A Guide to Staking as a Service

Ever felt like you're missing out on crypto rewards because the whole process seems way too complicated? You hear terms like "validator nodes" and "slashing penalties" and your eyes just glaze over. If that sounds familiar, you're not alone. This is exactly where staking as a service (SaaS) comes in.

Your Simple Entry into Crypto Staking

At its core, staking as a service is a simple solution that lets you earn crypto rewards without having to become a blockchain engineer overnight. Think of it like hiring a professional to manage a rental property; you provide the asset (your crypto), and they handle all the headaches for a small cut of the profits.

Instead of wrestling with setting up and maintaining your own complex validator node—which demands serious tech skills, 24/7 monitoring, and usually a hefty investment—you just hand over your digital assets to a provider you trust.

Analogy: Imagine you own a high-performance race car but have no idea how to handle it on a professional track. With SaaS, you're basically lending your car to a professional racing team. They take care of the driving, the pit stops, and the strategy. When they win, you both share the prize money, but you never lose ownership of your car.

This hands-off approach opens up staking rewards to pretty much anyone, no matter how tech-savvy you are. The service provider pools crypto from lots of users, runs all the necessary hardware and software, and makes sure everything is running perfectly around the clock.

This model comes with some pretty sweet perks:

- Lower Barrier to Entry: You don't need a huge bag of crypto to get started. Many services let you stake with much smaller amounts than what’s required to run your own validator.

- No Technical Headaches: Forget about software updates, server maintenance, or worrying about your internet connection. The provider handles all of that.

- Expert Management: You've got pros managing the whole operation, which drastically cuts down the risk of making costly mistakes (like getting hit with slashing penalties that can cost you your staked funds).

Ultimately, staking as a service takes a complicated technical job and turns it into a simple, accessible way to put your crypto to work. It’s quickly become the go-to option for anyone looking to grow their holdings while helping secure the blockchain networks they believe in.

How Staking as a Service Really Works

So, what's actually happening behind the curtain when you use a staking service? It’s a lot less complicated than you might think.

At its core, you’re basically lending your voting power—not your actual crypto—to a professional operator running a validator node.

Think of a validator node like a super-dedicated bouncer for the blockchain. It's a computer that's always on, working 24/7 to confirm transactions and keep the whole network safe and sound. These nodes are the backbone of the network, and they get rewarded for doing their job well.

When you "delegate" your assets, you’re telling the network, "Hey, I trust this operator to do the work on my behalf." In return, you get a slice of the rewards they earn for their efforts. The best part? Your crypto never actually leaves the safety of your own wallet.

