A Guide to Tokens and Cryptocurrency for Marketers

You've probably heard people use "tokens" and "cryptocurrency" like they're the same thing. Let's clear that up right now, because they're not.

Here’s a simple analogy: Think of a blockchain like an entire country. The cryptocurrency is its official, native currency—the dollar, the euro, the yen. Tokens, on the other hand, are everything else you can build or own in that country, like concert tickets, loyalty points, or even shares of company stock.

One is the money, the other is everything else you can do with that money's infrastructure.

Getting a Handle on the Digital Economy

If you really want to get what's happening in Web3, you have to look past the hype and understand the basic building blocks: tokens and cryptocurrency. People mix them up all the time, but knowing the difference is non-negotiable if you're trying to build a community or run a marketing campaign in this world.

Cryptocurrencies, which you'll often hear called "coins," are the native asset of their own blockchain. Bitcoin (BTC) is the lifeblood of the Bitcoin blockchain. Ether (ETH) is the gas that makes the Ethereum blockchain run. Their main job is to keep the network secure and act as a kind of decentralized digital cash.

Tokens are a different beast altogether. They are built on top of existing blockchains. They don't have their own custom-built highway; they're driving on the superhighway someone else already paved—most often, Ethereum. This is what makes them so incredibly flexible.

Cryptocurrency vs Tokens A Quick Comparison

To really nail this down, let’s look at a quick comparison. This table breaks down the core differences at a glance.

| Attribute | Cryptocurrency (e.g., Bitcoin, Ethereum) | Token (e.g., UNI, SHIB) |

|---|---|---|

| Foundation | Operates on its own independent blockchain. | Built on top of an existing blockchain (like Ethereum). |

| Primary Role | Acts as digital money; secures and powers the network. | Represents an asset or a utility (e.g., a vote, access right). |

| Creation | Complex; requires creating a whole new blockchain. | Relatively simple using smart contracts on an existing platform. |

| Analogy | The native currency of a country (e.g., USD). | Assets within that country (e.g., stocks, event tickets). |

As you can see, they serve fundamentally different purposes. You can't run the Ethereum network on anything but its native coin, Ether. But you can spin up thousands of unique tokens on Ethereum, each designed for a specific job. If you want to dive deeper, our guide on the difference between coins and tokens in cryptocurrency breaks it down even further.

This simple but profound difference is the key to unlocking Web3's potential. Cryptocurrencies provide the secure foundation, while tokens provide the limitless utility and creativity.

And this digital world is growing like crazy. The global crypto market hit an estimated $5.7 billion and is on track to reach about $11.7 billion by 2030. This isn't some niche hobby anymore; these assets are hitting the mainstream in a big way.

Why Does This Matter for Marketers?

Getting this distinction is the first real step to doing Web3 marketing right. You’re not just dealing with one kind of digital goodie; you're playing with a whole toolbox of them.

Here's a straightforward way to think about it:

- Cryptocurrencies are the economic layer. They handle security and the transfer of value.

- Tokens are the application layer. They enable specific actions, grant ownership, or provide access.

For marketers using tools like Domino, this opens up a ton of possibilities. You could design a campaign that rewards users with a stablecoin (which is a type of token) for completing quests, but the transaction itself is secured and paid for with the blockchain's native cryptocurrency.

This guide will give you that foundational knowledge so you can move through this space with confidence.

What Exactly Is a Cryptocurrency?

Let's start by getting one thing straight: cryptocurrencies are the bedrock of any blockchain. Think of them as the native currency of a digital nation. Just like you can't use Japanese Yen on the New York subway, you can't use Bitcoin on the Ethereum network. They're built-in, not bolted on.

Bitcoin (BTC) is the lifeblood of the Bitcoin blockchain. Ether (ETH) is what makes the Ethereum blockchain tick. You can’t have one without the other. This intrinsic link is the single biggest difference between a cryptocurrency and a token.

