What Are Crypto Tokens? Your Simple Explainer Guide

So, what exactly is a crypto token?

Think of it this way: tokens are like digital vouchers or loyalty points that exist on someone else's blockchain. They hold value or give you access to something specific within a project, but they don't run on their own independent network. They're guests, not the homeowners.

Breaking Down Crypto Tokens

If you're just dipping your toes into crypto, you've probably heard "coin" and "token" thrown around like they're the same thing. They're not. There's a really important difference between them.

A crypto coin, like Bitcoin or Ether, is the native currency of its own dedicated blockchain. It's the lifeblood of that network, used for everything from paying transaction fees (gas fees on Ethereum) to rewarding the people who keep the network secure.

A crypto token, on the other hand, is built on top of a blockchain that already exists. Most tokens you'll come across are built on the Ethereum network. This allows developers to tap into Ethereum's robust security and infrastructure without the massive headache of building an entire blockchain from the ground up.

The Key Difference Simplified

Let’s get to the heart of it. Picture a sprawling city (that's the blockchain) with its own official currency, like the US Dollar (that's the coin).

Now, imagine a business inside that city—say, a local arcade—issues its own arcade tokens. Those tokens have a specific use and value inside the arcade, but you can't use them to buy groceries down the street. That's a crypto token. It functions within a specific system and relies on the city's underlying economy to exist.

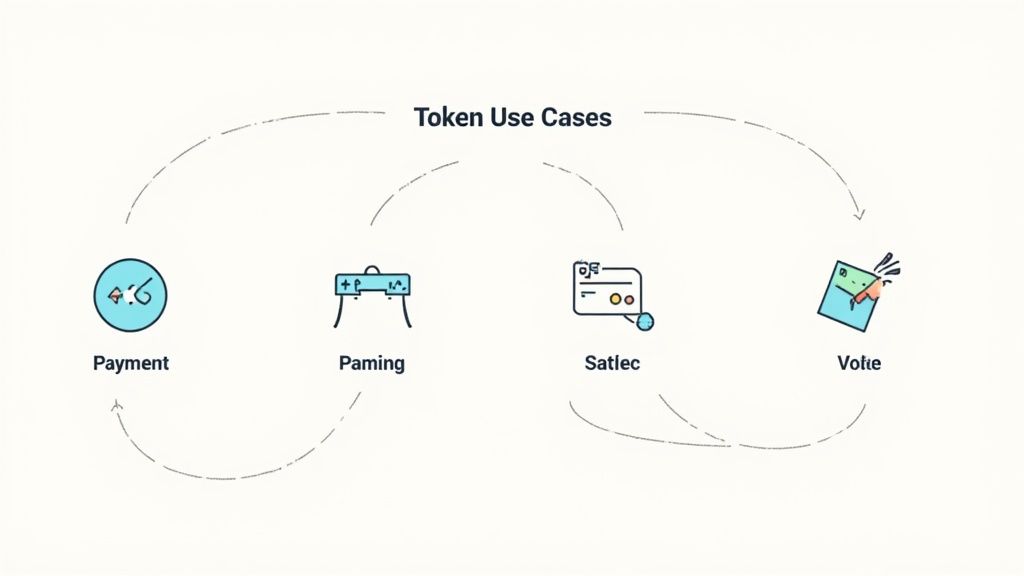

Crypto tokens are a game-changer because they can represent just about anything: a share in a new company, a vote on a project's future, or even a one-of-a-kind piece of digital art. This flexibility is what's really pushing the boundaries in the Web3 world.

This adaptability has kicked off a massive wave of new projects and investment avenues. In fact, the broader crypto market was valued at around USD 2.87 billion and is expected to nearly double, a sign of just how much interest is pouring in. For a deeper dive, you can check out the full research on this market growth on ResearchAndMarkets.com.

