token coin cryptocurrency: Coin vs Token Explained

Dipping your toes into the world of digital assets can feel like trying to learn a brand new language, right? Let's cut through the noise and get straight to it. Think of "cryptocurrency" as the big, all-encompassing term for any digital asset that uses cryptography to stay secure.

Under that huge umbrella, you've got two main categories. A coin is the native currency of its very own blockchain (Bitcoin is the classic example). A token, on the other hand, is built on top of an existing blockchain (like how Shiba Inu runs on the Ethereum network).

Unpacking the Digital Asset Landscape

Before we get into the weeds, it’s super helpful to really nail down the basic ideas separating a token, a coin, and a cryptocurrency. A good analogy is thinking of "cryptocurrency" as the category "vehicles." Under that, you have different types, like "cars" (which are like coins) and "motorcycles" (which are like tokens). They all get you from A to B, but they’re engineered completely differently.

To start, you really need a good handle on the foundational cryptocurrency concepts that everything else is built on.

This isn't just a matter of semantics; this core difference shapes everything from a project's core purpose to how you might approach it as an investor. The global crypto market isn't just big; it's expanding at an incredible pace. Valued at an estimated USD 5,702.5 million, the market is on track to hit USD 11,713.1 million by 2030. That alone shows you just how important these digital assets are becoming.

Key Terms at a Glance

Getting these core distinctions down from the start will give you a solid foundation for everything we're about to cover. Here's a quick and dirty breakdown of how they all fit together.

| Term | Role in the Ecosystem | Key Characteristic |

|---|---|---|

| Cryptocurrency | The overarching category for all digital assets secured by cryptography. | A broad term covering both coins and tokens. |

| Coin | A native asset that operates on its own independent blockchain. | Acts as the foundational layer and "fuel" for its network. |

| Token | A programmable asset built on top of a pre-existing blockchain. | Represents a specific utility, asset, or function within an application. |

The fundamental difference comes down to infrastructure. A coin has its own, while a token borrows it from another network. This single distinction dictates their creation process, use cases, and role within the Web3 ecosystem.

Understanding Cryptocurrency Coins

Alright, let's start with the OG's of the crypto space: coins. A cryptocurrency coin is the native digital asset of its own, dedicated blockchain. It isn't just something built on a platform; it's a fundamental piece of the platform itself.

Think of the big names here—Bitcoin (BTC) lives on the Bitcoin blockchain, and Ether (ETH) is the native asset of the Ethereum blockchain. They are the bedrock upon which their entire ecosystems are built.

The Primary Role of a Coin

Most people's first encounter with coins is as digital money, and that's a perfectly good starting point. One of their main jobs is to act as a medium of exchange or a store of value. You can zap Bitcoin across the globe without needing a bank, or you can hold onto Ether, hoping it appreciates over time.

But that's really just scratching the surface. A coin's role runs much deeper, right down to the technical guts of its blockchain. It's the essential lifeblood that keeps the whole system humming along securely and efficiently.

This direct, inseparable link is the single biggest difference between a token and a coin. A blockchain simply cannot function without its native coin.

Fueling the Network

So, how do coins keep things running? Think of them as the fuel that powers the blockchain engine. This works in a couple of crucial ways.

First, coins are used to reward the people who validate transactions and keep the network secure.

- On a Proof-of-Work system like Bitcoin, miners are paid in new BTC for solving complex math problems and adding blocks to the chain.

- On a Proof-of-Stake system, validators are rewarded with coins for "staking" their own holdings to vouch for the network's integrity.

Second, coins are what you use to pay for transaction fees, which you'll often hear called "gas fees." Anytime you do something on a blockchain—whether it's sending money or interacting with an app—you pay a small fee in the network's native coin. This fee goes to the people who process your transaction, giving them a reason to participate.

A coin is more than just currency; it's a fundamental utility that provides economic incentives to maintain and secure its blockchain. This deep integration ensures the network remains decentralized and functional for everyone using it.

For example, you absolutely need ETH to pay gas fees for any transaction on the Ethereum network. It doesn't matter if you're sending ETH itself or just moving around a token built on Ethereum—you still pay the toll in ETH. This is what truly defines a coin: its foundational, native connection to a single blockchain.

Defining Cryptocurrency Tokens

Alright, let’s pivot to tokens. If coins are the native currency of a blockchain, tokens are the versatile, programmable assets built on top of those blockchains. They don't have their own dedicated network. Instead, they hitch a ride on an existing one, with Ethereum being the undisputed king of host blockchains.

This is a game-changing distinction. Since tokens are built on established infrastructure, they’re worlds easier and faster to create. Developers don't have to go through the monumental task of building and securing a new blockchain from the ground up. They just need to write and deploy a smart contract, which lets them focus on what their application actually does.