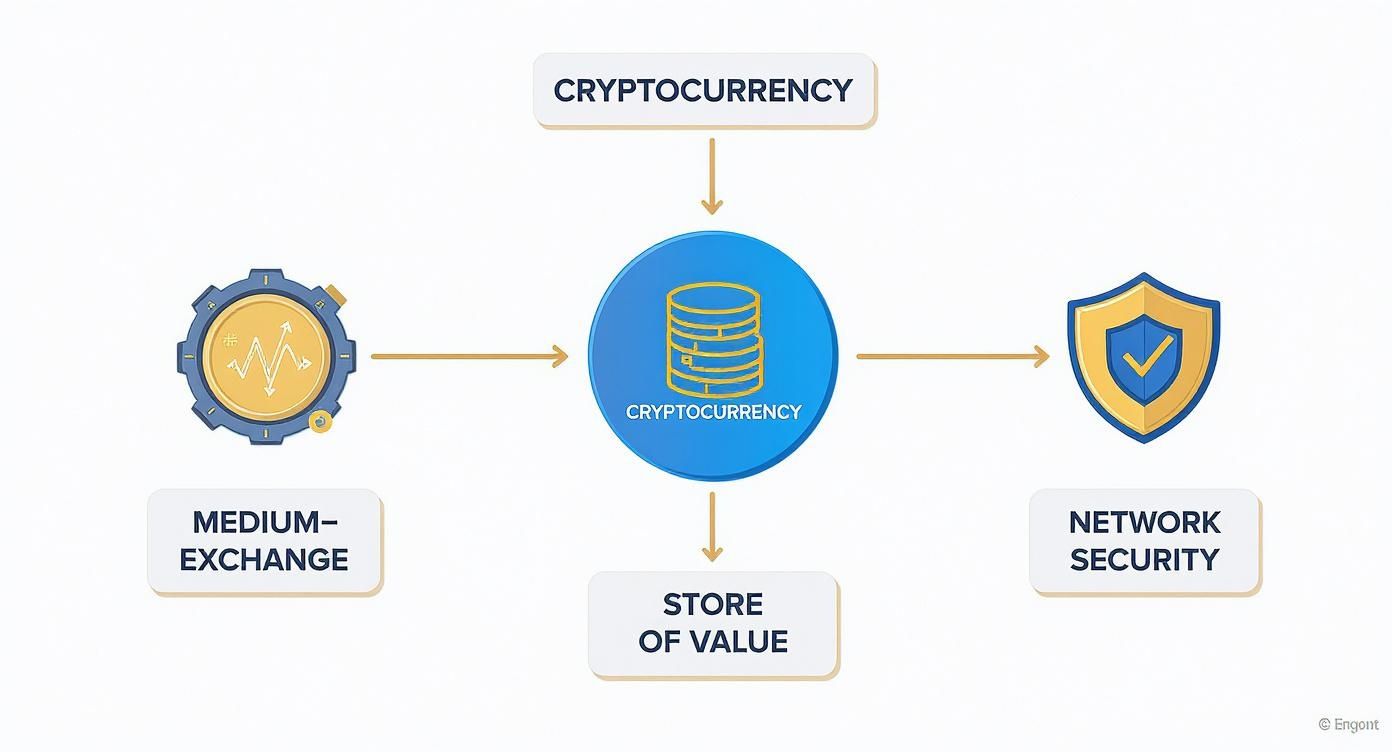

So, what does a cryptocurrency actually do? Its job is to keep the entire digital economy of its blockchain running, and it does that by playing three crucial roles.

The Three Pillars of a Cryptocurrency

At its core, a cryptocurrency is the economic engine of its network. It's not just digital cash; it’s a carefully designed system meant to power a decentralized world.

A Medium of Exchange: This is the most obvious one. It’s designed to be a form of digital money, letting people send value to each other without a bank or payment processor getting in the middle. It’s the "currency" in cryptocurrency.

A Store of Value: Much like gold, many cryptocurrencies are meant to hold their value—or even grow—over time. This often comes down to scarcity. For instance, there will only ever be 21 million Bitcoin created. Ever. That built-in limit, combined with network demand, gives it value.

A Unit of Account: This just means it provides a common way to measure value within its ecosystem. You price a coffee in dollars or euros; on a blockchain, you price things like transaction fees or an NFT in the network's native crypto.