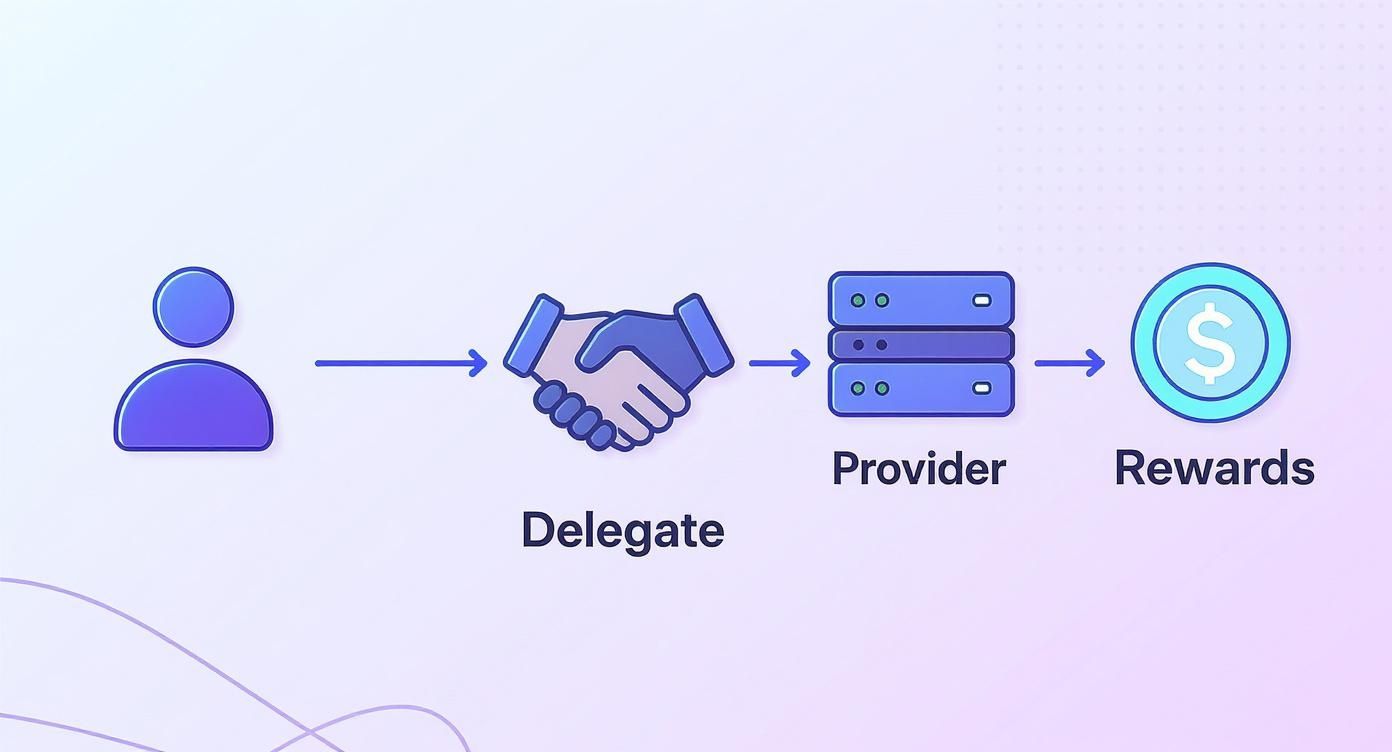

This little diagram breaks down the journey from delegating your assets to getting those sweet, sweet rewards.

As you can see, you stay in control, the provider handles all the technical headaches, and the rewards flow right back to you. It's a clean, simple cycle.

The Nitty-Gritty of Operations

Once you commit your crypto, the service provider takes over all the technical heavy lifting. Their main job is to make sure their validator nodes have nearly 100% uptime and are following every single network rule to the letter.

Why is this so important? Because any slip-ups, like downtime or mistakes, can lead to a nasty penalty called "slashing." That’s when the network actually destroys a portion of the staked crypto as a punishment. This is probably the single biggest risk that a professional staking service helps you dodge.

Staking has become a backbone of the digital asset economy, proving to be a critical infrastructure element beyond just a yield-generating activity.

For all this hard work, providers usually take a small cut of the staking rewards. This fee covers their costs for powerful hardware, tight security, and the expert team needed to keep the nodes humming along perfectly.

This setup aligns everyone's interests. Their success is directly tied to yours—if their nodes perform poorly and get slashed, their revenue takes a hit, too. It’s a win-win that provides a reliable source of yield for anyone helping to secure the network. To give you an idea, over a recent 180-day period, the Ethereum staking reward rate averaged 2.98%. For a deeper dive into the numbers, Grayscale's research on staking economics is a great read.

Platforms like Domino make it incredibly simple to weave these kinds of reward systems right into your community campaigns. You can explore a variety of Web3 apps that you can build with no-code tools to get your users involved and excited.

Why Use a Staking Provider Instead of Going Solo?

So you've decided to stake your crypto. That's the easy part. The big question now is how you're going to do it: fly solo or team up with a staking as a service provider? While going it alone gives you total control, it's a path filled with technical hurdles and steep requirements. Honestly, for most people, using a provider is just the smarter, safer, and easier way to go.

It’s a bit like deciding to build your own custom car. Sure, you could source every single part, learn the mechanics, and spend your weekends covered in grease. Or, you could buy a professionally engineered car that’s ready to drive off the lot. Both will get you from A to B, but one option is way less likely to end in a costly breakdown.

Lowering the Barrier to Entry

Let's get real—the biggest roadblock for most would-be solo stakers is the cash. If you want to run a solo validator on Ethereum, for example, you need a cool 32 ETH. That's a huge upfront investment that puts staking out of reach for a ton of people.

Staking services completely flip this script. They work by pooling together funds from lots of different users. This means you can jump in with a much smaller amount of crypto, opening up staking rewards to just about everyone, not just the whales.