More Than Just Money

While coins generally function like digital cash, tokens are designed to represent something else entirely. Think of them as a digital stand-in for a specific asset, a right, or a particular use case within a project’s ecosystem. This programmability opens up a universe of possibilities that simple transactions can't touch.

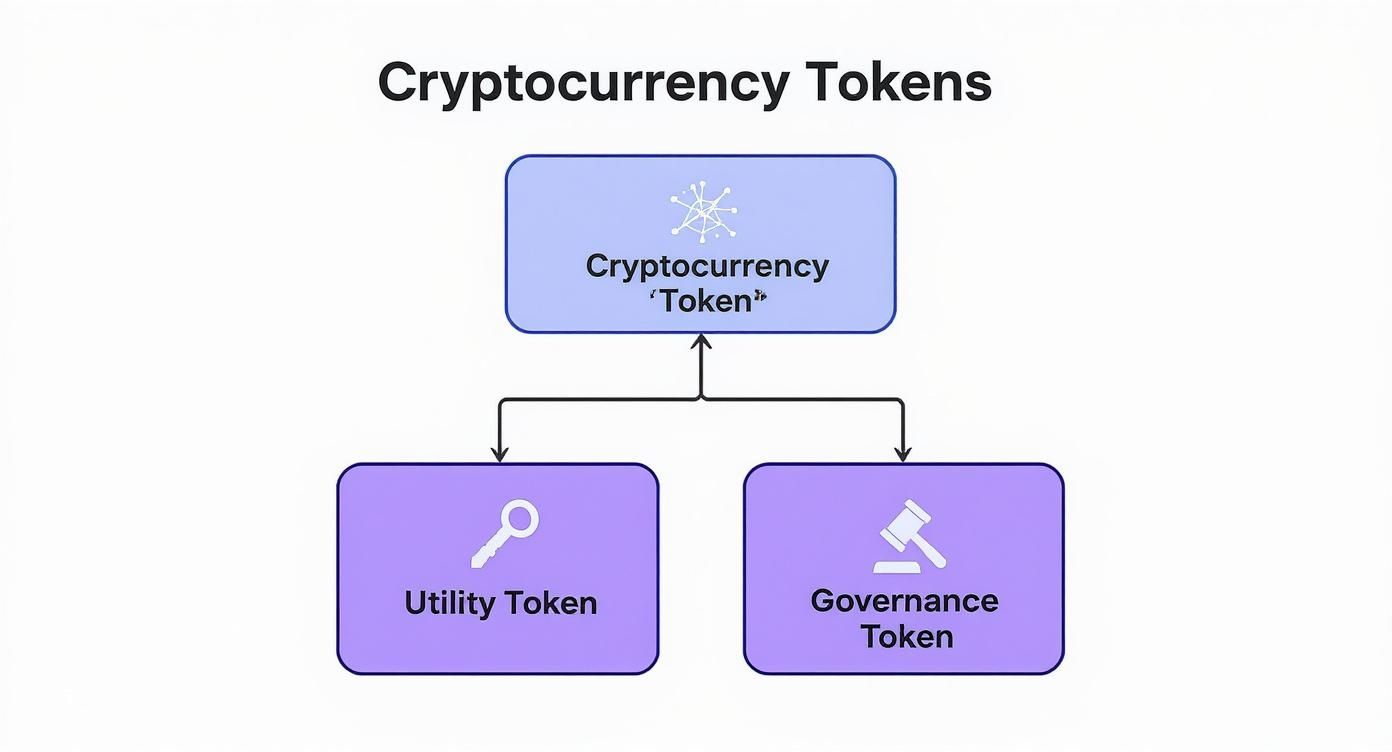

The token's purpose defines its type, and you'll run into a few common categories. Getting these straight is crucial to understanding the true power dynamic in the token coin cryptocurrency world.

- Utility Tokens: These are your digital keys. They grant you access to a specific product or service on a platform. It's like having an arcade token or an API key for a decentralized app.

- Governance Tokens: Holding these gives you a voice. You get voting rights and a say in how a project evolves. This is decentralization in action—handing control over to the community.

- Security Tokens: These are digital versions of traditional financial assets, like a share in a company or a piece of real estate. They fall under securities regulations and represent a legitimate claim of ownership.

- Non-Fungible Tokens (NFTs): Each one of these is unique. NFTs represent ownership of a one-of-a-kind item, whether it's digital art, a rare collectible, or even a ticket to an event.

The core idea behind a token is representation. It's a digital IOU that stands for a specific value or right within a particular ecosystem, all secured by the underlying blockchain it's built upon.