These three functions don't work in a vacuum. They weave together to create a self-sufficient economic system for the blockchain.

The real magic of a cryptocurrency isn't just that it's digital money. It’s that it creates a powerful economic incentive for a global, decentralized network of people to work together to keep a system secure and honest.

This incentive system is the secret sauce that makes the whole thing work.

The "Crypto" in Cryptocurrency

So, where does the "crypto" part come from? It's short for cryptography, the art of secure communication. Every transaction is a coded message, digitally signed and verified by a massive network of computers.

This cryptographic foundation is what makes blockchain so powerful. Once a transaction is locked into the chain, it's permanent and can't be changed. It’s what gives us the trust to send money to someone halfway across the world, knowing that no single company or government can step in and mess with it.

So, a cryptocurrency is much more than just a digital coin. It's the fuel, the security guard, and the base currency all rolled into one. Its value is completely tied to the health, security, and popularity of its native blockchain. Without a strong crypto, the network would have no one to protect it and would quickly fall apart. This is why understanding the difference between tokens and cryptocurrency starts with appreciating the coin as the absolute core of its world.

A Deep Dive Into the Wild World of Tokens

If cryptocurrencies are the foundational power grid of a blockchain, then tokens are all the cool gadgets and appliances you can plug into it. This is where Web3 really gets creative. Unlike a cryptocurrency, a token isn't native to a blockchain; it’s built on top of an existing one, like Ethereum. That simple distinction opens up a whole universe of possibilities.

Think of it like building with LEGOs. The blockchain (like Ethereum) provides the standard baseplates and those little connecting bumps. Anyone can then use those same connection points to build totally unique pieces—tokens—that do completely different things, from a spaceship to a race car.

For marketers, this is where the real action is. Getting a handle on the different "flavors" of tokens is a must if you want to run effective campaigns with tools like Domino. Each type unlocks new ways to drive engagement, build a community, and create a real sense of ownership.

Utility Tokens: The Keys to Your Kingdom

The most common type you’ll bump into is the utility token. Just like the name suggests, its main job is to provide access or "utility" inside a specific digital ecosystem. It’s not really meant to be an investment; it's more like a key that unlocks a feature or service.

It’s basically a digital arcade token. You can't use it to buy groceries, but inside that specific arcade, it's the only thing that lets you play the games.

- Your Access Pass: A utility token might get you into an exclusive Discord channel, give you early access to new products, or let you use a decentralized application (dApp).

- The In-House Currency: It can act as the internal money for paying fees or buying digital goodies within a single platform. For example, a project might require you to use its own token to mint an NFT or join a special event.

Utility tokens are an awesome way to build a self-contained economy around your brand. They get people to participate by making the token essential to getting the full experience.

This visual below breaks down how a native cryptocurrency provides the secure foundation that all these different tokens are built on.

As you can see, a cryptocurrency's roles—as a medium of exchange, store of value, and security layer—create the stable ground needed for tokens to flourish.

Governance Tokens: Giving Your Community a Real Voice

Next up, we have governance tokens. These are fascinating because they give holders the right to vote on the future of a project. For community-led brands, this is a total game-changer. Instead of a small team calling all the shots behind closed doors, the power is handed over to the token holders.

Holding a governance token is like owning a share in a co-op. Your stake gives you a say in everything, from tweaking the fee structure to deciding which new features get built next. This fosters an incredibly loyal and invested community because your users are no longer just customers—they're stakeholders who genuinely care about the project's success.

By distributing decision-making power, governance tokens turn passive users into active participants. This shift from a top-down model to a community-driven one is a core principle of Web3.

Security Tokens: Where Crypto Meets Traditional Finance

Security tokens are digital versions of real-world assets. Just think of them as a traditional financial security, like a stock or a bond, but living on the blockchain. This could represent things like:

- Equity in a company

- Ownership of a piece of real estate

- A stake in a venture capital fund

The biggest advantage here is making traditionally illiquid assets—like a slice of a commercial building—easy to trade and split into smaller pieces. These are heavily regulated and have to play by all the standard securities laws, which sets them apart from the other token types. As you get deeper into tokens, remember that solid digital asset management best practices are crucial for handling them safely and effectively.