This pooling model is a game-changer. It makes network participation democratic, letting smaller holders help secure the blockchain and earn rewards that used to be reserved for the big fish.

On top of the capital, solo staking is a serious technical commitment. You’re responsible for setting up and maintaining a dedicated machine, making sure it’s always online, and keeping all the software perfectly updated. One slip-up, and you could face penalties. A staking as a service provider handles all that messy stuff for you, managing the entire backend so you don't have to.

Professional Management and Risk Reduction

Running a validator isn't a "set it and forget it" kind of thing—it’s a 24/7 gig where mistakes can literally cost you money. If your node goes offline or messes up a validation, the network can penalize you through "slashing," which means a portion of your staked crypto gets destroyed. Poof. Gone.

This is where the pros come in. Professional providers run on top-tier, enterprise-grade hardware with all the bells and whistles, like backup systems, to ensure their nodes are always up and running. Their teams live and breathe this stuff; they're experts in network security and are constantly on the lookout for threats. This level of professional oversight massively reduces your risk of getting slashed and helps you earn the best possible returns.

Let’s break it down with a simple comparison.

Solo Staking vs Staking as a Service

This table gives you a quick side-by-side look at what you’re signing up for with each approach.

| Feature | Solo Staking | Staking as a Service |

|---|---|---|

| Minimum Capital | High (e.g., 32 ETH) | Low (often no minimum) |

| Technical Skill | Expert level required | None required |

| Time Commitment | High (24/7 monitoring) | Minimal (set and forget) |

| Slashing Risk | Full responsibility | Mitigated by provider |

| Rewards | 100% of rewards | Rewards minus a small fee |

Ultimately, while you keep 100% of the rewards when you stake solo, you also take on 100% of the risk, cost, and headaches. For a small fee, a service provider takes all of that off your plate.

How to Choose the Right Staking Platform

Let's be real: not all staking providers are built the same. Picking the right platform is the single most important decision you'll make to keep your crypto safe and your returns healthy. You wouldn't just walk into any random bank, right? The same logic applies here—do your homework.

First up, dig into the provider's historical performance and uptime. You need a validator that's always on, always working, and always earning rewards. If a provider has a shaky track record, they're a prime candidate for slashing penalties, which hits you directly in the wallet. Good services are transparent and show you their performance metrics right on their site.

Evaluating Security and Fees

Next, you need to look at security and how transparent they are about it. A solid staking as a service provider won't hide their security protocols. They’ll be open about things like slashing insurance and infrastructure audits.

While you're at it, check out their fee structure. Are the fees laid out clearly, or do you need a magnifying glass to find them in the fine print? It’s a good idea to explore different pricing models to get a feel for what’s standard and what’s a rip-off.

Don’t forget about community trust. What are people saying on X or Reddit? A good reputation backed by real user experiences is one of the best signs you’ve found a winner.

By 2025, the industry has matured significantly. Over $28 billion in assets managed by staking services are now protected by insurance and robust anti-slashing features, highlighting the growing emphasis on security.

Staking pools now attract about 38% of all retail stakers, which tells you people are looking for easy, low-cost ways to get involved. For a deeper dive, you can explore recent cryptocurrency staking statistics. Picking a platform that's already focused on top-notch security is just plain smart for protecting your assets in the long run.

Navigating the Risks of Staking Services

While staking as a service sounds like an easy way to earn crypto rewards, it’s definitely not a magic money tree. Let's be real—handing over control of your assets comes with some trade-offs and potential downsides you absolutely need to know about before you jump in.

The biggest one? Counterparty risk. You're putting a massive amount of trust in another company to manage your crypto responsibly. If that provider gets hacked, messes up their technical setup, or even goes belly up, your staked funds could be in serious trouble, especially if you're using a custodial service.

Understanding Key Vulnerabilities

Another huge thing to watch out for is smart contract vulnerabilities. The code behind these staking protocols is incredibly complex, and where there's code, there can be bugs. Hackers are always on the lookout for exploits. One way to get some peace of mind is to check if the platform has been audited. There are plenty of smart contract audit tools out there that help sniff out these kinds of flaws.

Then there's the creeping issue of centralization. When a handful of big-name providers hold a massive chunk of a network's staked tokens, it starts to undermine the whole point of decentralization. This concentration of power isn't just a philosophical problem—it could give these players an outsized influence over the network's future.

