How to Get Crypto Airdrops A Modern Guide

So, you want to get your hands on some crypto airdrops. The basic idea is to get involved with new blockchain projects before they officially launch their tokens. This means you need to create a digital footprint by doing things like swapping tokens, bridging assets between different networks, or even just playing around on a testnet.

These actions can make you eligible for a distribution of free tokens down the road.

What Are Crypto Airdrops and Are They Worth It?

Let's cut right to it. Crypto airdrops are basically a marketing tactic. New projects give away their native tokens to early users for free. Think of it as a user acquisition budget, but instead of paying for ads, the money goes directly into the wallets of the people who helped test and grow the platform from the ground up.

For the project, this move is a triple-win. It helps spread out token ownership, so a few insiders don't control everything. It also generates a ton of buzz and builds a loyal community right from the start. For you, the appeal is simple: you can get your hands on potentially valuable assets just for trying out new tech.

The Different Flavors of Airdrops

Not all airdrops are the same, and knowing the difference is key to figuring out where to spend your time. They usually fall into a few main buckets.

- Holder Airdrops: These are the easiest. A project simply rewards you for holding a specific crypto (like ETH or SOL) or an NFT in your wallet when they take a "snapshot" of all holders.

- Standard Airdrops: These are pretty straightforward, too. They just ask you to complete simple tasks that don't involve on-chain transactions, like following the project on X or joining their Discord.

- Retroactive Airdrops: Now, these are the big ones. They're the most valuable and the most sought-after. Projects reward users who have already used their protocol in a meaningful way—swapping, providing liquidity, or using a bridge. The massive Uniswap and Arbitrum airdrops are perfect examples of this.

The whole point of a retroactive airdrop is to reward genuine, early users who added value to the network when there was no guarantee of getting anything back. It helps weed out the people just looking for a quick buck.

Why This Is a Skill Worth Learning

So, is all this effort actually worth it? I'd say so. While some airdrops might only be worth a few bucks, others have been completely life-changing. I’m talking five or even six-figure payouts for some early users.

But learning how to get crypto airdrops is about more than just chasing free money. It forces you to become an active participant in the crypto world.

The process teaches you how different protocols tick, how to move between blockchains, and how to spot promising new projects. To get a better handle on the mechanics, you can check out our deep dive into https://domino.run/blog/how-airdrop-works. Ultimately, hunting for airdrops sharpens your crypto skills and puts you right at the edge of what’s coming next in Web3.

Setting Up Your Airdrop Hunting Toolkit

Before you even start looking for airdrops, you've got to get your gear in order. Think of it as setting up your base camp. This isn't just about downloading a random wallet; it's about creating a secure and efficient setup that separates the seasoned pros from the folks who end up getting scammed.

The absolute cornerstone of your toolkit is a dedicated burner wallet. This is a fresh, separate crypto wallet you'll use only for interacting with new, unproven protocols. Seriously, never, ever use your main wallet—the one with your long-term holds—for airdrop hunting. The risk is just way too high.

Your Essential Wallet Setup

Setting up this burner is easy. A browser wallet like MetaMask is pretty much the go-to standard and plays nicely with most Ethereum-based networks. Once you've got it installed, the most important step is to physically write down your seed phrase on paper and hide it somewhere safe. That phrase is everything. Never save it on your computer or share it with anyone.

Next, you’ll need a little bit of "gas money" to get started. This is just the network's native token—like ETH for Ethereum or SOL for Solana—that pays for all your transactions.

- Fund It Lightly: Don't go crazy. Send over just enough to cover transaction fees for a little while. Somewhere in the $50-$100 range is a perfect starting point.

- Top Up As Needed: You can always send more over later if you find yourself getting more active.

This strategy keeps your potential losses to a minimum if you accidentally connect to a shady smart contract. It’s all about risking a little for a potentially massive reward. If you're new to the concept of managing your own keys, getting a solid grip on understanding non-custodial crypto wallets is a crucial first step.

Your burner wallet is basically a firewall. It stands between your real crypto portfolio and the wild west of unaudited new projects. It's the single best safety precaution you can take.