Non-Fungible Tokens (NFTs): The Dawn of Digital Uniqueness

And finally, we have Non-Fungible Tokens (NFTs). While the other tokens we’ve talked about are "fungible" (meaning one is the same as any other, like one dollar bill is the same as another), each NFT is 100% unique. It cannot be replaced. This provable, digital scarcity is what gives them their value.

But NFTs are so much more than just digital art. They can represent ownership of anything unique, whether it's a concert ticket, a digital identity, or a one-of-a-kind item in a video game. For marketers, NFTs are a killer tool for creating verifiable digital collectibles that build deeper connections with fans and reward loyalty in ways we never could before.

How Tokens and Cryptocurrencies Are Made

So, where do all these digital assets actually come from? The way tokens and cryptocurrency are born is one of their biggest differentiators. It’s not just a technical detail—it gets to the very heart of what they are and what they’re for.

Think of it this way: creating a cryptocurrency is like building an entire highway system from the ground up. It’s a massive undertaking. Creating a token, on the other hand, is like designing a new car to drive on that existing highway.

Cryptocurrencies come into being through complex, energy-heavy processes that are baked into the security of their blockchain. It's like a system that prints new money while simultaneously paying for the network's security guards. Tokens, however, are simply "minted" on a blockchain that's already up and running—kind of like a company issuing new shares of stock.

The Two Paths of Cryptocurrency Creation

The native coins of a blockchain, like Bitcoin or Ether, are created in one of two main ways: mining or staking. Both methods have the same end goals: to verify transactions, keep the network secure, and release new coins into the world.

Mining (Proof-of-Work): This is the old-school method, the one that made Bitcoin famous. Picture thousands of powerful computers all over the world in a race to solve an incredibly complex math puzzle. The first one to crack it gets to add the next "block" of transactions to the chain and is rewarded with brand-new coins. This whole competition is called mining, and it's what secures the network and creates new Bitcoin.

Staking (Proof-of-Stake): A much greener alternative used by networks like Ethereum is called staking. Here, instead of a computational race, people lock up some of their own crypto as collateral for a chance to validate transactions. It’s like putting down a security deposit to show you’ll play by the rules. If you do your job honestly, you get rewarded with newly created coins.

These processes are intentionally difficult. They make sure no single person or group can take over the network and that new currency is introduced at a steady, predictable pace. No one can just decide to print more money on a whim.

The creation of a cryptocurrency is woven into the very fabric of its blockchain's security. It's not just about making new coins; it's the payment system that keeps the whole decentralized machine running.

The Simplicity of Minting a Token

Making a token is a whole different ballgame—and it’s way easier. Tokens don't need their own blockchain, their own miners, or their own stakers. They're built on top of existing platforms like Ethereum using something called a smart contract.

A smart contract is really just a piece of code that runs on the blockchain and automatically enforces a set of rules. To create a token, a developer just needs to write a smart contract that lays out the basics:

- Total Supply: How many of these tokens will ever exist?

- Name and Symbol: What's it called? (e.g., Domino Token, DMT)

- Rules for Transfer: How do people send and receive it?

Once that smart contract is live on the blockchain, the act of actually creating the tokens is called minting. It's as simple as telling the contract to generate a certain number of tokens and pop them into a specific wallet. It’s less like building a new financial system and more like a concert venue printing up a batch of tickets. You can dive deeper into how these different assets interact by checking out our guide on how to bridge tokens and coins across blockchains.

This is why we see millions of different tokens out there. Anyone with a bit of coding know-how can mint a new token for just about anything, from a loyalty program for a local coffee shop to a governance token for a huge decentralized organization. This fundamental difference in how they’re made is a key reason why tokens and cryptocurrency play such distinct roles in the world of Web3.

Applying Tokens to Your Marketing Strategy

Alright, let's get practical. Understanding the difference between tokens and cryptocurrency is one thing, but the real fun begins when you start using these tools to build marketing campaigns that people actually remember. This is where you can build a real community, drive meaningful engagement, and launch things that just weren't on the table in the old Web2 world.