A perfect example is Uniswap’s UNI token. It's a classic governance token. Anyone holding UNI can vote on proposals that shape the future of the decentralized exchange, like changing its fee structure. This perfectly illustrates how a token can empower a community in a way a simple coin just isn't built to do. If you want to go a bit deeper, our guide on what tokens are in cryptocurrency gets into even more detail.

This incredible flexibility is why tokens are the default choice for builders creating everything from DeFi protocols to Web3 games.

Comparing Coins and Tokens Side by Side

To really get to the bottom of the token coin cryptocurrency discussion, we need to go beyond dictionary definitions and look at how they actually work in the real world. Let's put them head-to-head to see what makes them tick, focusing on how they're made, what they're for, and the tech they run on. This will make it obvious why a project chooses one over the other.

Here’s a simple way to think about it: creating a coin is like building an entire city from scratch. You have to lay down all the roads, hook up the power grid, and write the laws—that's the blockchain. On the other hand, creating a token is like opening a new shop in a city that’s already up and running. You just use the existing infrastructure to set up your business, which is way, way easier.

This analogy really drives home the difference in the amount of work and resources involved. One builds the foundation, and the other builds on top of that foundation.

Core Distinctions Unpacked

The biggest, most important difference between a coin and a token is its connection to a blockchain. A coin and its native blockchain are a package deal—the coin is the network's lifeblood. A token, however, is more like a guest on someone else's network, borrowing its security and infrastructure to do a specific job.

This infographic does a great job of showing the hierarchy and how different tokens fit into the bigger picture.

As you can see, utility and governance tokens are specialized assets that operate within the crypto world, but they're fundamentally different from the coins that power the blockchains themselves.

A Head-to-Head Comparison

To make these differences super clear, here’s a quick-reference table that breaks it all down. It’s a handy cheat sheet for understanding the core distinctions that define how these assets operate.

Key Differences Between Coins and Tokens

| Attribute | Cryptocurrency Coin (e.g., BTC, ETH) | Cryptocurrency Token (e.g., UNI, LINK) |

|---|---|---|

| Underlying Technology | Runs on its own independent, native blockchain. | Built on top of an existing blockchain, like Ethereum or Solana. |

| Primary Function | Used as a medium of exchange, store of value, and to pay for network fees (gas). | Represents a specific utility, asset, or voting right within an application. |

| Creation Process | Involves the massive, complex undertaking of building a brand new blockchain. | Created by deploying a smart contract on an existing network—much simpler. |

| Transaction Fees | Paid in the native coin itself (e.g., you pay ETH for Ethereum transactions). | Paid in the host blockchain's native coin (e.g., you pay ETH to move a UNI token). |

This table lays out the technical nuts and bolts, but what’s the big-picture takeaway?

The key insight is simple: a coin is the currency of the network, while a token is the currency for an application on the network. If you remember one thing, make it that.

This single architectural choice shapes everything else. When a project decides to launch its own coin, it's signing up for the monumental task of building and securing a decentralized network. A team launching a token gets to sidestep all that heavy lifting. They can pour all their energy into perfecting their app's user experience and utility, leaving the network security to the blockchain they built on.

Real-World Applications You Can Actually Use

It’s one thing to know the technical jargon separating a token, a coin, and a cryptocurrency. But where the rubber really meets the road is in how these things are used day-to-day. Forget the abstract theory; these digital assets solve real problems and are building entirely new economies from the ground up.

Coins are the workhorses. Built on their own blockchains, they handle the core financial stuff—the secure, decentralized transactions that don't need fancy bells and whistles. Their use cases are straightforward but incredibly powerful.

Then you have tokens, and this is where the possibilities really open up. Because they're programmable and live on top of existing networks, tokens are like digital building blocks for just about anything you can imagine, from complex financial instruments to gaming and digital identity.

Everyday Uses for Coins

Think of coins as the foundation of the crypto world. They're primarily about moving value and keeping the network running. Their simplicity is actually their biggest advantage, enabling a few key things that are a pain to do with old-school finance.

- Painless Cross-Border Payments: Sending money overseas through a bank is a slow, expensive headache. With a coin like Bitcoin or Litecoin, you can send funds directly to anyone, anywhere, in minutes, often for a fraction of the cost of a wire transfer.

- A "Digital Gold" Hedge: For many, coins like Bitcoin are a store of value, much like digital gold. It has a hard cap—only 21 million BTC will ever exist—which makes it an attractive hedge against inflation, especially in countries with shaky local currencies.

- Paying for Gas: This is their most basic, non-negotiable job. Every single thing you do on a blockchain, whether it's a simple transfer or running a complex smart contract, costs a small fee. This "gas fee" is paid in the network's native coin, and without it, the whole system would grind to a halt.