Adding Networks and Keeping Tabs on Your Work

Airdrops aren't just an Ethereum mainnet game. You'll constantly be jumping between different networks like Arbitrum, Optimism, or Polygon. This means you'll need to add them to your MetaMask. We've got a simple guide on how to add a new network to MetaMask that makes it a breeze.

Finally, you need a reliable way to track everything you do. This is where a block explorer becomes your best friend. Tools like Etherscan for Ethereum or Solscan for Solana let you see every transaction you've made right on the public blockchain. You can use it to double-check that your swaps, liquidity deposits, and other actions actually went through. This on-chain history is your resume—it's the proof that airdrop projects look at to decide who qualifies for their tokens.

Alright, let's get into the nitty-gritty of what actually works for getting airdrops. This isn't about luck; it's about playing the game strategically.

Proven Strategies to Become Airdrop Eligible

Forget crossing your fingers and hoping for the best. Securing airdrops comes down to taking specific, intentional actions. Projects are on the lookout for genuine users who are actually kicking the tires on their protocol, not just bots farming for tokens. They figure this out by looking at your wallet's on-chain history right before they take their "snapshot."

Every transaction you make tells a story. Your goal is to build a wallet history that screams "active, curious, and engaged user." This digital footprint is your resume, and it's what gets you noticed.

Master On-Chain Interactions

By far, the most reliable way to get on a project's radar is to use its protocol directly. This goes way beyond just connecting your wallet. You need to perform actions that prove you're using the platform for its intended purpose.

A few core activities have proven time and again to be the most effective:

- Token Swaps: Head to the project's decentralized exchange (DEX) and swap some tokens. And please, don't just swap $1 back and forth. Real users trade different amounts at different times. Mix it up.

- Providing Liquidity: This one's a biggie. Deposit a pair of tokens into a liquidity pool. It’s a huge signal of commitment because you're helping the protocol function, and it shows you get DeFi beyond just simple trades.

- Bridging Assets: If the project has a bridge, use it. Move assets from one blockchain to another, like from Ethereum to Arbitrum. This is a critical test of their infrastructure and a highly valued user action.

Think of it like this: if a project builds a new bridge, they want to reward the first people brave enough to drive across it. Consistent, varied interactions spread out over weeks or even months look far more natural than a mad dash of activity on a single day.

Dive Into Testnets and Governance

While using live protocols is key, some of the best opportunities pop up before a project even hits mainnet. Participating in testnets is a fantastic, low-cost way to get on the list early. You're basically a beta tester, helping the devs find bugs and stress-test their system with "play money" (test tokens).

You don't always have to spend real money to get in on the action. Many of the biggest airdrops rewarded users for activities that didn't cost a dime.

Pro Tip: Don't just blaze through the testnet tasks and disappear. Get active in the project's Discord. Give real feedback in the right channels and report any bugs you find. This social engagement can be just as important as your on-chain activity.

Another smart move that many people overlook is governance. If a project already has a token and a DAO (Decentralized Autonomous Organization), participating can make you eligible for future airdrops from other protocols in that ecosystem. Buy a small bag of the governance token, delegate your voting power, and actually vote on proposals. It signals that you're a long-term, committed community member, not just a tourist.

Common Airdrop Qualification Methods

To help you visualize the most common strategies, I've put together a quick table outlining the key activities that projects look for. This isn't an exhaustive list, but it covers the methods that have historically paid off the most for airdrop hunters.

| Activity | Description | Example Projects |

|---|---|---|

| Testnet Participation | Using a protocol's pre-launch version on a test network to find bugs and provide feedback. | Sui, Aptos |

| Bridging & Swapping | Moving assets between chains and trading on the protocol's native DEX to generate volume. | Arbitrum, Optimism |

| Providing Liquidity | Depositing tokens into liquidity pools to help facilitate trading on the platform. | Uniswap |

| Governance Voting | Holding the project's governance token and actively participating in DAO proposals. | ENS, dYdX |

| Holding NFTs/Tokens | Holding a specific NFT or token in your wallet at the time of a "snapshot." | ApeCoin, LooksRare |

As you can see, the path to qualification often involves more than just one action. The most successful airdrop farmers I know combine several of these strategies to build a robust on-chain history that's impossible to ignore. For a deeper dive into these methods, check out this excellent guide to crypto airdrops.