Crypto Tokens vs Crypto Coins at a Glance

To really hammer home the difference, let’s put them side-by-side. This quick comparison table breaks down the fundamental distinctions between tokens and coins, clarifying their unique roles.

| Feature | Crypto Coins (e.g. Bitcoin) | Crypto Tokens (e.g. UNI) |

|---|---|---|

| Blockchain | Have their own native blockchain. | Built on top of an existing blockchain like Ethereum. |

| Primary Use | Used as money—a store of value or medium of exchange. | Represents a specific utility, asset, or voting power. |

| Creation | Requires complex mining or staking to create new ones. | Can be created pretty easily using smart contracts. |

| Analogy | A country's official currency (USD, EUR). | A company's gift card or loyalty points. |

Understanding this simple but critical distinction is the first step. Coins are the foundation, the native money of a blockchain. Tokens are the creative, flexible assets built on top of that foundation, unlocking all sorts of new possibilities.

How Crypto Tokens Actually Work (The Simple Version)

So, how does a new digital asset just pop into existence on an existing blockchain? The secret sauce is something called a smart contract.

Don't let the name intimidate you. A smart contract is just a program that lives on the blockchain. It's built to automatically execute certain actions when specific conditions are met, all without anyone needing to lift a finger.

Think of it like a really smart vending machine. You put in your money (a transaction), pick your snack (the desired action), and the machine automatically drops it for you (the outcome). There's no need for a cashier because the rules are all built right into the machine's code. This is exactly how tokens are minted and managed without a bank or any other middleman getting in the way.

Why a Shared Blueprint Matters

To keep things from turning into the Wild West, developers realized they needed a common set of rules for how these new tokens should behave. This led to the creation of token standards—basically, shared blueprints that make sure different tokens can play nicely together on the same network.

The most famous of these blueprints is Ethereum’s ERC-20 standard. It’s the foundational template for the overwhelming majority of tokens you'll run into.

A token standard like ERC-20 is the USB-C of the crypto world. It ensures that any ERC-20 token will plug into any wallet or exchange that supports the standard, creating a universal, plug-and-play system. This simple but powerful idea made it ridiculously easy for developers to build new things.

This standardization is the whole reason you can hold dozens of different tokens in a single Ethereum wallet like MetaMask. Without these shared rules, every single token would need its own custom wallet, which would be an absolute nightmare for everyone involved.

The Ground Rules Set by Token Standards

Token standards lay out a basic set of functions that every token of that type must have. This consistency is their superpower. For an ERC-20 token, the blueprint includes rules for things like:

- Total Supply: How many tokens can ever exist? This sets a hard cap.

- Balance: A simple function to check the token balance of any wallet address.

- Transfer: The core function that lets you send tokens from your wallet to someone else's.

- Approve & TransferFrom: These functions are key for decentralized finance (DeFi). They let you give another person or app permission to spend a certain amount of your tokens, which is how decentralized exchanges work their magic.

Because all ERC-20 tokens follow the same rulebook, any application—from a wallet to a lending platform—knows exactly how to interact with them. This predictability has been a massive driver of innovation in DeFi, where countless different tokens need to "talk" to each other all the time. It creates a reliable and stable foundation for building new financial tools.

Not all crypto tokens are created equal. Just like a mechanic has a whole toolbox for different jobs, the crypto world has different types of tokens, each designed for a specific purpose. Getting a handle on these categories is the key to understanding how blockchain technology goes way beyond just digital cash.

Let's dive into the main types you'll run into.

Utility Tokens: The Keys to the Kingdom

Think of a utility token like a ticket to a concert or a token for an arcade game. Its main job is to give you access to a specific product or service on a blockchain network. They aren't really meant to be investments; their value comes from what they let you do.

For instance, a decentralized cloud storage platform might require you to pay for storage space using its own native utility token. These tokens act as the internal economy, fueling the network by letting users pay for services and rewarding those who provide them. Simple as that.

Governance Tokens: A Voice in the Project

Next, we have governance tokens. If a utility token is your entry ticket, a governance token is your seat on the decision-making council. Holding these tokens gives you the power to vote on proposals that steer the future of a project.

This is the bedrock of Decentralized Autonomous Organizations (DAOs), where the community calls the shots instead of a single CEO. Holders might vote on things like:

- Which new features to build next.

