: Of the users who finished an onboarding quest, how many went on to use a core feature of your protocol? Track that percentage—it shows you're not just entertaining users, you're activating them.

- User Retention: Look at the churn rate of users who participate in your gamified campaigns versus those who don't. A great campaign creates stickier users who find more reasons to come back.

- Protocol Revenue: For any DeFi platform, this is non-negotiable. Measure the lift in trading volume or total value locked (TVL) coming from wallets that participated in a "Product Discovery Loop" campaign.

- Cost Per Acquisition (CPA): Tally up the total cost of your campaign rewards and divide it by the number of new, active users you gained. This gives you a crystal-clear picture of how efficient gamification is as a growth channel.

Ultimately, the measure of success is simple: did the experience lead to a meaningful, quantifiable increase in protocol usage, community loyalty, or revenue? If you can't connect those dots, you're just measuring noise.

When you focus on these bottom-line numbers, you can build a solid, data-backed case for your gamification strategy. It changes the conversation from "people are clicking our stuff" to "our last campaign drove a 15% increase in active stakers." Now that's a language every stakeholder understands.

Can Gamification Work for “Serious” Projects like DeFi and DAOs?

Absolutely. There's this myth that gamification is just for, well, games. Or maybe some lighthearted consumer apps. The truth is, the core human drivers—motivation, a sense of progress, and rewards—are universal. They can be incredibly powerful for even the most "serious" Web3 projects.

The key is to match the tone and mechanics to your audience. For a sophisticated DeFi protocol, the "game" isn't about collecting cute monsters. It's about empowering users to become master strategists within your ecosystem.

For example, a DeFi platform could gamify liquidity provision.

- Onboarding Quests: Create a step-by-step questline that walks new users through their first liquidity deposit, rewarding them with a small token bonus when they finish.

- Achievement NFTs: Award cool, non-transferable NFTs for hitting milestones like "Liquidity Sensei" for holding a position for over 90 days, or "Yield Champion" for hitting a specific return target.

- Leaderboards: Don't just rank LPs by the size of their wallet. Create leaderboards that rank them by efficiency or risk management, adding a layer of skill and strategy to the competition.

The same goes for a Decentralized Autonomous Organization (DAO). Gamification can be a huge boost for governance participation. Instead of just holding votes, you could introduce a reputation system where members earn "governance XP" for proposing ideas, joining debates, and voting consistently. As they level up, they could unlock special privileges, turning passive token holders into active, respected contributors. This turns governance from a chore into a status-building activity that people actually want to do.

Isn't This Just a Glorified Points Program?

This is a really important distinction. On the surface, crypto gamification can look a lot like the loyalty programs we’ve seen for decades—earn points, get stuff. But that comparison misses the two game-changing ingredients that blockchain brings to the party: verifiable ownership and decentralization.

In a classic points program, your points are just numbers sitting in a company's private database. They can change the rules, devalue your points, or even wipe them out entirely. You don't actually own them.

Crypto gamification completely flips this on its head. When you earn a token or an NFT, it’s yours. It lives in your wallet, on a public blockchain, and no one can take it away from you. This is the difference between renting and owning.

That fundamental shift creates a much deeper psychological connection. Let's break it down.

| Feature | Traditional Points Program | Crypto Gamification |

|---|---|---|

| Asset Ownership | Points are owned by the company | User truly owns tokens/NFTs in their wallet |

| Value | Locked to a single platform; no cash value | Assets have real, tradable market value |

| Transparency | The system is a total "black box" | All rules and rewards are on a public ledger |

| Interoperability | Points are useless outside the ecosystem | Assets can be used in other dApps or sold |

When your users own a piece of the ecosystem, their mindset shifts from "customer" to "stakeholder." They are invested—literally—in the project's success. That feeling of genuine ownership is something a traditional points system can never, ever replicate. It's the real secret weapon of crypto gamification.

Ready to stop managing spreadsheets and start building a real engagement engine? Domino gives you the no-code tools to launch powerful crypto gamification campaigns in minutes, not months. Start building your community with Domino today.