Alright, let's talk about the real legwork: finding and vetting airdrop opportunities without getting scammed.

Knowing the strategies to qualify is one thing, but finding legit projects before the rest of the world catches on is a totally different game. The crypto space is incredibly noisy, and learning to tell the difference between a golden opportunity and a wallet-draining scam is probably the most important skill you can develop.

Sourcing Potential Airdrops

You can't manually sift through thousands of new projects. It’s just not possible. Your best bet is to lean on smart aggregators and curated lists to do the heavy lifting for you.

DeFiLlama is an absolute powerhouse for this. They have a specific "Airdrops" tab that lists protocols that don’t have a token yet. This is a massive telltale sign that an airdrop might be in the pipeline. It’s one of the first places I check.

You can also poke around dedicated airdrop-tracking websites. Honestly, many of them are spammy, but a few reputable ones do a decent job filtering out the obvious junk. Just treat their listings as a starting point—a lead—not a final verdict. You still have to do your own homework.

Putting on Your Detective Hat: How to Spot Red Flags

Once you’ve got a promising project on your radar, it's time to get critical. This is where you separate the real deals from the rugs. Rushing in blind is the fastest way to get your wallet drained.

First things first, dig into the team behind the curtain.

- Who are these people? Look for a public-facing team with real identities you can verify on LinkedIn or X. If the team is anonymous or "doxxed to a third party," that's a huge red flag for me.

- Have they built anything before? A team with a proven track record is always a safer bet than a group of total newcomers.

- Who’s funding them? Check if they've raised capital from well-known venture capital firms. I'm talking about names like a16z, Paradigm, or Dragonfly. These big VCs do their own extensive due diligence, which acts as a powerful signal of legitimacy.

I cannot stress this enough: Never, ever connect your wallet to a project without doing this basic background check. A slick website means absolutely nothing if the team is a ghost. This one habit will save you from 99% of potential scams.

When you're digging around, it's also vital to look at the project's foundation. Most airdrops are designed to build a new community from the ground up, so understanding a project's ecosystem is non-negotiable.

Gauging the Vibe: Community and Fundamentals

Beyond the team, you need to get a feel for the community and the core idea of the project itself. A lively, engaged community is a fantastic sign.

Pop into their Discord. Is it filled with genuine discussion and questions, or is it just a wall of people spamming "wen airdrop?" The difference is night and day.

Then, check their official X account. Who follows them? Are they followed by other respected people in the crypto world? Are they posting regular, meaningful updates on their development? This shows a healthy, active project. This exact kind of engagement was a key tell for the massive Arbitrum airdrop, where an insane 42 million ARB tokens were claimed in the first hour. That's what a strong, early community can do.

Finally, just ask yourself the simple question: does this project actually solve a real problem? Or is it just another fork of something that already exists? In my experience, the most valuable airdrops come from truly innovative projects that bring something new and useful to the table. If you can't easily explain what the project does and why anyone would care, it's probably best to move on.

Claiming Your Tokens and Your Post-Airdrop Game Plan

Alright, you put in the time and qualified for an airdrop. Nicely done. But now comes the part where a single slip-up can wipe out all that effort. Claiming your tokens safely requires your full attention.

The second an airdrop goes live, scammers go into a frenzy. They bombard social media with fake claim links, hoping you'll click one and unknowingly sign a transaction that drains your wallet. Your first and most important task is to find the one official link. Go directly to the project's verified X (formerly Twitter) profile or their official Discord announcements. Don't click anything else. Seriously.