- How to spend funds from the community treasury.

- Tweaking system rules, like transaction fees or rewards.

This model puts the power right back into the hands of the people who actually use and support the project. If you're looking to get a deeper understanding of how these structures fit into the broader crypto world, events like the Beyond Bitcoin conference are fantastic for exploring these evolving ideas.

Security Tokens: Bridging to Real-World Assets

Security tokens are a different beast altogether. They are digital, blockchain-based representations of ownership in a real-world asset. Because they function like traditional investments—where you expect a profit—they fall under strict financial regulations.

Think about it: you can take a fraction of a skyscraper, a share of a private company, or even a piece of fine art and turn its ownership into a token. This process, often called tokenization, opens up a world of possibilities. It makes it easier to trade and own small pieces of valuable assets that were once out of reach for most people.

This explosion of different token types is a huge reason the crypto market has grown so massively. The total market cap, driven by this incredible variety, recently soared to a record high of USD 3.2 trillion, all thanks to new and expanding uses in decentralized finance and beyond.

Non-Fungible Tokens (NFTs): One of a Kind

Finally, let's talk about Non-Fungible Tokens (NFTs). The tokens we’ve covered so far are "fungible." That means one is the same as another, just like one dollar bill is interchangeable with any other dollar bill.

NFTs are the complete opposite. Each one is totally unique and can't be replaced by another.

An NFT is basically a digital certificate of ownership and authenticity for a specific item, whether that’s a piece of digital art, a rare collectible, or a special sword in a video game. They use the power of the blockchain to prove who owns what, creating a permanent and verifiable record that has completely shaken up the world of digital art and collectibles.

Real-World Examples of Crypto Tokens in Action

All the theory is great, but things really start to click when you see how crypto tokens are being used out in the wild. These aren't just speculative assets traded on exchanges; they're functional tools already solving real problems and opening up new doors in a surprising number of industries.

Let's get out of the weeds of technical definitions and look at some tangible examples of tokens you can actually interact with today. These use cases really highlight just how versatile a simple token can be.

Powering Decentralized Services with Utility Tokens

Imagine a cloud storage service, but instead of being run by Google or Amazon, it’s powered by a global network of people renting out their spare hard drive space. How would that even work? How would you pay for it?

This is the perfect job for a utility token.

A project like Filecoin does exactly this, using its native token, FIL, as the fuel for its entire ecosystem.

- Users pay with FIL to store their files securely across the network.

- Storage providers earn FIL for contributing their disk space and keeping files safe.

This setup creates a totally self-sustaining economy without a single company calling the shots. The token isn't just something to buy and hold; it's the essential gear that makes the whole machine run, granting users access to the service.

The Big Idea: Utility tokens are like digital keys or in-app credits. Their value comes from what they let you do inside a specific platform—whether that’s paying for a service, unlocking features, or participating in the network.

Shaping the Future with Governance Tokens

Decentralized Finance (DeFi) platforms often manage billions of dollars in assets. With that much at stake, who gets to decide how they're run? This is where governance tokens step in, giving the community a direct say in what happens next.

Take Uniswap, a massive decentralized exchange. It uses its UNI token to put power directly into the hands of its users. If you hold UNI, you get voting rights on important proposals that guide the platform's future. Token holders can weigh in on everything from changing trading fees to deciding how to spend money from the community treasury.

This model flips the script, turning users from passive customers into active stakeholders. It’s a bit like being a shareholder with a direct vote on the company’s roadmap, except everything is managed transparently on the blockchain for everyone to see.

Proving Ownership with NFTs

Finally, let's talk about Non-Fungible Tokens (NFTs). While they got famous for digital art, their real superpower is providing undeniable, rock-solid proof of ownership for any unique item, digital or otherwise.

An artist can "mint" their digital painting as an NFT. This creates a permanent, unchangeable record on the blockchain that proves it’s the original and tracks every time it changes hands. For art collectors, this is a massive breakthrough, solving the age-old problem of proving where a piece came from (its provenance).