Tokens give you a direct channel to your audience. You can reward specific actions, build genuine loyalty, and give everyone a feeling of shared ownership. With no-code platforms like Domino, you can actually design and automate these campaigns yourself, no dev team required. It’s all about turning those big Web3 ideas into real-world results.

Create Unforgettable Loyalty with Utility Tokens

Utility tokens are the absolute workhorses of Web3 marketing. We're talking way beyond flimsy punch cards or generic discount codes. Think of these tokens as verifiable digital keys that unlock exclusive perks and experiences for your most dedicated fans.

This creates a brilliant, self-sustaining loop. The more someone engages with your brand, the more tokens they earn, and the tighter their connection to your community becomes. This is loyalty on a whole different level.

Just imagine what you could do:

- Exclusive Content Access: Let token holders unlock premium articles, behind-the-scenes videos, or private channels in your Discord.

- Early Product Drops: Give your biggest supporters first dibs on new products or features before they hit the mainstream.

- Community Governance: Give your people a real say in brand decisions, making them feel like true partners on your journey.

Deepen Fan Engagement with NFTs

NFTs are so much more than digital art—they're the ultimate branding tool. Because every NFT is unique and its ownership is permanently recorded on the blockchain, they can act as a digital badge of honor for your community.

They're like digital collectibles that can't be faked or copied. This opens up some amazing ways to get people involved and create a provable record of their participation. For example, you could issue a unique NFT to everyone who attends a virtual event or crushes a quest in your community.

By turning achievements into tangible, ownable digital assets, NFTs create a powerful emotional connection. They transform a fleeting interaction into a lasting piece of brand history that your fans can proudly display.

Platforms like Domino make this surprisingly simple. You can set up campaigns that reward users for taking specific actions. For instance, you could run a Telegram airdrop campaign, rewarding your most active users right inside the app they use every single day.

Enable Seamless Global Transactions with Stablecoins

Finally, let's talk about a special kind of token that's quietly changing the game: stablecoins. These are tokens designed to hold a steady value because they're pegged to a real-world currency, like the U.S. dollar. For marketers, this is huge. It removes the price volatility you often see with other tokens and cryptocurrency.

You can reward your global community without worrying that the value of their prize will tank overnight. This makes stablecoins perfect for payouts, rebates, and cross-border promotions. It's a fast, low-cost alternative to clunky old bank transfers.

And they're not a niche product anymore. Stablecoins now make up about 30% of all on-chain crypto transaction volume. Annual volumes recently shot past $4 trillion—that's an 83% jump year-over-year. This growth is partly thanks to clearer regulations, which are making them a go-to for international payments.

Marketing Applications of Different Token Types

To tie it all together, here’s a quick look at how you can put these different token types to work in your marketing strategy.

| Token Type | Primary Function | Marketing Application Example |

|---|---|---|

| Utility Tokens | Providing Access & Functionality | Granting holders exclusive access to a private Discord channel or early access to a new product line. |

| NFTs | Proving Unique Ownership | Issuing a one-of-a-kind digital collectible to attendees of a virtual conference as a "proof of attendance." |

| Security Tokens | Representing Ownership/Investment | Offering tokenized shares in a community-funded project, giving early backers a real stake in its success. |

| Stablecoins | Maintaining Stable Value | Paying out rewards for a global user acquisition campaign in USDC to ensure the value remains consistent across borders. |

By weaving these different token types into your strategy, you’re not just marketing—you're building a more dynamic, engaged, and loyal community from the ground up.

Why the Future of Web3 Needs Both

Forget the "tokens vs. cryptocurrency" debate. It's not about picking a winner. The truth is, they're two sides of the same coin, working together to power the decentralized web. One simply can't thrive without the other.

Think of it like this: cryptocurrencies are the superhighways of this new digital world. They build the secure, reliable infrastructure that makes everything possible, ensuring every transaction is safe and sound. Tokens, on the other hand, are all the different vehicles driving on those highways—everything from sleek sports cars (NFTs) to massive freight trucks (utility tokens).