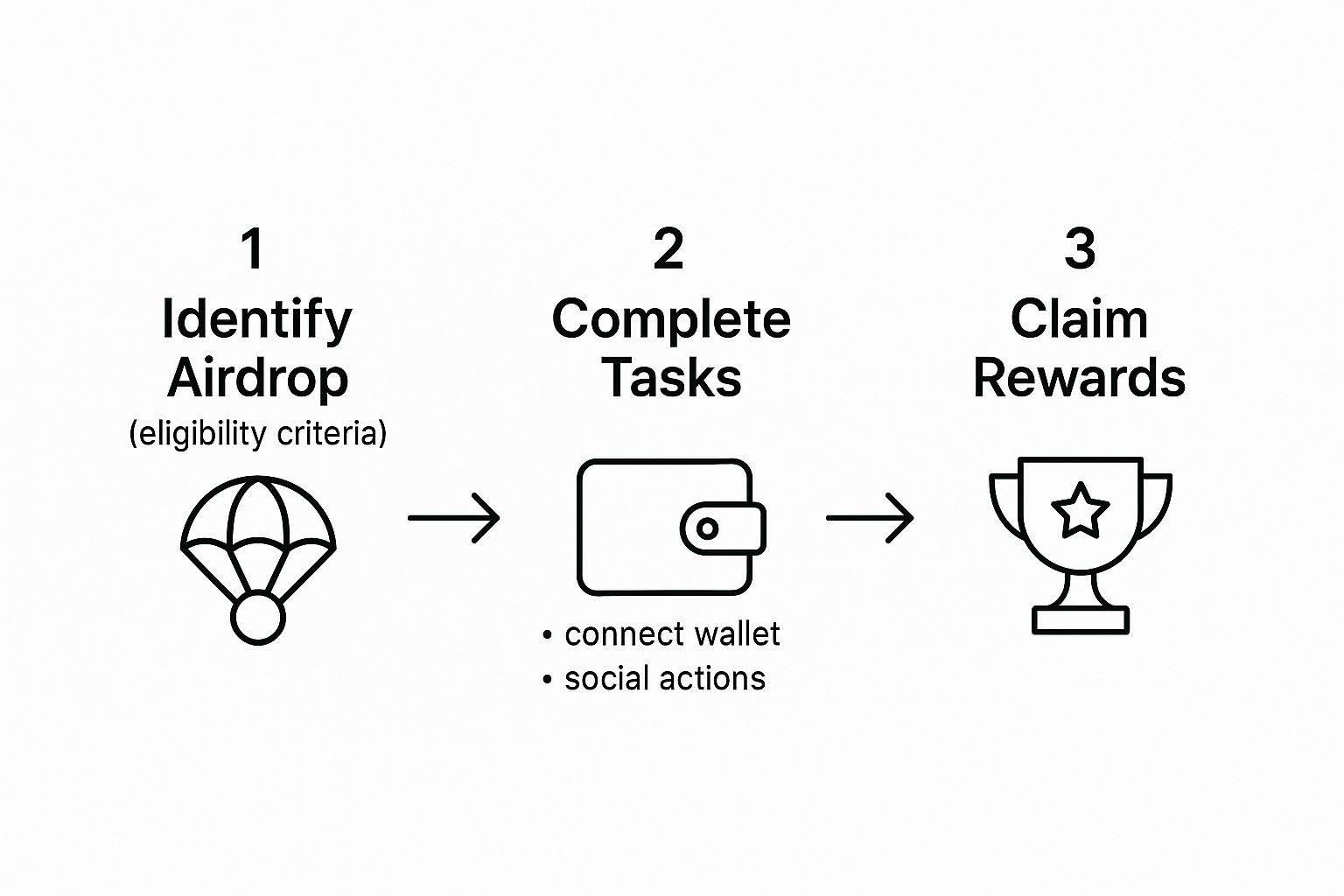

The Claiming Process Unpacked

Once you've got the legitimate link, the process itself is usually pretty simple, but stay sharp. You'll connect the wallet you used for the qualifying activities, and the site will typically show how many tokens you're eligible for. From there, you'll need to sign a transaction to approve the claim, which always involves a small gas fee.

- Triple-Check the URL: I can't stress this enough. Before you even think about connecting your wallet, inspect the URL character by character. Scammers are clever and will use domains that look nearly identical to the real one.

- Use a Revoke Tool: After you've successfully claimed your tokens, make it a habit to head over to a tool like Revoke.cash. It lets you disconnect the site's access to your wallet, adding a crucial layer of security that only takes a few seconds.

This whole journey, from finding the opportunity to finally getting your tokens, is a deliberate process. It's not about luck; it's about being actively involved.

As the visual above shows, there are distinct phases to this game, and each one requires you to be on the ball.

Crafting Your Post-Claim Strategy

Okay, so the tokens are finally sitting in your wallet. Pop the champagne, but don't check out just yet. What you do next is just as critical as the hunt itself. The last thing you want is to let the excitement of the moment lead to a bad decision. Have a plan.