Artists get a great deal, too. They can build a smart contract right into the NFT that automatically gives them a cut of every future sale. This same technology is now popping up for everything from concert tickets and unique in-game items to virtual real estate and even physical property deeds.

The Future of Ownership Is Tokenization

Crypto tokens are more than just digital keys or voting slips. Their real game-changing potential lies in completely rethinking what it means to own something. This is all happening through a powerful idea called tokenization—the process of turning the rights to an asset into a digital token on a blockchain.

Think about it this way: what if you could own a tiny, tradeable slice of a skyscraper in New York? Or a small piece of a Picasso painting? For most of history, investing in assets like these has been a club for the ultra-rich. Tokenization is kicking the door wide open.

By breaking down ownership into smaller, more affordable digital chunks, anyone can get in on the action. Suddenly, it’s possible to invest, trade, and build a portfolio with assets that were once completely off-limits.

How Tokenization Could Change Everything

This ability to divide and trade ownership of just about anything has some seriously huge implications. It’s not just theory; it’s starting to reshape entire industries.

- Real Estate: Forget saving for a massive down payment. You could buy tokens representing a small share of a rental property and start earning passive income from the rent.

- Art and Collectibles: An artist could sell fractional ownership of their latest masterpiece. This lets more people support their work and have a stake in its success, while the artist can still hold onto a portion.

- Startup Funding: New companies could issue tokens that represent equity, giving a global community of supporters the chance to invest small amounts easily and get in on the ground floor.

And this isn't just about physical stuff. Tokens are the Lego bricks for the next version of the internet, what people are calling Web3. In these new digital worlds and the metaverse, tokens will be everything from your digital identity to the deed for your virtual land or the access pass to an exclusive online club.

It's worth remembering that while thousands of crypto tokens are out there, the market is still very top-heavy. Bitcoin and Ethereum still make up about 75% of the entire crypto market cap, and a lot of the other tokens are pure speculation. You can dive deeper into the numbers with these crypto market distribution statistics.

That concentration just goes to show that even though the potential for tokenization is massive, we're still in the early innings. But the core idea is simple and powerful: tokens have the chance to make ownership more democratic, transparent, and accessible for everyone, fundamentally changing how we interact with both our physical and digital worlds.

Burning Questions About Crypto Tokens

Alright, let's dive into some of the questions that always pop up when people are first getting their heads around crypto tokens. I'll give you straight, simple answers to help clear the fog.

Are All Crypto Tokens a Good Investment?

Definitely not. A token's value is almost always tied to how useful and successful its project is. While some tokens have gone to the moon, many others are pure speculation or just fizzle out.

It's so important to do your homework. Look into the project's goal, the team behind it, and its "tokenomics"—the economic system that makes the token tick—before even thinking about putting money in. And always, always remember that the crypto world is a high-risk playground.

Here's the thing to remember: a token isn't a stock. Its value is based on what you can do with it or the rights it gives you in its ecosystem. That's a completely different game than traditional company shares.

Can I Create My Own Crypto Token?

Technically, yes. Blockchains like Ethereum have basically created fill-in-the-blank templates for tokens. The famous ERC-20 standard, for example, makes the coding part surprisingly simple for anyone with a bit of development know-how.

But here's the catch: launching the token is the easy part. The real work is building a worthwhile project around it. You have to give the token a real purpose, build a community that actually wants to use it, and create genuine demand. Without that, it’s just code.

Do I Need a Special Wallet for Tokens?

You bet. You'll need a crypto wallet that can handle the specific blockchain the token lives on.

For example, the huge number of tokens built on Ethereum all need an Ethereum-compatible wallet like MetaMask or Trust Wallet. Just make sure you double-check that your wallet supports the token's standard before you try sending anything to it. It’s a simple step that can save you a lot of headaches.

Ready to drive real engagement for your Web3 project? Domino is a no-code toolkit that lets you launch reward-based quests in minutes, integrating on-chain and off-chain tasks to supercharge user acquisition. See how leading teams have powered over 25 million quests by visiting the Domino website.