Finally, let’s bust a couple of common myths flying around:

- "Guaranteed Returns" is a fantasy. Staking rewards are never set in stone. The APY you see can (and will) change based on how busy the network is and how well the validators are performing.

- Super high APYs aren't always a good sign. If a return looks too good to be true, it probably is. Sky-high yields can be a major red flag for projects that are either way too risky or just plain unsustainable.

The core trade-off here is pretty straightforward: you're swapping convenience for control. With custodial staking, you get a simple, hands-off experience, but you give up direct ownership. It all comes back to that classic crypto saying: "not your keys, not your crypto."

Knowing these challenges helps you walk into staking as a service with your eyes wide open. It’s all about balancing the lure of rewards with a healthy dose of caution and making an informed choice, not just taking a blind leap.

How Institutions Are Shaping the Future of Staking

Staking isn't just for crypto hobbyists anymore. The big financial players are now getting in on the action, making staking as a service a serious part of their digital asset strategy. Frankly, this is bringing a whole new level of maturity and professionalism to the space.

So, what's behind this shift? Institutions are always on the hunt for new ways to generate yield. Compared to the wild swings of crypto trading, staking offers a relatively predictable and steady return. They see it as a smart way to put their digital assets to work, all while helping secure the blockchain networks they’re built on.

This institutional hunger is what’s driving the creation of specialized, enterprise-grade staking platforms. These aren't your average retail apps; they're built from the ground up to handle big money.

The Rise of Institutional-Grade Platforms

Unlike the platforms most of us use, these institutional services are all about features that large organizations need to operate securely and by the book. Here’s what sets them apart:

- Serious Security: We're talking multi-signature wallets, hardware security modules (HSMs), and iron-clad internal controls. When you're protecting millions (or billions), you need this level of security.

- Compliance and Reporting: Financial institutions live and die by regulations. These platforms provide the detailed, auditable reports needed for taxes and compliance—it's completely non-negotiable.

- White-Glove Support: Forget waiting on a support ticket. Institutions get dedicated account managers and technical experts on call to keep things running smoothly.

This isn't just a fleeting trend. It’s a huge vote of confidence in staking's long-term value. When the big money moves in, it tells you something big is happening and helps build a more stable ecosystem for all of us.

The numbers back this up, too. The institutional staking market is expected to grow at a compound annual growth rate of 18.9% between 2025 and 2033, potentially hitting a whopping $33.3 billion market size. You can dig into the numbers and explore more market growth projections to see just how massive this is becoming. This institutional wave is fundamentally changing the future of staking as a service.

Got Questions About Staking as a Service?

If you're thinking about using a staking as a service provider, you probably have a few questions rolling around in your head. It's totally normal. Let's tackle the big ones so you can feel good about your next move.

Do I Still Own My Crypto?

This is the big one, and for good reason. The answer comes down to one key difference: custodial vs. non-custodial services.

With a non-custodial provider, you absolutely keep control. You hold your private keys, and you’re just delegating the staking rights to them. They can’t touch or move your funds—they just put them to work for you.

On the other hand, custodial services hold your assets for you. It's crucial to know which model you're dealing with before you hand anything over.

What’s This “Slashing” I Keep Hearing About?

Slashing is basically a penalty. If a validator misbehaves—like going offline for too long or trying to cheat the network—the network can slash, or take away, a portion of their staked crypto. It's the network's way of keeping everyone honest.

Good providers go to great lengths to avoid this. They use top-tier, redundant hardware and have expert teams on standby to prevent any issues. Many even offer slashing insurance to cover you just in case.

A top-notch service treats your assets like their own. Their entire business hinges on keeping their validators online and performing perfectly, which is the best defense against slashing.

Are My Staking Rewards Guaranteed?

In a word: no. Anyone promising a guaranteed return is a major red flag. Staking rewards, often shown as an Annual Percentage Yield (APY), are dynamic. They change based on how many people are staking on the network, the validator’s performance, and general market shifts.

A professional staking as a service platform will do everything they can to maximize your rewards, but the final numbers will always have some level of variability.

For more deep dives into Web3 topics, you can always check out our blog for other guides and articles.

Ready to bring the power of crypto rewards to your community? With Domino, you can create no-code staking quests in just a few minutes, driving real engagement and growth. Start building your campaign today.