The worst thing you can do is have no plan at all. Airdropped tokens are notoriously volatile in the first few hours and days. A clear strategy is your best defense against making a panicked move you'll regret.

Generally, you've got three main options on the table:

- Sell Immediately: Lock in those profits. A very common—and often smart—strategy is to sell a portion, maybe 25-50%, right away. This covers your gas fees and ensures you walk away with something tangible, leaving the rest to ride.

- Hold for the Long Term: If you've done your homework and truly believe this project has legs, holding could be the play. This isn't just about hoping for a moonshot; it requires real conviction in the project's long-term vision.

- Stake or Provide Liquidity: Some projects will immediately offer ways to put your new tokens to work. You might be able to stake them for rewards or use them to provide liquidity on a decentralized exchange. This not only earns you yield but can also be a savvy way to qualify for future airdrops within that same ecosystem.

We're seeing projects get really creative here. Berachain, for instance, airdropped millions of BERA tokens to users who engaged with their testnet and held specific NFTs. Kaito AI rewarded its earliest platform adopters. These examples show it's not just about one-off transactions anymore; it's about rewarding genuine, varied engagement. While plenty of people cash out, many stick around, proving that airdrops are becoming a powerful tool for both marketing and building a base of long-term believers. You can dig deeper into these evolving strategies and https://domino.run/blog/how-to-share-in-airdrop to see how you can position yourself for what's next.

Your Top Airdrop Questions, Answered

Jumping into the world of crypto airdrops can feel like walking into a foreign country. You'll hear a lot of new terms and face a bit of a learning curve. Let's break down some of the most common questions I get asked to clear things up and help you get started on the right foot.

Are Airdrops Actually Free Money?

Not really, and thinking of them that way can be a trap. While you aren't swiping your credit card for these tokens, they absolutely require an investment. You're investing your time, sometimes a lot of it, and you're spending your own crypto on gas fees for every single transaction.

Think of it less like a free handout and more like getting paid to be a product's first user. Projects are looking for real people to test their networks, provide liquidity, and build an initial community. They want users who will actually stick around, not just people looking to cash out instantly. The work you put in is what you're really getting paid for.

Okay, So How Much Can I Realistically Make?

This is the million-dollar question, isn't it? The honest answer is that there's no set number, and you should be wary of anyone who promises you a specific return. The potential payouts are all over the place.

We've all heard the stories of legendary airdrops like Arbitrum or Uniswap, which dropped five or even six-figure sums into the wallets of early, active users. But for every big winner, there are dozens of others that barely cover the gas fees you spent chasing them. It's a game of high variance.

What you end up with really depends on:

- The Project's Success: Does it actually take off and build a valuable ecosystem?

- The Market Vibe: A raging bull market can turn a small airdrop into a huge win, while a bear market can make even a large allocation feel worthless.

- Your Personal Allocation: How many tokens you get is often tied to how much you used the protocol. More volume and more consistent activity usually lead to a bigger reward.

My advice? Treat airdrops as a potentially high-reward bonus for exploring new crypto tech you're genuinely interested in. Don't bank on it as a steady paycheck.

What’s the #1 Way to Avoid Getting Scammed?

This one is crystal clear and has zero exceptions: Never, ever, under any circumstances, share your wallet's seed phrase or private keys. A real project will never ask you for this. Full stop.

Get into the habit of being incredibly suspicious. Ignore unsolicited DMs on X or Discord, delete surprise "You've Won!" emails, and treat random tokens appearing in your wallet as toxic. They are almost always bait for a phishing attack.

The golden rule for staying safe is to only trust information from a project's official, verified channels. I always triple-check that I'm on the correct website or their real X (formerly Twitter) profile before connecting my wallet or clicking a claim link. The single smartest thing you can do is use a completely separate "burner" wallet for all your airdrop activities. It's your best line of defense.

Ready to scale your community and reward engagement without the manual grind? Domino is your no-code toolkit for launching powerful, automated quest campaigns in minutes. Join the top Web3 teams who have powered over 25 million completed quests and see how you can drive real growth. Design your first campaign today.