The Expansive World of Tokens

Tokens are where things get creative. They unlock a much wider range of functions that are hyper-specific to an application. This flexibility allows them to represent pretty much any asset or utility, which is what fuels the most innovative corners of Web3.

Gaming is one of the most exciting frontiers. Non-Fungible Tokens (NFTs) are a perfect example—a special kind of token representing ownership of a one-of-a-kind digital item. This means you can truly own your in-game assets, like a legendary sword or a plot of virtual land, and even sell them on an open market. If you're curious about how this works, checking out a free mint NFT is a great way to see how projects bring new people into their ecosystems.

Tokens are essentially digital wrappers for value and function. They allow developers to create intricate economic systems within their applications without the immense overhead of building a new blockchain from scratch.

Decentralized finance (DeFi) is another universe built almost entirely on tokens. Here, tokens can represent a share in a liquidity pool, a collateralized loan, or even voting rights in a decentralized autonomous organization (DAO). They are the lego bricks for building a new, open financial system.

A special class of token, the stablecoin, has become an essential piece of the puzzle. These tokens are pegged to a stable asset, usually the U.S. dollar, to sidestep the wild price swings you see in the broader token coin cryptocurrency market. They're the go-to bridge between traditional finance and crypto.

Stablecoins have exploded in popularity for transactions. At its peak, USDT (Tether) alone was processing $1.01 trillion in a single month—a mind-boggling figure you can explore further on Chainalysis.com. This stability makes them perfect for everything from everyday commerce to being a safe haven for traders.

Choosing the Right Digital Asset For You

Alright, you get the difference between a coin and a token now. But which one should you actually care about? Honestly, the "right" choice has less to do with the tech and everything to do with what you're trying to accomplish. Your focus will be completely different if you're an investor, a developer, or just someone using a decentralized app.

If you're looking at this from an investor's point of view, it's all about risk and strategy. Big, foundational coins like Bitcoin are seen as more established assets—though still volatile, of course. They're a different beast entirely compared to a shiny new utility token from a project that hasn't proven itself yet. Each comes with its own potential for massive gains or painful losses, which is why you have to understand its core purpose before putting money down. A great place to start is learning how to buy decentralized crypto safely.

Context Is Everything for Developers and Users

For a developer, deciding between creating a token coin cryptocurrency is a huge fork in the road. Building a whole new blockchain from scratch for a coin is a monumental task. It takes an incredible amount of resources to get it secure and get people to actually use it. On the other hand, launching a token on a battle-tested network like Ethereum is way faster and cheaper, plus you get to plug into an existing community of users right away.

For the everyday user, the difference is much more straightforward and practical.

- You'll need a coin (like ETH) to pay the "gas" fees for transactions on that blockchain. Think of it as the fuel for the network.

- You'll use a token (like an NFT or a governance token) to do something specific inside an app, like playing a game or voting on a project's future.

This isn't just a niche hobby anymore. A global survey found that nearly one in four people across the US, UK, France, and Singapore own some crypto. That's a clear sign these digital assets are hitting the mainstream. You can dig into the specifics in the 2025 Global State of Crypto Report.

It all boils down to knowing your role. Investors are weighing risk, developers are thinking about infrastructure costs, and users just want the asset that lets them do what they need to do. Each viewpoint requires a totally different lens.

Got Questions? We’ve Got Answers

Diving into the world of tokens, coins, and crypto can feel a bit like learning a new language. Let's clear up some of the most common questions people ask.

Can a token become a coin?

Absolutely. This is actually a popular playbook for new projects.

Many start by launching a token, like an ERC-20 token on Ethereum, to get the ball rolling and build a community. Once their own native blockchain is built and live, they'll do what’s called a "mainnet swap." This process lets everyone trade in their original tokens for the project's brand new native coin.

Is Ether (ETH) a coin or a token?

Ether (ETH) is 100% a coin. It’s the native currency of the Ethereum blockchain, the digital fuel you need to pay for transaction fees (known as "gas") and help keep the whole network running.

On the flip side, all those assets built on top of Ethereum, like SHIB or LINK, are tokens.

Are all cryptocurrencies either coins or tokens?

Pretty much, yes. Think of "cryptocurrency" as the big umbrella term. Everything underneath it is either a coin, with its own dedicated blockchain, or a token, which borrows an existing blockchain to operate. That's the fundamental split.

This isn't just a technical detail—it has real-world implications. It affects everything from how they function to how you manage them. For example, a common question for beginners is how to store Bitcoin securely, a concern that's central to owning any native coin.

Ready to turn community members into active participants? Domino helps you launch reward-based quests in minutes, automating on-chain and off-chain tasks to boost engagement without any code. See how it works at https://domino.run.

Level Up Your dApps

Start using Domino in minutes. Use automations created by the others or build your own.