A Symbiotic Digital Economy

This partnership between foundational security and endless utility is the real magic of Web3. Without the sturdy rails laid down by cryptocurrencies like Ether, tokens would have no trustworthy ground to stand on. But a blockchain with just its native crypto would be like a brand-new highway system with no cars, no exits, and nowhere to go. It would be functional, but pretty lonely.

Tokens are what bring life, creativity, and actual human engagement to the blockchain. They turn a secure database into a bustling ecosystem for gaming, art, community building, and digital ownership. It’s this dynamic relationship that creates all the value.

The core strength of the Web3 ecosystem lies in this symbiotic relationship. Cryptocurrencies provide the unshakeable trust, while tokens deliver the boundless innovation that attracts and engages users.

The Proof Is in the Volume

The sheer scale of activity tells the whole story. In a recent third quarter, for example, the top centralized exchanges saw a mind-boggling $5.1 trillion in spot trading volume. That’s a 31.6% jump from the previous quarter alone. The derivatives market was just as hot, with Ethereum futures and options seeing their average daily volume rocket up by 355% year-over-year. You can dig into the full picture by reading up on these Q3 crypto market trends.

This massive volume isn't just one type of asset. It's the entire ecosystem of tokens and cryptocurrency being traded, used, and built upon together. As this space grows up, their interdependence will only get stronger.

For marketers, getting this partnership isn't just a "nice-to-have." It’s the key to the whole kingdom—the fundamental insight needed to build brands, connect with communities, and actually lead the way in the next chapter of the internet.

Frequently Asked Questions

Even after wrapping your head around the basics, a few questions always seem to pop up. Let's tackle some of the most common ones to clear up any lingering confusion you might have.

Are All Tokens Actually Worth Something?

Heck no. Just because someone minted a token on a blockchain doesn't give it any real value. Think of it like this: anyone can print a flyer, but that doesn't make it money.

A token's value comes from its utility, the demand from its community, and the credibility of the project behind it. A utility token for a popular app with millions of users? That's probably valuable because it unlocks something people actually want. On the flip side, a token made for a dead project or a flash-in-the-pan meme is basically digital dust. You have to look past the hype and ask, "What does this thing do?"

It's easy to create a token. It's incredibly hard to create real, lasting value. Always dig into the project behind the token before you assume it's worth anything.

Can a Token Ever Become a Cryptocurrency?

This is a great question that trips a lot of people up, but the short answer is usually no. It’s not really an "upgrade" path; it's more like changing the entire foundation of a house.

Remember, tokens are built on top of an existing blockchain. To become a true cryptocurrency (or "coin"), a project has to build and launch its very own, independent blockchain. That's a huge technical lift. When a project pulls this off, it’s called a mainnet launch. They go from being a tenant on a platform like Ethereum to owning the entire building. Once their asset lives on its own native blockchain, it officially graduates to being a coin.

What Are the Biggest Risks for Marketers Using Tokens?

Tokens can be an amazing tool for engaging an audience, but they come with a few major "watch-outs" for marketers. You really need to be careful, because the risks generally fall into three buckets:

Shifting Regulations: The rulebook for crypto is still being written, and it changes all the time. A token campaign that’s perfectly fine today could be in a legal gray area tomorrow, especially if your token starts looking like a security.

Security Holes: The smart contracts that run tokens are just code, and code can have bugs. A tiny flaw could be exploited by hackers, leading to all your campaign's tokens being stolen. That's a nightmare for your budget and your brand's reputation.

Brand Damage: If you tie your brand to a sketchy or low-effort token project, it can blow up in your face. Doing your homework on potential partners isn't just a good idea—it's essential for protecting your credibility.

If you're managing a bunch of these digital assets, staying organized is key. You might find our guide on the best crypto portfolio tracker super helpful for keeping tabs on everything.

Ready to build a more engaged and loyal Web3 community? With Domino, you can design and launch powerful, automated reward campaigns in minutes, no coding required. See how leading Web3 teams are driving real growth by visiting https://domino.run.